General Motors Co

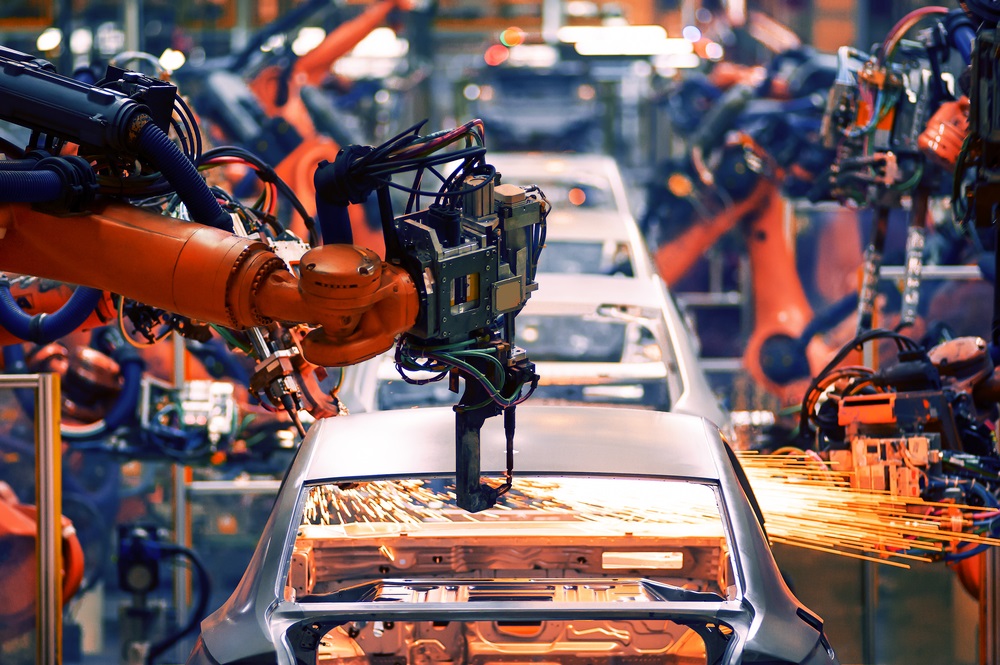

General Motors Co (NYSE: GM) is one of the world’s largest automobile manufacturers. It primarily caters to three regions: North America, the Asia Pacific, and South America.

Investment Rationale for Valuation – Hold at USD 54.27

Key Risks

Financial Highlights (for three months ended 30 June 2021 (Q2 FY2021), as of 4 August 2021)

(Source: Company Website)

One Year Share Price Chart

(Source: Refinitiv, Analysis done by Kalkine Group)

Valuation Methodology: Price/Earnings Approach (NTM) (Illustrative)

Conclusion

Driven by vaccinations, the US market is gradually coming back on track, and the situation in international locations is also expected to improve. For rest of FY2021, the Company would continue to invest in research and development and innovate new automotive models. It is planning to introduce two new commercial vehicles in near future. With substantial liquidity, the Company is ready for growth and weather any further adverse impacts. The stock made a 52-week low and high of USD 27.15 and USD 64.30, respectively.

Based on the introduction of new models by the Company, its favourable profitability than the industry, resilient demand for automobiles, and support from valuation as done using the above method, we have given a “HOLD” recommendation on General Motors Co at the closing market price of USD 54.27 (as of 11 August 2021), while we would revisit our stand based on further corporate announcements by the Company.

CleanSpark Inc

CleanSpark Inc (NASDAQ: CLSK) is a diversified intelligent energy services and software company.

Investment Highlights – Watch at USD 14.87

One Year Share Price Chart

(Source: Refinitiv, Analysis done by Kalkine Group)

Conclusion

Based on its loss-making operations and its dependence on external funding, we have given a "WATCH" stance on CleanSpark Inc at the closing market price of USD 14.87 (as of 11 August 2021).

*The reference data in this report has been partly sourced from Refinitiv.

*All forecasted figures and Peer information have been taken from Refinitiv.

Disclaimer

The advice given by Kalkine Canada Advisory Services Inc. and provided on this website is general information only and it does not take into account your investment objectives, financial situation and the particular needs of any particular person. You should therefore consider whether the advice is appropriate to your investment objectives, financial situation and needs before acting upon it. You should seek advice from a financial adviser, stockbroker or other professional (including taxation and legal advice) as necessary before acting on any advice. Not all investments are appropriate for all people. The website www.kalkine.ca is published by Kalkine Canada Advisory Services Inc. The link to our Terms & Conditions has been provided please go through them. On the date of publishing this report (mentioned on the website), employees and/or associates of Kalkine do not hold positions in any of the stocks covered on the website. These stocks can change any time and readers of the reports should not consider these stocks as advice or recommendations later.