Plug Power, Inc.

PLUG Details

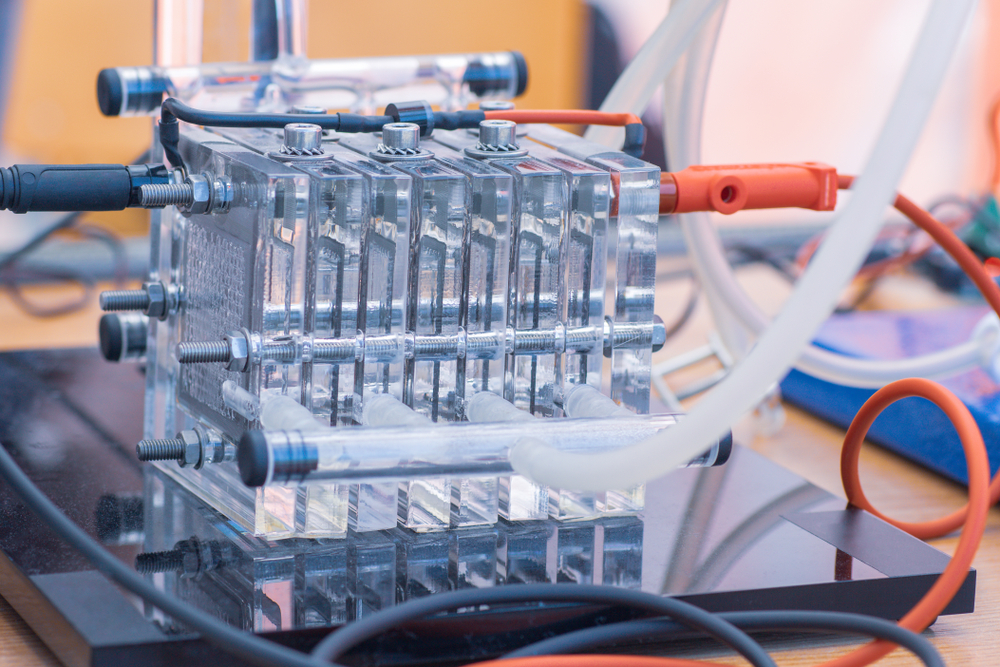

Plug Power, Inc. (NASDAQ: PLUG) is a provider of comprehensive hydrogen and fuel cell turnkey solutions. The company has a market capitalization of ~US$15.45 billion as of 29th July 2021.

Q1FY21 Results Performance (For the Quarter Ended 31 March 2021)

Revenue Generation Increased to $72.0 million: The company has generated revenue of $72.0 million in Q1FY21 compared to $40.8 million in Q1FY20. The shipments of GenDrive units for the quarter stood at 1,308 compared to 825 GenDrive units in Q1FY20. Gross billings increased to $73.7 million in Q1FY21 from $43.0 million in Q1FY20.

Reported Product Gross Margin of 38%: Fuel gross margins were negatively impacted by transitioning costs from one specific industrial gas company to another owing to its increase of rates over the last several quarters. The company reported product gross margin of 38% in Q1FY21 despite the impact of high freight costs of around an incremental $2 million.

Key Data (Source: Company Reports)

Entered into a Partnership

As per the press release of 14 July 2021, PLUG Power and Apex Clean Energy, (one of the largest independent clean energy companies in the US) entered into a 345 MW wind power purchase agreement (PPA) as well as development services agreement for a green hydrogen production facility. The power purchase through the PPA will be supplied to a new hydrogen production plant with 100% renewable power, being co-developed by both these companies.

Outlook

The company is witnessing unusually high freight costs that are likely to continue into Q2FY21. However, the costs are expected to ease as it continues to diversify its supply chain and the expectations of normalcy in the transit industry with increased global COVID-19 vaccinations. The company also experienced higher than normal professional service expenses which are expected to continue into Q2FY21 but will abate in Q3FY21. In order to expand and solidifying its global presence, the company has entered into various strategic partnerships. This includes MoU with Group Renault, SK Group of South Korea, ACCIONA, etc.

Key Risks

The company’s products and services hinge primarily on the availability of hydrogen gas. A deficient supply of hydrogen could unfavourably hurt its sales as well as deployment of the products and services. Fluctuations in the commodity prices and supply levels may hurt its costs.

Valuation Methodology: EV/Sales Multiple Based Relative Valuation (Illustrative)

Technical Overview:

Chart:

Source: REFINITIV

Note: Purple Color Line Reflects RSI (14-Period)

Stock Recommendation

We have valued the stock using an EV/Sales multiple-based illustrative relative valuation and have arrived at a target price that reflects a rise of low double-digit (in % terms). We have assigned a discount to EV/Sales Multiple (NTM) (Peer Average) considering the negative ROE as well as higher costs associated with freight and professional service.

Considering the aforementioned factors along with its focus on accelerating global expansion, we give a “Speculative Buy” recommendation on the stock at the current market price of $27.20 per share, down by 2.26% on 29th July 2021.

Note 1: The reference data in this report has been partly sourced from REFINITIV.

Note 2: Investment decisions should be made depending on the investors’ appetite on upside potential, risks, holding duration, and any previous holdings. Investors can consider exiting from the stock if the Target Price mentioned as per the analysis has been achieved and subject to the factors discussed above alongside support levels provided.

Technical Indicators Defined:-

Support: A level where-in the stock prices tend to find support if they are falling, and downtrend may take a pause backed by demand or buying interest.

Resistance: A level where-in the stock prices tend to find resistance when they are rising, and uptrend may take a pause due to profit booking or selling interest.

Stop-loss: It is a level to protect further losses in case of unfavourable movement in the stock prices.

Disclaimer

The advice given by Kalkine Canada Advisory Services Inc. and provided on this website is general information only and it does not take into account your investment objectives, financial situation and the particular needs of any particular person. You should therefore consider whether the advice is appropriate to your investment objectives, financial situation and needs before acting upon it. You should seek advice from a financial adviser, stockbroker or other professional (including taxation and legal advice) as necessary before acting on any advice. Not all investments are appropriate for all people. The website www.kalkine.ca is published by Kalkine Canada Advisory Services Inc. The link to our Terms & Conditions has been provided please go through them. On the date of publishing this report (mentioned on the website), employees and/or associates of Kalkine do not hold positions in any of the stocks covered on the website. These stocks can change any time and readers of the reports should not consider these stocks as advice or recommendations later.