Image Source : Krish Capital Pty Ltd

Index Update: The S&P/TSX Composite Index added 0.06% to close at 25,854.01 on Thursday, as the market continued to pull back from Tuesday's record high. Investors were weighing the risks posed by higher fiscal deficits in the US after the US House approved a tax bill expected to significantly increase the budget deficit, adding to recent concerns about US debt and credit rating downgrades.

Macro Update: The Canadian Raw Materials Price Index (RMPI) experienced its most significant monthly decline since September 2024, falling 3.0% in April 2025 after a 1.0% drop in March. This surpassed market expectations for a 2.2% decrease. The primary driver was an 8.1% fall in crude energy products, with conventional crude oil down 9.4%, influenced by OPEC output adjustments and global demand uncertainty. Additionally, prices for metal ores, concentrates, and scrap decreased by 1.5%, ending a seven-month streak of gains. Conversely, gold ores, concentrates, and steel bars for machining saw a 5.2% rise, partially offsetting other subcategory declines. YoY, the RMPI was down 3.6%. Concurrently, Canadian Industrial Producer Prices (IPPI) declined 0.8% MoM in April 2025, exceeding the anticipated 0.5% decrease and breaking a six-month trend of increases. This was largely attributed to a 3.6% reduction in energy and petroleum product prices, particularly diesel fuel (-4.1%), mirroring the fall in crude oil. Excluding energy, the IPPI still saw a 0.5% decline, predominantly due to currency effects. Non-ferrous metal prices decreased by 2.8% despite a 5.0% increase in gold, while lumber prices fell 4.4% (softwood lumber down 11.1%) amid tariff concerns. Vehicle prices also dropped by 0.9%. In contrast, food prices rose, notably canola oil (+8.4%) and beef (+4.8%), driven by robust export demand and tight domestic supply. Annually, producer prices advanced by 2.0%.

Top Movers and Losers: The biggest gainers of the session on the S&P/TSX Composite were MDA Ltd (TSX: MDA), which rose 7.60%. Aecon Group Inc. (TSX: ARE) added 3.82% and Celestica Inc. (TSX: CLS) was up 3.74%. Biggest losers included Lightspeed Commerce Inc (TSX: LSPD), which fell 7.97%. G Mining Ventures Corp (TSX: GMIN) declined 5.63% and Brookfield Renewable Energy Partners LP (TSX: BEP_u) down 4.78%.

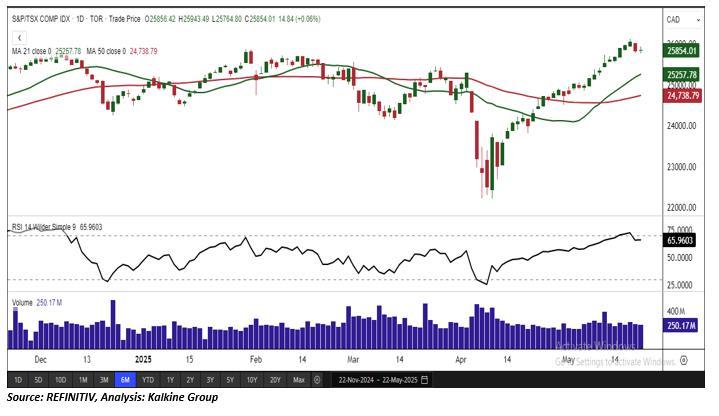

Our Stance: The index remains in a favorable position, trading comfortably above its 21-period Simple Moving Average (SMA). This alignment continues to support the current bullish trend. Moreover, with the Relative Strength Index (RSI) at 65.96, the index retains further upside potential without entering overbought territory. However, it is presently testing a critical support level near 25,600.

Commodity Update: The U.S. dollar softened on Friday, heading for its first weekly decline in five weeks against the euro and yen, as concerns over America’s $36 trillion debt and a costly tax bill dampened sentiment. Moody’s recent downgrade of U.S. debt spurred safe-haven buying. Gold dipped 0.08% to $3,291.80, silver slipped 0.05%, while copper rose 0.12%. Brent crude dropped 0.50% to $64.11 on renewed OPEC+ oversupply concerns.

The advice given by Kalkine Canada Advisory Services Inc. and provided on this website is general information only and it does not take into account your investment objectives, financial situation and the particular needs of any particular person. You should therefore consider whether the advice is appropriate to your investment objectives, financial situation and needs before acting upon it. You should seek advice from a financial adviser, stockbroker or other professional (including taxation and legal advice) as necessary before acting on any advice. Not all investments are appropriate for all people. The website www.kalkine.ca is published by Kalkine Canada Advisory Services Inc. The link to our Terms & Conditions has been provided please go through them. On the date of publishing this report (mentioned on the website), employees and/or associates of Kalkine do not hold positions in any of the stocks covered on the website. These stocks can change any time and readers of the reports should not consider these stocks as advice or recommendations later.