RY 151.2 -0.6636% TD 80.12 0.9577% SHOP 83.0 1.3802% CNR 158.42 -0.9751% ENB 50.51 0.0198% CP 113.01 0.9108% BMO 119.55 0.3357% TRI 227.18 0.6334% CNQ 47.185 -0.851% BN 64.45 1.7524% ATD 82.17 -0.8208% CSU 4335.0 0.7153% BNS 62.975 -0.3402% CM 69.78 0.7508% SU 53.02 0.9136% TRP 57.81 1.1018% NGT 63.51 -3.5535% WCN 241.16 -2.9029% MFC 35.73 0.7614% BCE 45.805 0.0546%

The Funds Report

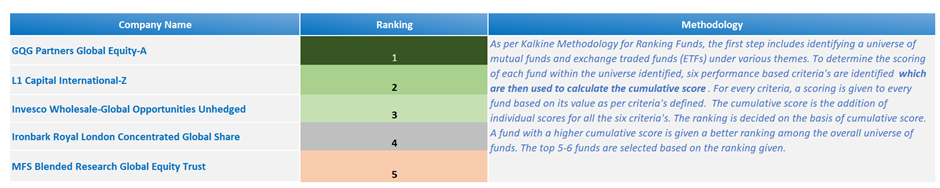

Kalkine, through its publication 'The Funds Report', endeavours to assess and rank mutual funds and exchange-traded funds (ETFs). The primary objective is to provide investors with valuable insights into various investment options while aiming to mitigate market volatility. This is achieved through a unique ranking methodology developed by a team of qualified in-house researchers.

Introduction

The Funds Report employs a unique methodology crafted by a team of proficient in-house researchers to address market volatility. By categorizing mutual funds and exchange traded funds (ETFs) based on various market themes and ranking them from low to high, the report endeavours to offer a diverse selection of high-quality funds listed in Australian Stock Exchange for investors.

Given this backdrop, the report aims to incorporate a range of metrics to identify funds with higher alpha and a track record of historical annualized performance over three years, higher Sharpe ratio, and low total expense ratio, among other defined metrics. By considering these factors comprehensively, the report seeks to highlight funds that offer potential for better risk-adjusted returns while maintaining cost efficiency.

Kalkine’s Funds Ranking Methodology

Source: Kalkine Group, Copyright © 2024 Krish Capital Pty. Ltd.

Source: Kalkine Group, Copyright © 2024 Krish Capital Pty. Ltd.