How to define the ability-to-pay principle?

The ability-to-pay is an essential principle in economics that suggests the amount of tax that is to be paid by an individual to the government of a particular nation. The amount of tax must depend upon the income and wealth of that individual.

How to define the ability-to-pay taxation?

The ability to pay taxation can be defined as the taxation theory that states that every individual must be imposed tax as per the taxpayer's capability. It indicates that people, businesses, and corporations with higher annual income or turnover are bound to pay a higher tax rate than those with lower annual income or turnover.

Rather than setting a flat percentage of income as taxation, the amount is kept variable as per the income of an individual. This is done to make tax collection a fair practice. A taxation amount of 10,000 ASD could be a reasonable amount for someone who earns 100,000 ASD annually. Still, the same amount of 10,000 ASD tax could become a considerable burden to someone who makes 50,000 ASD annually.

Summary

- The ability to pay taxation is a theory that explains that a state can only impose a tax on an individual based on his ability to pay the tax by considering his or her annual salary and wealth.

- The theory was proposed by Adam Smith in the year 1776.

- The progressive taxation method is a crucial system of tax collection in Australia that refers to the bit by bit increase in the amount of the tax as per the increase in income and wealth.

- The ability to pay taxation allows the government to bring in more funding for government services and saves individuals from getting overburdened due to heavy tax.

Frequently Asked Questions:

How did the ability to pay taxation emerge?

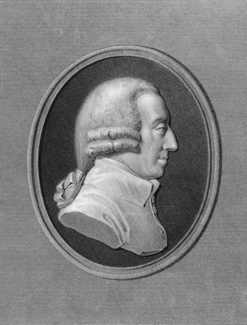

The theory of ability to pay taxation and progressive taxation was first introduced by Adam Smith in the year 1776. He is also regarded as the father of economics.

Adam Smith, Scottish economist

Image source: © Georgios | Megapixl.com

Smith stated:

"The subjects of every state ought to contribute towards the support of the government, as near as possible, in proportion to their respective abilities; that is, in proportion to the revenue which they respectively enjoy under the protection of the state."

Therefore, it can be rightly said that the theory of taxation is an age-old concept suggested back in 1776.

|

Income threshold |

Rate |

Tax payable |

|

$0-$18,200 |

0 |

NIL |

|

$18,201- $45,000 |

19% |

19cent for each $1 over $18,200 |

|

$45,001- $120,000 |

32.5% |

$5,092 plus 32.5 cent for each $1 over $45,000 |

|

$120,001- $180,000 |

37% |

$29,467 plus 37 cents for each $1 over $120,000 |

|

$180,001- above |

45% |

$51,667 plus 45 cents for each $1 over $180,000 |

Copyright © 2021 Kalkine Media

What is the concept of progressive taxation?

The concept of progressive taxation refers to the bit by bit increase in the taxation level as per the increase in annual income of individuals or yearly turnover in businesses and corporations. The main aim of progression taxation is to make a fair practice of tax collection from the citizen with diversity in income.

The progressive tax system is followed in Australia. As per the tax rate of 2020-2021, anyone earning above $18,200 must pay a certain percentage of money from their income to the government as their tax. An income below $18,200 would not cause you to pay any tax.

What are the advantages of ability-to-pay taxation?

- Bring in more resources for government services:

The citizen of a nation highly relies upon the government for availing of its services such as the police, healthcare, education, etc. In that case, resourceful people can put forward enormous contribution and funding to the government for all needed services.

- Government revenue depends on earnings:

The ability to pay taxation theory and progressive taxation method allows the taxpayers to pay tax according to their income and wealth. The tax amount increases along with the increase in income and wealth. Thus, the low-income individuals are not burdened in this process to pay a heavy revenue. They are made to pay a nominal percentage of money from their income as tax, and the rest can be utilised for their expenses.

What are the discredits of the ability to pay taxation?

- It does not allow higher incentive to increase income:

The ability to pay taxation theory and progressive tax system restrict employees to gain a higher incentive. A significant amount of gain in their income could also result in them paying a higher percentage of their salaries as tax. Therefore, there is always a slight rise in the income of the employees as a yearly incentive.

- No accountability for government expenditure:

It is always the government to decide on how the money will be spent. The government has absolute power over the amount of tax that the citizens pay. However, it is a fund that is supposed to be utilized for government services that benefit citizens. Some individual argues that they do not receive service from the government which is equivalent to the amount of tax they pay. So, they demand services that are equivalent to the amount paid by them as tax.

Why is the ability to pay taxation important?

The principle of ability to pay taxation is essential in such country where there is a diversity in income among every citizen of that nation. The ability to pay taxation principle states that the government can only charge tax from the citizens depending upon their annual income. Therefore, by following the ability to pay taxation principle, the government cannot create an unnecessary burden of tax on people with low annual income.

Please wait processing your request...

Please wait processing your request...