What are Absolute Return Funds?

Absolute return funds are a kind of investment vehicle, which holds the capability to produce smoother returns regardless of market conditions. These funds are also known as ‘target-return funds’ and ‘hedge funds’ in the financial market.

Absolute return funds invest in a broad array of asset classes, with an intention to deliver returns in both rising and falling markets. Such funds employ several investment strategies, and as a result, their performance is not related to the performance of conventional asset classes like property, shares or bonds.

Back in 1949, a famous Australian investor, Alfred Winslow Jones, formed the first absolute return fund in New York. He created a market-neutral fund at that time, which was able to outpace the average equity mutual fund of the US.

For instance, in Australia, most of the absolute return funds aim to outperform the interest rate target set by the central bank. Some of the common absolute return funds operating in Australia, include Blackrock Australian Equity Market Neutral Fund, Firetrail Absolute Return Fund, Munro Global Growth Fund, Schroder Absolute Return Income Fund and Atlantic Absolute Return Fund.

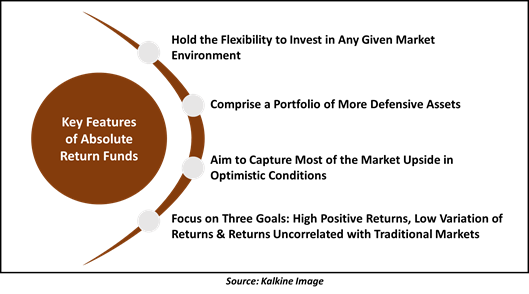

What are the Key Attributes of Absolute Return Funds?

While absolute return funds are not a perfectly valid alternative to traditional funds, they hold some interesting attributes. These features include:

- Absolute return funds manager maintains the flexibility to invest in any given market environment, wherever they see potentially lucrative returns.

- Such funds typically comprise a portfolio of more defensive assets, wherein hedging techniques can be employed to prosper in a weak market.

- In optimistic market conditions, absolute return funds aim to capture most of the market upside by tapping assets exposed to high risk and fascinating return profile.

- Absolute return funds seem to have three goals: high positive returns, the low standard deviation of returns and returns that are not correlated with usual bond and stock markets.

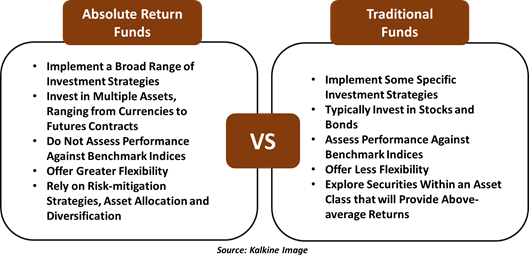

How are Absolute Return Funds Distinct from Traditional Funds?

As the objective of an absolute return fund is to deliver favorable returns in every market condition, they are different from traditional funds, which intends to outperform a specific benchmark index.

Let us quickly browse through some key points of differences between absolute return funds and traditional funds:

- Investment Strategies: As absolute return funds assure a certain return despite the market conditions; they implement a broad array of strategies and assets than traditional funds to wade through market storms.

- Investment Types: Absolute return funds typically comprise investing in fixed income securities, international equities, currencies, commodities, derivatives, futures contracts arbitrage and related assets. However, traditional funds involve investing in traditional stocks and bonds.

- Index Performance: In contrast to the traditional funds, the performance of absolute return funds is not assessed against traditional market indexes like S&P/ASX 200 or S&P 500.

- Flexibility: Unrestrained by benchmarks, absolute return investment strategies can flexibly alter with emerging risks and changing market conditions, which makes them an appealing choice to diversify traditional portfolios.

- Reliance: Absolute return funds rely on risk-mitigation strategies, asset allocation and diversification to generate positive returns over market cycles. However, traditional funds compete based on returns against a benchmark by exploring the securities within an asset class that will give above-average returns.

While absolute return and traditional funds can produce different results over the short run, both aim to cater to the similar broad objective over the long haul – to produce sufficient growth in capital.

What are the Advantages Vs Drawbacks of Absolute Return Funds?

Absolute return funds’ approach of consistently striving for positive performance, offers a broad range of potential benefits, including:

- Lower overall volatility of the portfolio.

- Reduce losses in down markets.

- Expand the sources of investment returns.

- Offer valuable diversification potential.

- Increase the risk-adjusted return of a portfolio.

While the advocates of absolute return funds paint a colorful picture of such funds, the opponents highlight the following drawbacks:

- More expensive than traditional funds.

- Tend to underperform the traditional funds in strong markets.

- Do not guarantee high returns.

- Less compatible with an investment strategy where an income target is set.

- Can be more illiquid than traditional funds.

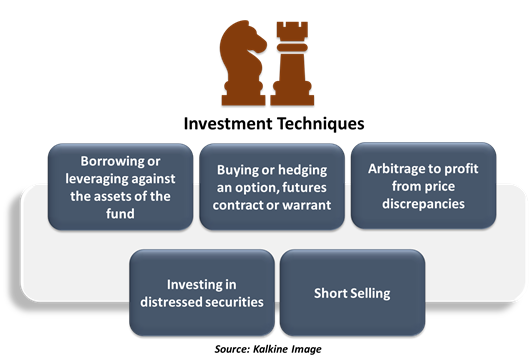

What are Investment Techniques used by Absolute Return Funds?

Absolute return fund managers use more complex investment strategies than conventional fund managers, conducting deep-dived research of investment assets. Absolute return fund managers use several investment techniques, which include:

- Borrowing or leveraging against the assets of the fund to potentially earn significant returns and increase the size of the investment portfolio.

- Buying or hedging an option, futures contract or warrant to retain the price of a security at present, offsetting the market risk of loss from volatility.

- Arbitrage to profit from price discrepancies in a securities market.

- Investing in distressed securities of government entities or companies that are either heading towards bankruptcy or are in default, assuming that capital injection or restructuring will improve the entity’s value.

- Short selling which involves buying an overvalued security and subsequently selling it to purchase back the security at a reduced price, returning it a later date.

Any Key Points to Note While Investing in Absolute Return Funds?

While investing in absolute return funds seems encouraging, such funds are designed to suit investors who desire to access growth assets with reduced volatility than traditional funds.

Besides, fees are an important consideration of absolute return funds, which an investor need not neglect in making hasty decisions. Absolute return fund managers charge a sizeable amount than benchmark-aware fund managers, with their fees comprising both performance and management fees.

Investors can understand the way these fees are calculated, considering the below factors:

- whether there are hurdles and high watermarks in place for the performance fees

- whether the track record or return expectations can justify the amount of fees

Please wait processing your request...

Please wait processing your request...