What are Accounts Receivable?

Accounts Receivable (AR) is simple terms is the amount due to a firm/company for the goods sold on credit. Businesses sell goods on credit, and cash is realised after the credit period. The goods on the retailer’s range are usually bought on credit from distributors, who in turn buy on credit from manufacturers or suppliers.

Accounts receivable is an important consideration in the cash flow trends of the business and reflect the core cash as the amount stands due to be received in a short span of time, maximum within a year.

Firms can provide discounts to the party liable to pay the cash, and sometimes parties are not able to honour payment, causing bad debts. While looking at accounts receivables of a firm, one may find provision for bad debts. Provision for bad debt is also known as provision for losses on accounts receivable; it highlights an amount that is doubtful to be received during a given period. Suppose the amount is not received its written down under the term Bad Debts.

Bad debts are recorded as expected credit losses. Expected credit losses are calculated based on the past behaviour of customers, and loss rates are adjusted to reflect the underlying conditions of the economic environment and ability of customers to settle dues on a forward-looking basis.

Trade receivables define any receivables due to the company, it may be accounts or notes receivables. Accounts receivable is important in calculating the working capital of a firm. The amount mentioned as AR indicates the expected future cash for a firm in a given period of time. As a current asset of the company, it also indicates the liquidity levels of the business, and analysing the number of days allows to evaluate the company’s cash realisation capabilities.

What is accounts receivable turnover ratio?

Accounts receivable turnover ratio shows the capability of a firm to receive cash from its customer after a credit sale. It is considered as an important ratio to analyse the cash generation expertise of the firm and its relationship with customers.

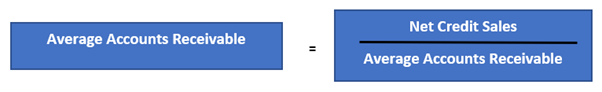

It is calculated as

Source: Kalkine Image

A higher ratio may indicate 2 things:

- Either the company is operating on Cash basis or.

- Effectiveness of the company in giving credit and collecting its account receivables.

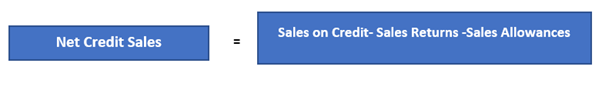

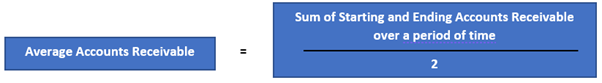

Net Credit sales and Average Account receivables of the company are calculated as

Consider a firm has recorded net credit sales of $60k during the year. At the beginning of the period, accounts receivable was $3000 and $4000 at the end of the period. Now the average accounts receivable will be $3500 (3000+4000/2).

Since net credit sales are $60k, the accounts receivable turnover ratio will be around 17.14 (60000/3500). A higher turnover ratio means cash realisation from the customer is fast.

Further, this can be used to calculate average credit sales period or average collection period. Average Credit Sales Period defines the time it takes for a business to collect cash.

Continuing with the above example: The number of weeks in a year (52) will be divided by accounts receivable turnover ratio to arrive at average credit sales period. In this case, it is around 3.03 weeks (52/17.14), which means the customers on average take around three weeks to pay cash.

Please wait processing your request...

Please wait processing your request...