What is Accounts Receivable Aging?

Accounts receivable Aging is a method implied by stakeholders of an organisation to identify receivable irregularities. Accountants use it to classify and assess receivables based on the length of time they were outstanding. It is useful to identify customers to whom fund collection reminders need to be sent.

The technique helps management and auditors understand the financial fitness of a company's debtors. If the method shows that receivables are turned into cash slower than standard, it becomes a red flag. It signifies greater credit risk assumed in sales by the organisation.

Summary

- Account Receivable Aging helps filter Outstanding receivables based on organisations' credit policy. Organisations generate excel or software reports to determine collection success.

- It also tells the managers about budding bad debts, warning them to make provisioning accordingly.

- Accounts receivable Aging helps reduce insolvency risk for an organisation.

Image Source: © QuiteSimplyStock | Megapixl.com

Frequently Asked Questions (FAQs)

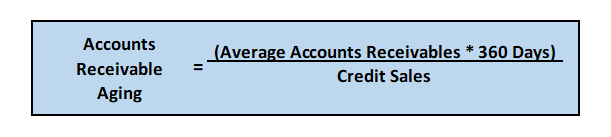

How is Accounts Receivable Age computed?

Account receivables are created when credit sales occur. Therefore, one way to determine the Aging of an account receivable is by the number of days of sale amount outstanding with the customer. This is also called Daily Sales Outstanding. Thus, formula to computing Age of Accounts Receivable is:

Source: Copyright © 2021 Kalkine Media

In the above formula, the number of days in a Financial Year is taken as 360 days to avoid fractions, but it is a discretionary choice.

EXAMPLE

Suppose, A company has made two credit sales to date. Its debtors are A & B, having a total outstanding sales bill of USD 100,000. The sale to 'A' is USD70,000 and to 'B' is USD30,000. Now to determine the Age of receivable balances with the company using the above Formula would be -

We multiply the average receivable amount, i.e. USD50,000 by 360 days and then divide the resultant by total credit sales of USD100,000. So, the Accounts Receivable Age is 180 days.

Similarly, if instead of the Average Receivable number we take Specifically USD70,000 for A & USD30,000 for B, A's Receivable will be outstanding for 252 days (70,000*360/100,00) and B's Receivable for 108 days (30,000*360/100,000).

What is an Aged Receivables Report?

An Aged Accounts Receivable report lists unpaid customer invoices by date ranges. It is the primary report used by collection managers know as debtors with balances overdue for payment—the report used by management, to analyse the efficiency of credit policies and collection functions.

It is usually an excel template or a software report. Following details are entered in the Aging Report template or software- client name & address, credit terms, present collection status, and outstanding amount.

The report is generally organised by the debtor's name, listing all invoices in its name. There is further sorting based on invoice number date. It may also show any reversals for each client.

The collections team uses the report to identify potential bad debts. They use this information to revise credit policies and update provisions for probable loss on default.

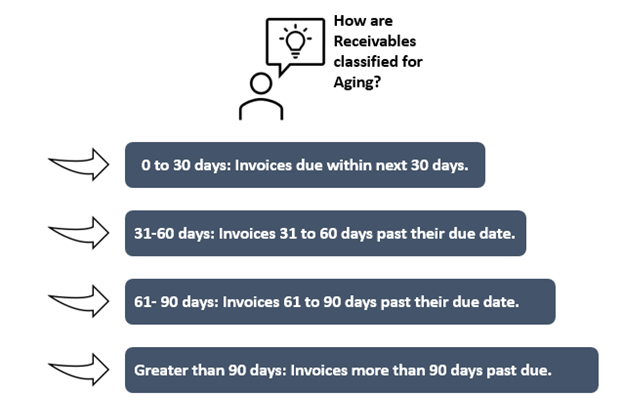

How are Receivables classified for Aging?

Mainly Accounts receivables are classified as below for an Aging Report-

Copyright © 2021 Kalkine Media

In the aging report, invoices are in 30-day lots, as per the figure above. All extremely old invoices are also reflected, which need to be confirmed and reversed or declared bad.

How beneficial is analysing Aging Accounts Receivable?

Organisations' management uses the Accounts Receivable aging technique for the following-

- To determine the efficiency of its collections function and practices followed.

- It shows the company determine a timeline for regular review of the collection practices.

- Aging receivables indicate the credit risk posed to a company.

- The ageing technique shows the insolvency position of an organisations customers.

- Payment terms for debtors can be changed from time to time using this technique.

- Organisations may decide to change their billing policy depending on the Aging receivables report.

- It becomes the basis for computing allowance for bad debts.

- Management can also identify potential bad debts.

- Bad debts for write off are identified using this technique.

- Any Factoring, if undertaken by an organisation, is based on Accounts Receivable Aging.

- It can be used to maintain cash flows in the organisation.

What are the Disadvantages of Aging Accounts Receivable?

Like any other management technique, it also has a few drawbacks-

- Different softwares or skilled, experienced employees are required to take over this task to make it error-free.

- Organisations need to allocate resources to carry out aging exercise aptly separately.

- It may not always be accurate in judging the solvency of a debtor.

- The results are in the number of days, thus sometimes insignificant debts with past due for many days may also be red-flagged.

- Sometimes collections team may not appropriately match bills with payments and reversals.

- Inaccurate aging schedules may prove harmful for entity's buy implying excess provisioning or insufficient funds to backup defaults.

- Aging should not be the only criteria to determine credit policies. Factors like the goodwill of debtors also need to be considered before making provisions

- Aging reports should be frequently updated on a daily or weekly basis to ensure correct interpretation of receivables balance.

- The process is prone to fraudulent practices and deliberate hiding of bad debts.

Please wait processing your request...

Please wait processing your request...