What is an Acquisition?

Acquisition is a corporate process by which one company gains possession/ownership of either a portion of another company or the entire company.

The acquisition process allows the acquiring company to take over the assets of the target company, along with its business operation. The target company, on the other hand, gets compensation in terms of cash, shares, etc. as stipulated in the deal, orchestrating its exit.

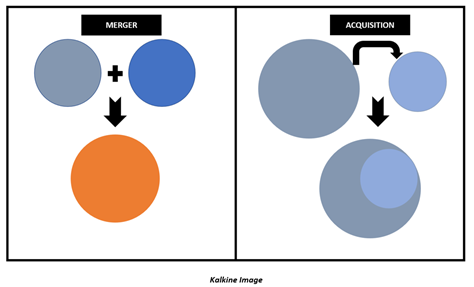

What are the Key Differences between Merger and Acquisition?

Notably, the term 'acquisition' is often synonymously used with 'merger'. While in actual, they do not represent the same thing. Below are some of the apparent differences between the two transactions:

- When undergoing a merger, the two companies come together to form a new entity. The parent companies cease to exist legally. On the other hand, in the acquisition, one company purchases the other, which then operates under the acquiring company.

- Merger is generally a friendly association to ensure business gains. Acquisition can be hostile with the acquiring company dominating the terms of the deal.

- Merger involves coming together of two or more equal companies to form a joint venture. On the other hand, the acquiring company is relatively large compared to the target.

- Merger usually involves new company name creation. While acquisition generally retains the acquirer’s name.

What is the Significance of Acquisition?

A company can be motivated by several factors when pursuing an acquisition. The target company is generally encouraged to dispose of its portion of a business or the entire business due to accumulation of debts, spiralling operative performance or lucrative deal offered by some large company. The acquiring company, on the other hand, considers several elements before advancing with the acquisition process.

The objective of acquiring company typically includes the following factors:

- Foreign Market Entry

Companies eyeing to enter a foreign market often pursue acquisition of a local company in order to reduce the entry barriers. It is considered as one of the convenient ways to outright gaining entrance into the new foreign market along with the established set up. The acquiring company, however, considers the laws concerning foreign ownership before undertaking an acquisition.

- Expansion of Customer Base

The acquiring company often seeks to expand its customer profile or add another target group of customers through the acquisition strategy. It allows them to widen their customers' width or target a niche segment by adding the already existing customers of the acquired company.

- Leveraging Competencies of the Target Firm

Another factor that aids in augmenting the growth rate of the company is achieving new competences and resources. While the addition of competencies may be a cumbersome process for a company demanding ample time, it can cut corners by pursuing acquisition strategy. The corporate transaction can help add technological or other competitive advantages of the target firm as well as provide the company with skilled human resources.

- Seeking Economies of Scale

Companies are garnered towards acquisition strategy to boost their earnings and increase their overall profitability. The strategy may provide the acquiring firm economies of scale, which thereby enhances its overall operational efficiency.

- Reducing Market Competitiveness

High competition in the market often enhances the bargaining power of the customers, thereby hurting the overall profitability of the companies. The acquisition in such a scenario not only provides the acquiring company with additional capabilities but also reduces the degree of competition in the market.

- Increasing Size

The acquisition of another company offering similar products or services overall offers greater command on the market with a higher market share. Meanwhile, the company may also acquire a firm operating in different space. It diversifies the market offerings of the firm, preventing it from sector-specific demand shocks.

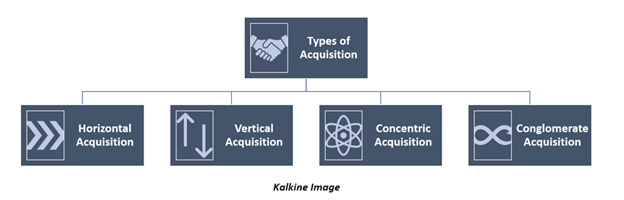

What are the Types of Acquisition?

Depending on the nature of business of the acquiring and target firm, acquisition can be classified into the following categories:

- Horizontal Acquisition

In Horizontal acquisition, one company (generally a larger one) acquires another company in the same business providing similar offerings. Simply put, it involves the acquisition of a competitor. The focus of such type of acquisitions is to increase the market share and reduce the competition in the market.

Significantly, Horizontal acquisition is different from market extension acquisition and product extension acquisition.

While market extension acquisition, like Horizontal acquisition, takes places between companies operating in the same industry, the market in which the two companies operate is different. Similarly, in product extension acquisition, the acquired company though offers similar products operates in a different market. Thus, the acquired and acquiring company are not the competitors. Such type of acquisitions are undertaken to gain entry into the new market.

- Vertical Acquisition

Vertical integration is defined when two companies involved in the acquisition work towards the production or delivery of the same product but at different stages. This type of acquisition is carried out along the supply chain. The acquiring company eventually integrates additional production or logistics operations under its umbrella.

Depending upon the direction of the integration, vertical acquisition can be either forward acquisition or backward acquisition.

The acquisition in which the process brought in through the acquisition is one step ahead of the company's original operational process is called forward integration. Thus, a manufacturing company acquiring a distributor or retailer is an example of forward acquisition.

In the backward acquisition, the acquiring company takes control of a preceding process relative to its original operations. For example, a manufacturing company acquiring its raw material supplier is an example of backward acquisition.

- Concentric Acquisition

Concentric acquisition occurs when a company acquires another company which offers complementary services to the same customers. While the companies operate in different industries, they serve the same customers as they operate in the same market space.

For example, a car manufacturer acquiring an insurance company represents concentric acquisition.

- Conglomerate Acquisition

Conglomerate refers to companies that through previous mergers and acquisitions own many small companies which operate in different areas. They are usually multi-national organizations functioning in different industries.

The conglomerate acquisition occurs when the company acquires an entirely unrelated business. This type of acquisition aims to diversify risk and increase the market share of the company.

What are the Challenges Associated with Acquisition?

While acquisition offers multiple advantages and synergies to the parties involved, some inherent challenges cannot be avoided:

- Administrative Strain-The acquisition of another company demands higher efforts and operational requirements. It may lead to administrative stress and diseconomies of scale.

- Risk on Brand Reputation- Since the acquired company also comes under the banner of the original company, there may be some sort of risk on brand image. The variation in the services or failure to comply with the requirement of existing customers of the target company can impact the brand reputation of the acquirer.

- Financial Fallouts- The acquiring company, due to the considerable costs incurred in an acquisition, may face significant debt obligations.Besides, failure to reap profits effectively and timely may create financial issues.

- Conflict of Objectives and Values- The acquirer and the target company may have different philosophies, principles, values and missions. It could be well reflected in operational procedures and employee behavior.

- Cultural Conflict-The acquired company might have distinct organisational cultural compared to the acquiring one. It could affect the smooth takeover of the operations. Furthermore, the companies venturing into different geographic markets or countries through acquisition may face additional cultural alignment challenges.

Please wait processing your request...

Please wait processing your request...