"Dividends may not be the only path for an individual investor's success, but if there's a better one, I have yet to find it"- says the author of The Ultimate Dividend Playbook, Josh Peters.

For a sensible investor, dividend investments are perhaps one of the closest things that guarantee capital appreciation. For others in the stock market ball game, dividend products may serve to reduce the amount of volatility in a portfolio. Having said this, Warren Buffett's number 1 rule of investing- “don't lose money” followed by number 2- “don’t forget rule number 1”, is probably what makes dividend attractive to so many investors.

Also Read: All About Smart Dividend Investing

What Are Dividends?

Dividends are that portion of a company’s profit that it may possibly decide to pay-out/ disburse to shareholders and not retain it to meet financial requirements such as, invest in R & D, product launches, acquisitions etc. Publicly listed companies pay dividends to shareholders as a means of rewarding their investment in the company. Cash dividends are the most common form of dividend. However, dividends may be issued in the form of shares of stock or additional property.

Dividends are paid at a planned frequency- be it on a monthly, quarterly, or annual basis. Interestingly, at times, companies may make dividend payments even when they don’t make suitable profits to maintain their established track record of regular dividend payments.

To know about stocks which are paying dividend in uncertain times, read: Certain Payments in Uncertain Times: A Look at Dividend Stocks

What Are the Types of Dividends?

There are numerous types of dividends, some of which do not involve the payment of cash to shareholders-

- Cash dividend- this is the most common form of dividend payment. Dividend is paid in cash to those investors holding the company's stock on a specific date.

- Stock dividend- refers to issuance of common stock by a company to its common shareholders without any consideration.

- Property dividend- a non-monetary dividend to investors may be opted for instead of cash or stock. It may include subsidiary shares or any other form of company assets.

- Scrip Dividend -when a company is lacking sufficient funds to pay dividends, it may issue a promissory note to the shareholders. This promissory note, on the date of its payment, can be used to pay dividends giving the company enough time to accrue adequate funds.

- Liquidating Dividend- It’s the last in priority to be paid by the company after the creditors and lenders obligations are meet. Usually paid in the form of cash or other assets to shareholders and is an indication for shutting down of the business.

What Is the Dividend Process?

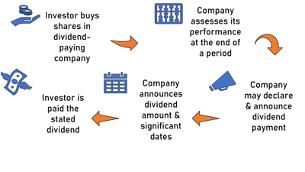

A company's Board and Management may opt to pay dividend to shareholders in a process that typically comprises of the below depicted key steps:

Also read: Guide to investing in Dividend Stocks

What Are Key Dividend Concepts & Terms Investors Should Know?

Declarations: Declaring a dividend is the process by which Companies announce to the market when they intend to pay a dividend and how much that dividend will be.

Ex-dividend date: To be eligible for receiving dividends, one must own the shares on the ex-dividend date. On the ex-dividend date, the company's share price will often fall by almost the amount of the dividend, to reflect that buyers from that date onward will not be eligible to receive the currently announced dividend.

Payment Date: Date of payment comes post the ex-dividend date and is the date when the company pays dividend to shareholders.

Franking Credits: In Australia, dividends often come with bonus tax credits, called franking/ imputation credits. Dividends are a chunk of company profits, and franking credits embody the company tax is already been paid on these profits. Also, to highlight, similar concept for avoiding double counting of tax in New Zealand, dividends are distributed with Imputation credits.

Dividend Reinvestment Plans (DRPs): Few companies give shareholders the option to reinvest dividends in the form of additional shares in the company, rather than in cash, called DRPs.

What is Dividend Yield/ Annual Dividend Yield?

Expressed as a percentage, dividend yield is basically a financial ratio. Dividend yield reveals the amount of money that a company pays out in dividends each year relative to its stock price. Simply put, dividend yield measures the amount of earnings made by investors by way of total dividends through investing in a particular company.

Dividend yield can be calculated by dividing the firm’s annual dividend with its share price. It can be computed by using the following formulas:

Dividend Yield = Annual Dividend/Share Price

OR

Dividend Yield = Cash Dividend per share/Market Price per share x 100

Assuming that dividend is not lifted or slashed, the yield will grow when price of the stock falls. On the contrary, it will fall when price of the stock rises. Dividend yields change relative to the stock price and consequently, can often look extraordinarily high for stocks that are falling in value, quickly.

In simple terms, dividend yield of a share is inversely related to its share price.

Breaking Down Dividend Yield?

Let us understand the concept through an example:

Consider a company trading at a price of $ 25, which pays consistent quarterly dividends of $ 0.15 per share. For this firm, dividend yield can be calculated by taking a sum of four quarterly dividends and then dividing it by the share price, and subsequently multiplying the result by 100.

Dividend Yield = (0.15X4) / 25 X 100 = 2.4 %

Therefore, the dividend yield is 2.4%, which means an investor will earn 2.4 per cent per annum on the company’s shares by way of dividends.

Why Should Investors Look at Dividend Yield?

To start with, dividend yield is notable depiction of the Company’s robust financial health and confidence that propels it to make dividend payments that are usually not dependent on the share price.

Also, historical evidence indicates that focus on dividends tends to strengthen returns rather than slow them down.

Besides, long-term investors particularly consider dividends to be extremely powerful as they can be used to buy more shares by reinvesting, signifying that investors do not have to spend more cash resources to boost their equity.

Good dividend investment strategy: Why is a Dividend Stock Investing Strategy Important For An Income Stream?

Does Annual Dividend Yield Come with Shortcomings?

Think about this- every dollar a company is paying in dividends to its shareholders is a dollar that it is not spending on reinvestments to grow and generate more capital gains. Therefore, though high dividend yields seem attractive, it is possible that they exist at the expense of potential growth of the company.

Besides, dividend data can be old/ based on inaccurate information. Therefore, investors should not rely completely on it to evaluate a stock base.

Furthermore, there are two more things to consider- at times a high dividend yield is the result of a stock's price tanking and some companies may manipulate their growth costs to lure investors.

So being cautious and doing thorough research is very important.

Lot of policy changes are taking place in Australia amid COVID-19. A read through Australian affection to dividends; will policymakers ban dividends? will help you with better insights about dividend related decisions.

What Are Types of Dividend Yield?

Broadly, there are 4 types of dividend yield-

- Preferred share dividend yield- Though preferred shares do not have voting rights at stockholders' meetings, they pay a fixed dividend that is stated in the stock's prospectus when the shares are first issued.

- Common share dividend yield- Dividends paid to holders of common stock are set by management and depend upon company's earnings.

- Trailing dividend yield- It provides a dividend percentage paid by the company in previous years. It is recognised as an indicator of future dividends.

- Forward dividend yield- Deemed as the company's guidance or an analyst estimate, forward dividend yield estimates the future yield of a stock.

Do You Know These Facts About Dividend Yield?

As deciphered, when the dividend is compared to the market price of the share, it is called the dividend yield. It represents the annualised return paid by a stock in the form of dividends. Let us cast an eye on some interesting dividend yield facts-

- In the absence of any capital gains, dividend yield is effectively the return on investment for a stock.

- It's important for investors to know that a higher dividend yield does not necessarily suggest attractive investment opportunity as dividend yield of a stock may be higher owing to a declining stock price.

- A high or low yield depends on factors such as the industry and the business life cycle of the company. For instance, a fast-growing company may choose not to pay any dividends and reinvest to grow it business. On the contrary, a mature company may report a high yield due to a relative lack of future high growth potential.

A comparison: Dividend yield vs P/E ratio, to read in detail: Dividend Yield Versus P /E - 4 Things You Need To Know

Which Businesses/ Sectors Pay Most Dividend?

Ideally, dividends tend to come from established companies with solidified cash flow as the younger, growing companies may choose to rather pay heed to a potential pool of reinvestment capital. Telecoms, financial and utilities have provided excellent dividend yields along with materials sector. Dividends in technology, healthcare and biotech sectors tend to be more hit or miss owing to high emphasis on growth.

The Australian share market has the highest dividend payers listed in the world. Dividends paid by Australian listed companies have grown substantially since the Global Financial Crises (GFC), most notably among large resources companies and the banks.

Still should bank dividend be a source of stress: Dividend cuts from banks; Should you worry?

How Do You Find High-Yield Companies?

Selecting a portfolio of shares based on dividend yield alone is believed to be a "scattergun" approach to investing. Having said this, a wise investor consider a selection process not solely based on dividend yield but investigate for companies that demonstrate solid underlying business fundamentals, low debt and good business prospects, have a dividend policy consistent with its underlying earnings, show consistent high returns on equity, have control over the price of the products and services they provide- to name a few.

Applying the reverse psychology approach, investors can choose to avoid companies that borrow to pay dividends or have large and ongoing requirements for new capital to maintain their economic viability.

Do not miss: Top 25 ASX Stocks By Dividend Yield

Please wait processing your request...

Please wait processing your request...