What is Asset Under Management?

Asset under management (AUM) is the total market value of the investment an organisation handles for its customers. These investments are managed by finds or family of funds, a brokerage firm, a venture capital firm or an individual registered as a portfolio manager or investment advisor.

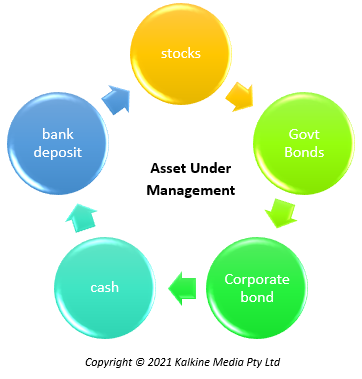

While calculating AUM, few financial entities incorporate cash, mutual funds, and bank deposits.

What is the calculation of Asset Under Management?

Different companies follow different approach while calculating asset under management. However, the key thing while calculating AUM depends on the cash inflow and outflow of a particular fund. Because of this cash in and cash out, you may probably see fluctuations in the AUM value on a daily basis.

Apart from this, the performance of the asset or fund, capital appreciation and reinvested dividends are other such factors which directly influences the value of AUM. If there is an increase in the customers and assets, there would be an increase in the total firm’s AUM.

In case of decrease in the market value due to investment performance losses or fund closures, there will be a drop in the cash inflow which would reduce the AUM.

What is the importance of Asset under management?

Asset under management is important as it defines the size and portfolio success of the organisation. Hence, it is essential for the investors to consider them before making any investment decision.

AUM includes returns from different mutual funds. When one fund is compared with the other fund, the fund with greater value of AUM is regarded as a better fund delivering increased returns to the investors.

While AUM is only one of the factors included while making investment decision, one should also look into other ratios like expense ratio, fund managers, historical performance etc.

What is an Asset Management Company?

An asset management company is an organisation that gathers the funds of different investors and investment into different types of financial instruments like debt, equities, gold, real estate, bond etc.

AUM company handles different funds with different objectives. These firms have fund manager or asset manager who sets the investment objectives, assess the market risk and reward profile, and based on the outcome decide the investment strategy.

For example, an equity fund. Equity fund would include equities of different companies. These equity funds could be of high, medium, or low risk. According to the risk taking capacity of the investors, these AUM company offers different funds to the investors.

Another type of fund offered by these AUM companies is debt funds which focuses on investing in bonds and government securities. These funds provide moderate return with minimal risk.

An asset management company is managed by the capital market regulator of that particular nation. In the US, capital market is regulated by Securities and Exchange Commission.

How does an asset management company work?

Investment into an asset management company means investing in the funds managed by these companies. These funds which are managed by the AMC’s are subjected to market risk. A fund that is well managed by these AMC’s have the potential to deliver improved results to the investors. In return, the AMC charges fund management fees. This fund management fees are the primary source of revenue for these companies.

Generally, while making investment decision, people prefer funds of reputed AMCs. Hence to be at par with the peer group, there are a couple of steps which AMCs follow.

- Asset Allocation: This is an important process for an AMC to be at par with the peer group as well as gain investor’s confidence. Here, professional expertise and experience of the fund manager comes into play. These fund managers efficiently assign the fund to different asset class to gain improved returns.

- Designing of the investment portfolio: Developing an investment portfolio is a crucial part for any AMC as they design a risk-adjusted portfolio by researching different investment products. While designing risk-adjusted the portfolio, AMCs have to keep in mind that the fund should not underperform despite turbulence in the market.

- Assessment of Performance: As people invest their hard-earned money into the funds managed by the AMCs, they are answerable to the investors. Hence, the AMCs assess the funds’ performance regularly by taking into consideration its NAV value, return, asset allocation etc.

What are the advantages of an Asset Management Company?

- Economies of scale: It includes the cost advantage that a company can earn by improving the size of operations. For example, AMCs might acquire th shares in large quantities and can negotiate on more favourable trading commission prices.

- AMCs have access to broader asset: Individual investors can invest in stocks or bonds. However, it is difficult for them to invest in big projects like infrastructure projects. These AMCs make investment in these projects which is beyond the reach of an individual investor.

- Access to expert professional: AMCs have trained and expert financial professionals with huge experience in managing funds.

What are the disadvantages of an Asset Management Company?

- Management fees: AMCs charge fees for managing funds, even if the performance of the fund deteriorates. Hence, it could be possible that few investors may find AMCs expensive.

- Conflict of Interest: There could a situation a conflict of interest between the investor and investee may arise.

- Risk of Underperforming: The performance of AMC is compared to the benchmark, which is usually the market index. While AMCs aim to generate good returns, there is always a chance that a fund underperforms the market.

Please wait processing your request...

Please wait processing your request...