What are Blue chip stocks?

Blue chip stocks are shares of large companies with historically good market standing highlighted by its strong financials. Such stocks have the potential to wade through safely in unfavourable economic conditions as bad as and they are known to fetch safe and/or high gain when markets are doing well.

The term blue chip was given by Oliver Gingold around 1923 by correlating the highly priced stocks with the blue chips in the game of poker. Over time the term became synonymous for high quality stocks.

Frequently Asked Questions

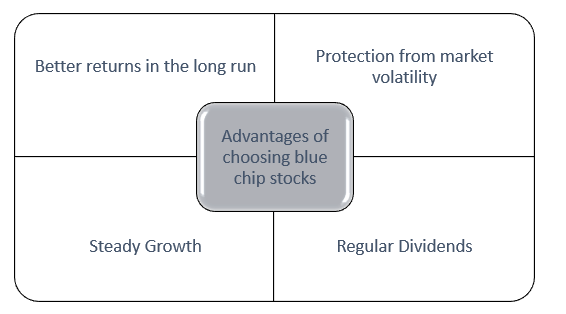

Why choose blue chip stocks?

- Superior Returns in the Long Run: Being the strongest players of their respective sector the companies have higher profits than the other players. Due to the benefit of economies of scale, when blue stock companies grow, their profits grow relatively more than the other smaller players of the segment. The relative competitive advantage is higher.

- Steady Growth: Blue chip companies have reached very close to their highest growth potentials. For example, Coco Cola is the market leader in the segment and hence already has a large proportion of the market share, hence the scope for incremental growth may not be massive but steady growth is certain in alignment with the core market.

Copyright © 2021 Kalkine Media Pty Ltd.

- Low Volatility: The interest of the investors is safeguarded by mitigating the risks of volatility caused by the business cycle and other macro-economic factors. Such companies have better ability to absorb market shocks compared to their peers and thus are able to maintain the trust of the investors.

- Regular Dividends: Dividend is the proportion of profit distributed to shareholders and therefore is directly related to the profits earned. Companies in good financial standing tend to be more profitable.

What are the markers for blue chip stocks?

Copyright © 2021 Kalkine Media Pty Ltd

There are varied opinions on what qualifies a stock as blue chip but typically seen features of a blue chip are-

- Large market capitalisation: Market capitalisation is estimated as (number of shares*share price.)

- Growth in earnings: Earnings are indicators of a company’s performance. Earnings per Share (EPS) is a widely used measure of earnings. EPS is estimated as (Net profit/ number of shares) The Earnings per share of blue chip companies show steady increase.

- High dividend yield: Companies that perform well are more profitable and thus have a higher dividend payout ratio.

- Brand credibility: Over years the companies have managed to become a household name and it is often a leading indicator of its financial performance as well. Such companies enjoy very high brand loyalty.

- Sound activity ratios: Activity ratios judge the soundness of the operations of a company. Activity ratios are a better measure to compare peers in the sector as opposed to absolute numbers. Some prominent activity ratios are Debt to equity ratio, profitability ratio, leverage ratios, long term debt to total asset ratio, shareholder equity ratio, solvency ratio, interest coverage ratio etc. All these ratios help judge the financial stability and operational efficiency of a company which are key factors for investor decisions.

- Low volatility: Sound management, stable activity ratios, strong reserves enables a company to survive adverse market conditions and thus simultaneous ensure better returns for investors.

- Stable cash flows: Cash flow stability of a company hand in hand with the sound financial statements is a major factor protecting the stocks against market volatility.

- Sector leader: These companies are the best performing ones of their respective sector and have a relative advantage over other players in terms of operation.

- Strong corporate governance: Sound operational rules and procedures of a company are pre requisite to and are indicative of sound financial and ethical health of a company. This also creates trust among investors.

- Ratings: The blue chip stocks are highly rated by rating agencies and thus are considered more credible.

What are some well-known Blue chip stocks?

Commonwealth Bank of Australia, BHP Billiton Limited, Westpac Banking corporation are blue chip stocks on ASX. Few blue chip stocks on Nasdaq are Apple, Walt Disney, Johnson & Johnson. Similarly, the Sensex has blue chip stocks like those of Reliance Industries, Tata Consultancies, Hindustan Unilever, Infosys.

As of December 2020, famous blue chip stock Amazon was valued at $1trillion, Alphabet- the holding company that operated Google, Android, Chrome too was valued at $1 trillion and Coco Cola company was valued at $229 billion.

Diversification or only Blue Chip Stocks?

A diversified portfolio is always the wise investing decision. However, in cases where the aim is capital gain and long term investment, blue chip stocks are a good option. Due to the stability in dividends, it ensures regular income at fixed intervals. All these features also make it a good retirement savings option. Also, the prices of these shares are higher and thus are costlier are than other shares. Similarly, those who are looking for short term returns can consider diversification of portfolio and include blue chip stocks as the safe options and risk mitigating components of the portfolio. The proportion of blue chip stocks in ones portfolio depends on the extent of risk aversion and financial capability.

Does the Blue-Chip ship sink?

Data analysis, financial modelling and tons of number crunching sure can predict the possibilities of the future. But just as standard deviations from estimated values are possible so is the crash of blue chip stocks too because always there is risk. Some classic examples are Lehman brothers, General motors, Satyam and Nokia.

Please wait processing your request...

Please wait processing your request...