What is a budget deficit?

A budget deficit arises when expenditure exceeds revenues (i.e., tax and other borrowed money), usually over a single fiscal year, increasing the national debt. Budget deficits are typically associated with organisations, governments, corporations, and people.

A country may need to boost revenue-generating activities to close a budget deficit while cutting back on specific expenditures or a mix of the two.

Summary

- When spending surpasses receipts, a budget deficit arises, and it indicates a nation's financial condition.

- Unplanned policies and events may cause budget shortfalls.

- Budget imbalances can be addressed by decreasing spending and boosting taxes.

Frequently Asked Questions (FAQs)

What are the factors that contribute to a budget deficit?

There could be a variety of circumstances that cause expenditures to exceed revenue.

- An unavoidable job loss can result in a loss of revenue.

- Bills for unexpected medical expenses can quickly spiral out of control.

- If the debt repercussions aren't too severe and individual is in the early phases of credit card debt, spending can quickly exceed revenue. The debtor continues to charge and makes the minimum payment.

- Governments lose income during recessions. When workers lose their employment and become unemployed, they pay less in taxes; this means the government receives less revenue.

- Budget deficits may arise due to unexpected actions and events, such as increased defence spending following the 11 September 2001 terrorist attacks. While the initial battle in Afghanistan cost an estimated $22.8 billion, the cost of the war in Iraq in the fiscal year 2003 was $51 billion.

Source: © Francy874 | Megapixl.com

What are the circumstances that lead to budget deficit?

- Most businesses with long-term deficits may experience immediate consequences.

- If a person or a family has a budget deficit, their creditors will contact them. As debts go unpaid, their credit score soars, making new credit more costly or impossible to get. As a result, they may be forced to file for bankruptcy.

- Bond ratings decline for companies with chronic budget deficits. When this happens, they must pay higher interest rates to obtain any loans, referred to as junk bonds.

- Governments rely on taxes for revenue. By delivering services, government leaders maintain popular support. They will spend as much as possible if they want to keep their power. The majority of voters are unconcerned about the debt's consequences.

What are the types of budget deficits?

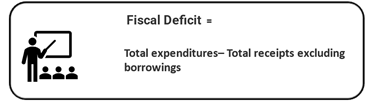

Fiscal Deficit

The fiscal deficit means the amount of money the government will need to borrow to cover its expenses. The more significant the budgetary imbalance, the more money will be borrowed. In the absence of cash, the fiscal deficit helps to understand the government's shortage while paying for expenses.

A large fiscal deficit causes the government to spend money it doesn't have, thereby putting the economy under inflationary pressure.

On the other hand, borrowing more money will hamper future economic growth because most of the funds will be used to pay off debt.

In addition, reduced bonus, subsidies, and leave encashments, lowered public expenditure, disinvestment of public sector units, and increased tax revenue can all help to lower the fiscal imbalance.

The following is the formula for estimating the fiscal deficit:

Image source: Copyright © 2021 Kalkine Media

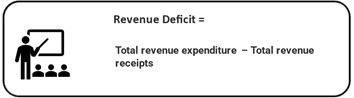

Revenue Deficit

The term "revenue deficit" refers to a situation in which the government's revenue is insufficient to cover the costs of essential government services.

To cover the revenue deficit, the government must liquidate some assets, contributing to inflation in the market. A considerable amount of borrowing increases the country's financial debt burden.

Decreased needless spending, increased tax rates, and the imposition of additional taxes, when possible, could be some of the steps taken by the government to reduce the deficit.

The formula for calculating the revenue deficit is as follows:

Image source: Copyright © 2021 Kalkine Media

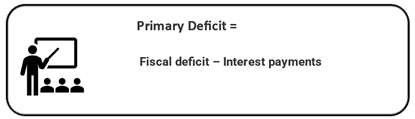

Primary Deficit

The primary deficit depicts the expenditure that government borrowings will cover while omitting the payment of income interest.

A zero deficit indicates that credit or borrowing is required to pay off the outstanding interest payments.

Because the primary deficit is any borrowings above the existing debt or borrowings, measures to reduce the primary deficit can be comparable to those made to lower the fiscal deficit; like a reduced bonus, subsidies, and leave encashments or lowered public expenditure etc.

The primary deficit is calculated using the following formula.

Image source: Copyright © 2021 Kalkine Media

How to deal with a budget shortfall?

There are only two methods to keep a budget deficit under control: either raise revenue or reduce spending. On a personal level, getting a raise, obtaining a better job, or working two jobs will enhance revenue. Starting a business or renting out real estate are two ways to boost revenue.

Many experts advise avoiding costly non-essentials such as television subscriptions and Starbucks coffees. It can also benefit someone with a spending problem if they seek help.

Social insurance taxes, corporate taxes, consumption taxes, and income taxes provide the majority of revenue for national governments. These tax increases are the way for governments to increase revenue.

Please wait processing your request...

Please wait processing your request...