What is a Buy-Sell Agreement?

An agreement or a legally binding contract that governs the situation if a business partner dies or otherwise leaves the business is termed as a buy-sell agreement. Such an agreement is designed to provide for the organized disposition or continuation of a person's ownership in a business.

The buy-sell agreement is also called a ‘buyout agreement’, which reflects what will happen to the shares of an enterprise when an unforeseen event occurs. Sometimes, it is also known as the ‘business will’ as it is concerned with the succession of an enterprise or business at the time of a crisis.

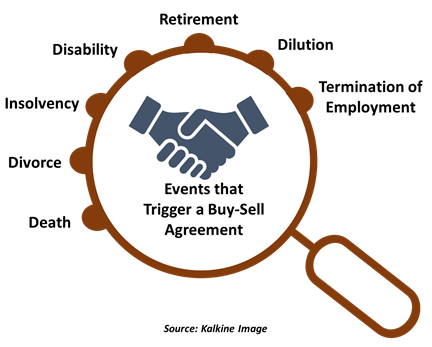

What are the Events that Can Trigger the Buy-Sell Agreement?

A buy-sell agreement is formed to ensure the successful run of transactions during certain triggered events, which can result in a potential disaster. These events majorly comprise:

- Divorce: Amidst the growing frequency of divorce in today’s world, a buy-sell agreement often contains divorce as an activating event. This is done to ensure that a non-employee spouse is not provided with an ownership in the shares of a company post-divorce.

- Disability: In circumstances where a shareholder becomes disable and incapable of performing company’s duties, a buy-sell agreement can provide clarity on the meaning of disability and the length of time before disability prompts a buyout.

- Death: A buy-sell agreement is often created to resolve issues at the time one of the owners passes away. The agreement can provide a tool on delineating the value of shares for the purpose of estate taxes and their dissemination to other surviving members or family post owner’s death.

- Bankruptcy: At the time an owner declares insolvency or bankruptcy, a buy-sell agreement can enable the remaining shareholders to buy his or her shares to prevent their dissemination to creditors.

- Retirement: A retiring shareholder can cash-out his or her possessed interest through a buy-sell agreement. Usually, the remaining shareholders do not want a retired stockholder to harness the benefit of their ongoing efforts. Hence, either a current shareholder purchases his shares, or the shares are put up for a bid.

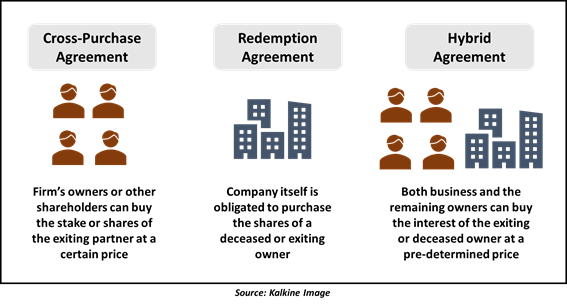

What are the Different Kinds of Buy-Sell Agreements?

Buy-sell agreements can be broadly classified into three categories – cross-purchase, redemption and hybrid agreement.

- Cross-Purchase Agreement: Such an agreement enables a firm’s owners or other shareholders to buy the stake or shares of a partner who becomes disabled, dies or retires, at a certain price.

- Redemption Agreement: Such an agreement allows the company’s owners to ascertain in advance the terms of transferring or purchasing ownership stakes in the event of a departure of an owner from a company. In this agreement, the company itself is obligated to purchase the shares of a deceased or exiting owner.

- Hybrid Agreement: An integration of cross-purchase and redemption agreement is termed as hybrid agreement or ‘wait and see’ agreement. In such agreement, both business and the remaining owners can buy the interest of the exiting or deceased owner at a pre-determined price.

Why are Buy-Sell Agreements Important?

In order to facilitate the systematic transfer of business interests in case of occurrence of some specific events, the business partners prefer to enter into a buy-sell agreement. Below are some of the key advantages associated with the buy-sell agreement:

- Defines ownership succession plans and the desired exit strategy.

- Prevents obstruction in the voting control of the business and a tiff in the management.

- Minimises the risk of a departing owner or the related family members, taking a legal action over the company’s valuation.

- Prevents the threat of a departing owner’s spouse selling their share of the business to an unsatisfactory third party.

- Makes sure that the survivor of a deceased business partner is paid compensation for the deceased partner’s share in the business.

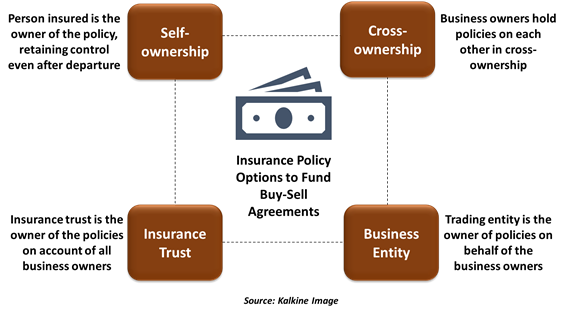

How are Buy-Sell Agreements Funded?

The buy-sell agreements are usually funded by purchasing insurance policies, with numerous options in place for policy ownership:

- Self-ownership: The person insured is the owner of the policy in this case. In this case, the departing owner is usually required to give up his or her interest in the company to existing shareholders upon departure, with the leaving owner receiving policy proceeds. It is considered as the simplest structure in which the insured person controls the policy even if he leaves the business.

- Cross-ownership: The business owners hold policies on each other in cross-ownership. Such ownership varies with changes in ownership of the business. In this case, when a trigger event occurs, the continuing owners generally use the policy proceeds to buy the departing owner’s interest in the business.

- Insurance Trust: An insurance trust is the owner of the policies on account of all business owners in this case. Herein, policy ownership is unaffected by the changes in business ownership. In case a trigger event occurs, the trust can dispense the policy proceeds to the existing owners.

- Business Entity: In this case, the trading entity is the owner of policies on behalf of the business owners. Unless and until the insured person does not want the policy assigned to him while leaving the business, policy ownership is unaffected by the changes in business ownership.

How to Choose an Effective Buy-Sell Agreement?

Once the owners reach a decision that the buy-sell agreement is required, it is imperative to choose an appropriate agreement. Typically, an influential buy-sell agreement answers the following queries:

- Who can hold a stake in the business?

- What occurrences will cause the obligation to sell or buy a stake in the business?

- What will be the procedure for assessing the shares?

- What will be the terms of the transaction and the purchase price of the shares?

- How will the agreement be funded?

Please wait processing your request...

Please wait processing your request...