What is Capital IQ?

Capital IQ is the name of S&P Global- research division as well as the name of its software and web portal. S&P Global is a world-renowned rating agency and a market research firm. Its' research arm, S&P Capital IQ, provides comprehensive research and analysis services and actionable market intelligence data to investors.

Subscriber of the Capital IQ website or software also gets access to its expert data feeds and analyst reports. In this Information hungry world, Capital IQ is one of those many companies that conduct and sell research reports. It offers valuable and comprehensive insights into numerous stocks. These insights help investors make more conscious choices.

Highlights

- Capital IQ is the research agency and analysis unit of S&P Global. It is also the name of its website and software.

- It provides users with essential data for fundamental and technical analysis. It enables investors to build financial models and monitor investment ideas.

- The Information is valuable to large institutional traders, retail investors, and financial speculators.

Frequently Asked Questions

How does Capital IQ work?

Source: © Chormail | Megapixl.com

- Capital IQ works on a B2B (direct contracts) as well as B2C models (through its web portal and software). The Information generated is accessed by consultants, banks, companies, investment managers, hedge funds, academies.

- It provides an overall market analysis, and investors or other users can utilise this data for implementing investment strategies.

- The data available with Capital IQ has company profiles, abstracts, financial material, and independent expert intelligence. Capital IQ also probes into financial updates, market perceptions, performance data, and sectoral trends.

- The firm provides subscribers insights on several public companies and private firms. As per its web portal, it covers the financials of 88,000 publicly listed companies, which is 99% of the global market cap.

- Capital IQ also works on intricate investment arrangements, mutual and hedge funds, providing investors with an up-to-date performance evaluation and understanding. The Information is valuable to large institutional traders, retail investors, and financial speculators.

What are the key attributes of Capital IQ software?

Capital IQ software is an excel-based, web-enabled financial research application. It classifies historical stock information, market trends, and securities transactions. It provides users with essential data for fundamental and technical analysis. It enables investors to build financial models and monitor investment ideas.

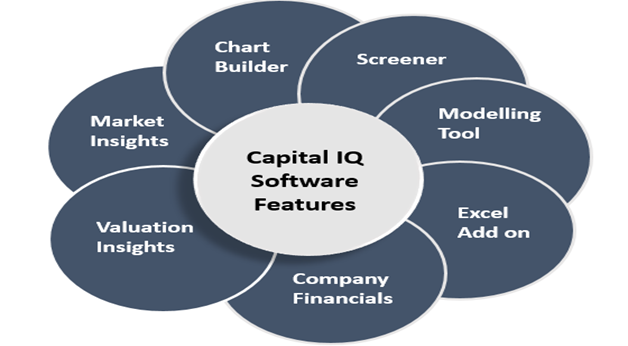

Some of its key features are –

Copyright © 2021 Kalkine Media

The Software has seven key menu offerings for subscribers-

- Report builder- Using this feature, clients can develop a customised report of their Capital IQ insights or interests.

- Company intelligence- this option gives an inclusive information database for public & private companies, private equity firms and transactions undertaken by them. Its 'Tearsheet' page provides details like basic business details, investor list, subsidiaries, share information, financial ratios, etc.

- Financials/valuation- this feature offers a detailed list of financial information for financial analysis and stock valuation. Primary financial statistics, cash flow details, income statement, balance sheet and other information can be found here.

- Estimates- under this tab, a summary of analysts' forecasts regarding a company/share are available. It also has a current price, trade recommendations, long-term growth forecasts and other estimated details.

- Markets- in this page, comprehensive industry analysis is present. Major sectors and in-depth research on them are available. Industry performance, comparative graphs, sector performance ratios are available.

- Company screener- In this part, users are allowed to find comparable Information based on a wide range of screening points. Here, clients select and apply filters for companies data. Companies can be screen-based on corporate actions as well. There is also transaction screening, where companies are sorted by transactions like takeovers, buybacks, new issues, etc.

Why users prefer Capital IQ?

- Capital IQ tools allow effortless comparisons of updated company filings over time.

- The screening tool for comparable companies and/or transactions is very comprehensive.

- Users are allowed to customise dashboards and 'tear sheets' in numerous ways.

- Software is compatible with any device; users can therefore access it at their ease.

- Editable PDF reports can be extracted and printed by users for analysis.

- The private equity profiles, their investment criteria, and fund size data are extremely useful to analysts and investors.

- Data aggregation and charting tools allow comparing multiple indices and/or individual publicly traded securities.

- Transaction monitoring is possible because of a reliable and continuously updated database. It is very handy for analysing deals, particular in an industry/sector.

What are the defects of Capital IQ?

- Few users report that add-in from Capital IQ slows down excel when formulas are linked into it.

- Software algorithms don't always take up data from footnotes of company filings. This can sometimes make the analysis of financials and multiples less robust.

- The user interface doesn't seem user-friendly to less knowledgeable users. They, therefore, minimise the utility of the software's features.

- Not all the private companies’ financials are available, sometimes leaving a gap in transactional analysis.

- Even debt market data related to bankruptcies and distressed debt, or special situations is not as detailed.

Please wait processing your request...

Please wait processing your request...