What is meant by a Certificate of Deposit?

A certificate of deposit is a savings account in which a predetermined amount of money is deposited in a fixed account for a specific amount of time, offering an interest rate higher than other savings account. Certificates od deposit or CDs, are issued to increase the range of money market instruments giving investors greater flexibility in terms of short-term funds utilization.

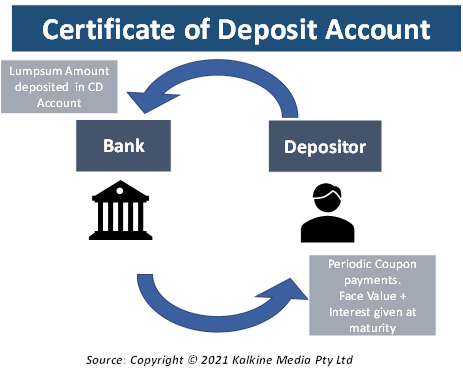

CDs are issued by commercial banks and act as an agreement between the depositor and the bank. The deposit by the customer must be a lump sum amount and should be left untouched for the specified period.

The rates offered on CDs may differ from bank to bank. Besides, the term for which the account is issued may also vary with each bank. If the deposit is withdrawn before the specified amount of time, then the depositor may be subjected to a fee.

How does a certificate of deposit work?

The depositor must deposit a lump sum amount of money while opening a CD account. The issuer of the CD, in return, offers interest payments at regular intervals till the date of maturity. At maturity, the account holder receives the entire amounted that was initially invested, in addition to all the interest.

Investors may find it profitable to opt for CDs that have a longer term rather than those with a shorter term as the former usually have a higher yield. Additionally, CDs have a higher interest rate associated with them compared to other savings accounts to compensate for the funds not being as liquid as other savings deposits.

Certain banks may offer a variable interest rate while others may prefer to hold onto the stock market related indices as an index for the CD. Moreover, not all banks may charge a fee in case of early withdrawal as they allow the owner to withdraw out of the interest earned till that period.

In certain instances, CDs may automatically roll over post the maturity date. Whereas, in many other cases, CDs stop accumulating interest post the maturity.

What are the different features of a CD?

Following are the features of a CD that make it a unique security instrument:

- Low risk: CDs are deemed as low-risk investments as they offer a steady income without much volatility. These are good investment options for those who want to save money for retirement.

- Lower liquidity: When compared to bonds and other types of investment vehicles, CDs are not as liquid and are hard to convert to cash.

- Interest rate: The longer a CD account is maintained, the higher interest it would accumulate. Thus, the prize for keeping one’s money locked up in a CD is higher interest. When interest rates are rising overall, it is a good idea to invest in a CD account.

However, it might not be beneficial to lock up money in a long-term CD when interest rates are rising too quickly as the depositor may be locked into one rate, missing out in the increasing rate. As a solution to this, investors set up “CD ladders” wherein money is placed in different CDs having differing maturities. Thus, it allows them to always have liquid funds, even with money locked up in CDs.

What types of CDs are there?

CDs can be of various types, some of these include:

- Traditional CD: A traditional CD involves depositing a fixed amount of money for a predetermined amount of time, against a fixed interest rate. These CDs do not have any additional provisions and can only be withdrawn at the end of the maturity period. Early withdrawals come with a huge penalty, which can be as high as the initial principal amount.

- Step-up CD: A step-up CD can be used to move towards a higher yield, automatically. These are lesser-known CDs as there is no guarantee that the new yield would fetch higher Annual Percentage Yield (or APY) than a traditional CD.

- Bump-up CD: Just like a step-up CD, a bump-up CD is also used when the depositor wants to move to a higher yield. However, here the difference is that the bump-up is not automatic. Here the depositor must seek permission from the bank to move to a higher yield. In this case too, investors might be met with a lower APY than that earned on a traditional CD.

- Liquid CD/ No-penalty CD: These offer the feature of early withdrawal of funds without the depositor having to pay a fee. The APY associated with a liquid CD can be higher than that offered on other savings accounts however, not as high as that of a traditional CD. A liquid CD may have varying periods until which the deposit must be held with the bank. However, most banks may require the deposit to stay intact for at least a week’s time.

- Zero-Coupon CD: These CDs do not have any coupon payments attached to them. However, the only returns offered on these types of CDs is the face value paid back at maturity along with the accrued interest.

- Callable CD: These CDs offer higher interest; however, they have a risk attached to them. In the event when rates might fall, the issuer can call back the bond and issue it at the new rate, which is lower than the original agreed upon rate. Thus, a higher yield comes at the cost of future uncertainty regarding the rates.

Which institutions can issue a CD?

Almost every bank may be able to offer at least one CD, even those institutions that do not have a brick-and-mortar presence may be authorized to issue a CD. Thus, any institution that accepts customers through online platforms may be eligible to issue a CD.

It is advisable to explore different types of CDs that are available before taking the decision to invest in one.

Please wait processing your request...

Please wait processing your request...