What is a Clean Revenue Classification System?

A Clean Revenue Classification System classifies goods and services across all sectors providing social benefits and a clean environment. The system was developed by Corporate Knights and is updated and reviewed annually. It can also be termed as Clean Revenue Taxonomy.

What is clean revenue?

Clean revenue is earned from goods and services that clear environmental and social edges. It includes revenues from the low-carbon economy, clean transition, and circular economy’s revenue segments.

Clean revenue varies as it is sector specific. For instance:

- Financials/ Banking: Interest revenue generated from green credit operations and renewable energy loans.

- Information Technology: Revenue generated from data centers that are fully power backed up by renewable energy resources.

- Industrials: Sales revenue generated from solar panels, wind turbines, energy monitoring, and management equipment.

What is a clean investment?

A clean investment is an investment done in projects, businesses, and schemes that are aligned with the purpose to provide a clean and sustainable environment and social benefits.

Need and scope of introducing Clean Revenue Classification System

In 2018, Corporate Knights took a step to calculate green revenue metrics by defining global clean revenue taxonomy standards. These standards should be comparable, consistent, relevant, consistent, specific, and should be available to the public. The ultimate goal of defining clean revenue and clean investments is to get these clean metrics integrated into reporting guidance by global accounting standards-setting institutions. Corporate Knights have also developed clean revenue and clean investments metrics by using clean taxonomy as the foundation for calculations.

Some were initiatives taken to compliment the Clean Revenue Classification System:

- Climate Bonds Initiative: It is an initiative to guide assets and projects aligned with the climate. It is a tool to identify the key investments delivering a low carbon economy. This tool is used by investors, governments, municipalities, etc.

- Sustainability Account Standards Board (SASB): It is an independent non-profit organization aimed to develop sustainability accounting standards. The organization was founded in 2011 by Jean Rogers.

- Green Bond Principles (GBP): GBP is the best voluntary best practice guideline established by a consortium of banks in 2014. These guidelines promote transparency and integrity in the development of the green bond market.

What is Carbon Clean200™?

The Clean200™ includes the largest 200 publicly traded companies ranked based on clean economy revenue in US$. To be eligible, the company should earn revenue of at least US$ 1 billion in the most recent year and 10% of total revenue should be generated from clean resources. This clean revenue was first calculated and published in 2016 by Corporate Knights and As You Sow. The report highlights the fact that clean energy investments and stocks outperform in comparison to fossil fuel stocks.

It also uses the methodology of negative screening. The Clean200™ excludes utilities and oil and gas companies generating less than 50% of their power from green sources, top 100 coal companies measured by reserves, weapon companies, deforestation- affecting agriculture business, pipeline and oilfield companies, companies using forced and child labor, etc. For instance, some companies that were not re-included in Clean200 in 2021 due to negative screening are:

- Ball Corp: Top 100 major military contractors

- SNC-Lavalin Group Inc: Illegal activity

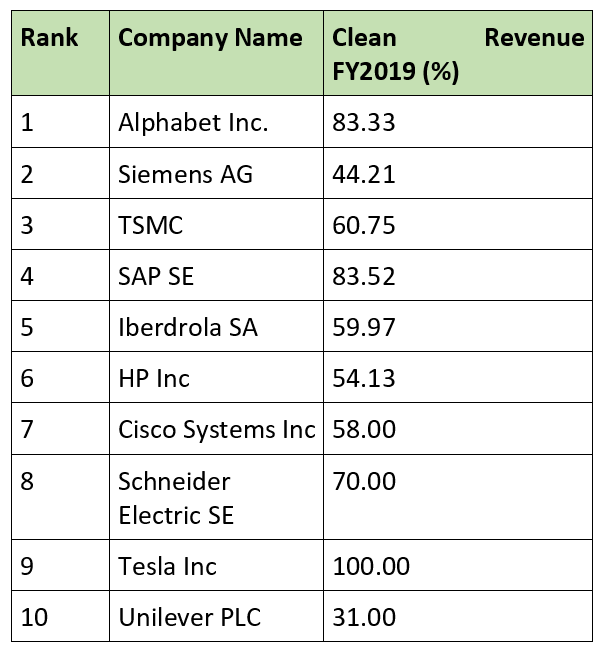

The 2021 Carbon Clean200™, reporting the data till the end of December 2020, ranks the top 10 companies as mentioned below:

According to the 2021 Carbon Clean200™ report, the below graph shows the number of firms from each sector (as defined by Global Industry Classification Standard). In the Industrials sector, there was a maximum number of companies generating clean revenue.

What is the Green Revenues Data Model and Green Revenues Classification System?

The Green Revenues Data Model is developed by FTSE Russell to monitor the aggregate and individual’s contribution in making the growing economy greener. To quantify the term ‘green investing’ has been a challenging task, as it was largely based on concepts and used very loosely. This model provides a structured methodology to meet the demand for quality data on green revenues and green investments. The revenues are tiered in three categories to simplify the assessment of securities and companies: green, greener, and greenest. The EU is setting up standards before any investment is marked as sustainable or environmental and the data provided by FTSE Russell’s model helps the investment community to better understand.

The model assesses the green revenue of thousands of companies based on Green Revenues Classification System (GRCS), which is a thorough categorization for clean goods and services across sectors.

This system was established in 2013 to help financial markets and investors in recognizing enterprises that focus on products supporting a green economy. These goods and services are said to be evaluated based on their impact on climate change, resource use, etc.

Please wait processing your request...

Please wait processing your request...