What is Consumer Price Index (CPI)?

Consumer Price Index or CPI is a measure of weighted-average of goods and services’ prices purchased largely by households. It is used to measure the percentage change of overall price level in the economy and consequently to calculate inflation.

CPI is an important tool used to judge the economic stability and financial steadiness of a country. Central banks introduce policies aimed at inflation control that use CPI as a measure of effectiveness. CPI is calculated for few essential goods which include food, housing, transportation, electronics, medical care, education, etc.

Why is CPI important?

CPI does not only compute the level of inflation in the economy but also gives a picture of the cost of living. Inflation can reduce the value of existing money in the consumer’s hand and can considerably lower the standard of living.

CPI is a timed measure of inflation rates which can shed light on the other macroeconomic indicators. For example, as inflation increases, the input costs for firms also increase. Thus, they are compelled to reduce their production and lay off workers. Therefore, high inflation can lead to unemployment in the economy.

Keeping a tab on inflation rates becomes necessary, especially for governing bodies like central banks. When prices are expected to increase, the central bank must control the supply of money in the economy by adopting contractionary monetary policies. This can only be done with prior knowledge about prices and inflation rates.

The current period CPI can also be used to determine future price stream. For instance, future property rents may be calculated by multiplying the current rent with the prevalent CPI. If CPI increases, so will the rent.

How is CPI calculated?

CPI is calculated by taking a base year as a reference period and calculating the price change from that year onwards. Simply put, it is the ratio of the cost of the basket of goods in the current period to the cost of the basket of goods in the base period, whole multiplied by 100.

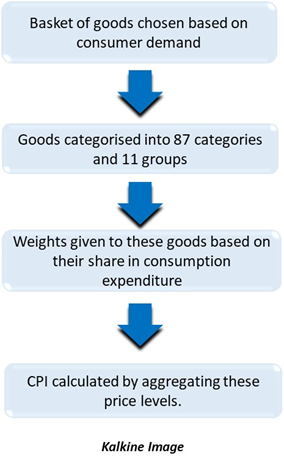

Various countries have different methods of calculating CPI based on the basket of goods they choose. In Australia, CPI is calculated by the Australian Bureau of Statistics and is published once every quarter. These items are then categorized into 87 categories (or expenditure classes) and 11 groups. Every quarter, price changes in these goods are calculated from the previous quarter, and then are aggregated to find out the inflation rate.

Each good included in the CPI basket has a weight attached to it. CPI is then calculated by taking a weighted average of the prices of these consumption goods. The weights attached to the prices of these goods are arrived at by calculating their share in the total expenditure.

How are the goods and prices arrived at?

Prices are collected from various sources that sell household items like supermarkets, department stores and websites. Other sources include the prices of government provisions like electricity and fuel through government bodies designed to supply them.

For deciding the consumption basket, ABS focusses on the level of consumption of various goods and services in the economy. The item on which people are spending a larger part of their income, ends up gaining a higher weightage in the CPI calculation. Thus, it is important to note that higher weightage is given to those goods which take up a larger share in the expenditure of overall consumption.

What are some of the problems with CPI?

Despite government authorities and international organisations relying heavily on CPI for information about various economic indicators, CPI has its own set of limitations which need to be considered. These include the following:

- CPI is not a direct indicator of price level: CPI measures the rate of change of price and not the actual price levels in the economy. Thus, it is only a relative measure of prices and not an absolute measure of prices. A higher CPI may falsely indicate that a commodity is more expensive than the other, However, it only means that the prices of that commodity have increased more than the other.

- Limited Inclusivity: CPI only includes the prices of certain select goods for major residential hubs. A lot of times, CPI calculation may exclude the prices of goods in lesser inhabited areas or regional areas. Moreover, it is only an aggregate and not an absolute measure, thus, it would not be able to justify different spending habits of various households.

- Exclusion of quality changes: The products included in the consumption basket may experience a change in their quality and not just their prices. The prices of a good may also change because of better quality of the good being provided and consumers shifting to the newer variant. Therefore, the adjustments made to the same product in terms of better quality cannot be adjusted while calculating CPI. Similarly, services are also difficult to quantify, especially when the quality of services are to be incorporated into CPI calculation. An example of this can be, a hospital expanding their equipment and introducing better services.

- Substitution Bias: When the price of a good increases, then people might shift to a closer substitute of that good. However, CPI fails to incorporate this change. This is called the substitution effect. Therefore, unfair weightage might be given to the good that has increased prices, rather than the good which has greater share in the consumption basket.

- Exclusion of new goods: It takes a lot of time for new goods to be incorporated into CPI calculation because of the various defined categories.

- Not a precise indicator of cost of living: CPI might be a helpful aid in estimating the cost of living; however, it can never be an accurate measure of the same. There are other indexes which might be more accurate in justifying the cost of living.

Despite all these limitations, CPI is a powerful tool used across the globe in analysing markets and economies. It can be used to compare how markets are progressing and which goods are more expensive in an economy. While using CPI, it is important to note that it is only a relative measure of price and it records price changes and not the absolute price levels.

Please wait processing your request...

Please wait processing your request...