What is Contango?

Contango is used to refer a situation of market where the future price of financial instrument or commodities is more than its spot (current) price. These commodities include currencies, financial instruments, stocks etc.

Source: Copyright © 2021 Kalkine Media Pty Ltd

Understanding Contango

The term Contango is used to indicate the market situation where the price of commodities in future is more than its current price. These commodities include currencies, financial instruments, stocks etc.

In the trading of financial instruments, Contango is common as ultimately investors invest with the assumptions of contango (the price of a commodity is higher that its spot price. Contango is used for the future market possibilities where future prices of commodities and contracts are more than its current price (spot price).

Contango is affected by the demand and the supply in the market. It is the scenario of market where long-term securities are traded at higher than short-term commodities.

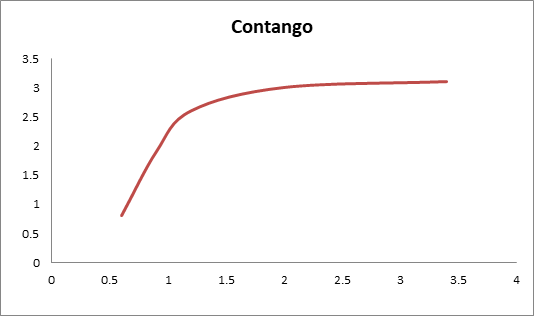

Source: Copyright © 2021 Kalkine Media Pty Ltd

Here this chart represents, in contango market the forward (future) price is higher than the spot (base) price which result an upward sloping forward curve.

Frequently Asked Questions (FAQs)

What is spot price in Contango?

Spot price refers to the price at which financial commodities are traded (buy/sold) such as securities, stocks etc. It is also called the current price at which an investor buys or sells a security at a fixed place or time.

Spot price is used as base price at the time of future contracts. Investors or traders use spot price as a base indicator for the assumptions about future price of the commodities.

In contango, spot price represents the current price or base price of a commodity which is used at the time of trading. It helps investors to expect the future prices of that commodity. In the point of view of an investor or trader, it plays a vital role to set a market expectation at the time of trading or future contracts to represent market expectation.

What is the advantage of Contango?

If we are talking about the advantage of the contango, the term arbitrage strategies comes in our mind.

Arbitrage strategies refers to the trading strategy from which an investor or trader seeks profit from the different market for the same asset. An investor or trader purchase a commodity at current (spot price) of market and sell it in future with profit.

Under contango, an investor and trader may focus on buying more securities at the spot price in order to enjoy profit in future by selling them at higher prices. Traders also use other ways to get profit in contango market such as spread trading.

In spread trading strategy, investors simultaneously trade (buy and sell) two related commodities or future contract to get profit from contango situation. Investors may take advantage by buying future contract but investors may enjoy this only when the actual future prices are higher than future contract prices.

What is disadvantage of Contango?

When it comes to disadvantage of Contango, automatic rolling forward contracts treated as one of its disadvantage. In this investors and traders face some loss when future contracts mature or expire at more price than the spot price.

There is an exception in this disadvantage; it is only for the commodity ETFs that use futures contracts. It is for oil exchange traded fund (ETFs) because in other exchange traded fund (like gold) investors don’t get losses as it use actual commodities.

Automatic rolling forward contracts, it is one of the strategies of commodity ETFs (exchange-traded fund). Investors and traders who purchase commodity contracts at the point when markets are in contango may suffer from some loss when the future contracts expire with more price than the spot.

What is the role of contango in commodity exchange traded funds (ETFs)?

Exchange-traded funds (ETFs) refer to the investment funds which are traded on a stock exchange. Contango may create a decline in profit of investors who involves in long dated commodity ETFs. In contango, if an investor invests in ETFs futures contract than there may be chances that contract perform worse and also a challenge for futures-based commodity ETFs is a chance that an investor or trader may trade in investment funds before the roll process.

Investors invest indulge in future trade with many maturities at different prices. In long term investors have to do regular roll process of the contracts that are near of its expiry by selling and buying longer dated contracts.

Roll process may be expensive as the next contract does have more cost than the current one in the contango situation of market. Sometimes, the return (profit/loss) from the roll process becomes a pivotal actor in commodity return.

In contango market, investors must perform roll process from one contract to another (next). On the other side if market is in backwardation, roll process may be favorable for investors as future price of the futures contract is less than its expected spot price.

How are Contango and Backwardation related?

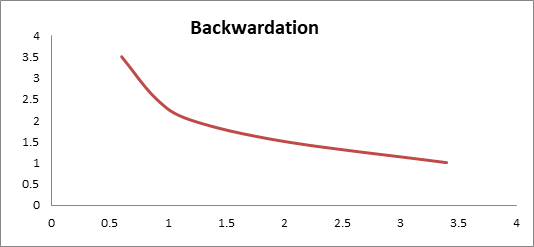

Backwardation opposite to what contango is. But they both are used in the structure of forward curve. Backwardation refers to the market situation in which forward price of a commodity of futures contracts is less than the spot price. Talking about its graphical curve, it always shows a downward slope.

Backwardation can be a result of several reasons, including current demand and supply of market, short-term events. It is work as a signal for investors to expect asset prices may fall over time.

On the other side, Contango is just opposite of backwardation. Contango refers to the market situation in which forward price of a commodity of futures contracts is higher than the spot price. Talking about its graphical curve, it always shows an upward slope.

Source: Copyright © 2021 Kalkine Media Pty Ltd

Here this chart represents, in Backwardation market the forward price is lower than the spot price which result a downward sloping forward curve.

Please wait processing your request...

Please wait processing your request...