What is core inflation ?

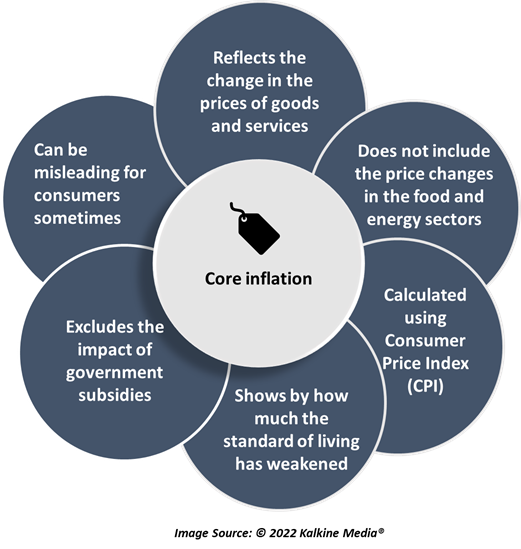

Core inflation reflects the change in the prices of goods and services in all sectors except food and energy. These two sectors are excluded from calculating core inflation as they are highly volatile. Any change in these sectors can throw off the entire measure of inflation, depicting the underlying trends.

Like most other measures of inflation, core inflation is also calculated using Consumer Price Index (CPI). Essentially, the CPI measures the change in prices of goods and services. Another measure of inflation is the core personal consumption expenditures index (PCE) which is measured for the consumer prices in the US. Alternate measures of calculating core inflation involve the outliers method, under which products with the largest price changes are removed.

Apart from excluding change in the cost of food and energy, core inflation also excludes the impact of government excise duties. Moreover, core inflation is considered an important guide to long-term inflation. However, it can be misleading for consumers due to the exclusion of some important sectors of the economy.

Why does core inflation not include food and energy prices?

A major reason for excluding food and energy prices from the calculation of core inflation is that these prices fluctuate too much. Since both these categories comprise essential or staple goods, any fluctuations in their prices do not immediately reflect in their demand.

Consider food items such as bread, flour and fruit, which are a key part of daily consumption and cannot be removed from one’s consumption basket. Any rise in their prices would be met with a subsequent reduction in the demand for other, non-essential goods in the consumption basket. Similarly, any rise in the price of gas does not dampen the demand for it significantly. While demand might be affected by price changes in these categories to a small extent, it does not always move at the same level as prices.

Why do the prices of food and energy fluctuate so much?

There are many factors at play which determine the change in the prices of food and energy. For instance, food prices depend highly on environmental factors that can impact the value of the crop. At the same time, oil supply is also subject to fluctuation based on the decisions taken by OPEC. These factors may not necessarily highlight the underpinnings of the domestic economy.

Oil and gas are integral components of the stock exchange, where traders actively bet on their price movements. Food is also traded on these exchanges, resulting in higher volatility in their prices. These drastic price movements may reflect an inaccurate measure of inflation, especially given the fact that such price movements are resulting due to trading operations. Meanwhile, some of these price movements can be self-correcting, leaving no impact on inflation.

Most of these changes in food and energy prices stem from temporary factors that can reverse with time. However, to keep the measure of inflation on a safer and more accurate side, these prices are not included in the overall calculation.

Why is core inflation measured?

It is important to gauge by how much the underlying inflation is rising to measure the amount of decline in the standard of living in a region. If income does not rise at the same rate as the rise in prices of goods and services, then inflation can significantly weaken peoples’ buying power.

Inflation can multiply over time and show an even stronger impact as years go by. Rising consumer prices eat away the value of money and make the living standards poorer. When wages match pace with inflation, consumers do not feel much of an impact of rising inflation. However, the alternative can be severely damaging and is exactly what has been visible in the post-COVID era.

Thus, inflation can also impact the economic productivity of a country and can also hurt businesses to the point of shutdown. The pressure is even higher when inflation transforms into high inflation that does not go away. Prolonged inflation can result in ‘stagflation’, which is the harbinger of high unemployment and slow economic growth.

Please wait processing your request...

Please wait processing your request...