What do you mean by Cost of Carry?

Cost of carry refers to the cost which incurred in holding an investment. Cost of carry may include interest cost on financial instrument, cost of margin accounts, interest on loan and any other cost incurred in carrying assets or an investment.

Source: Copyright © 2021 Kalkine Media Pty Ltd

Understanding Cost of Carry

Talking about cost of carry in commodity market, it defines the cost of carrying or holding an asset such as insurance payment. In the derivatives market, it defines the cost which incurred on an underlying security such as interest expense on margin accounts and it also include opportunity cost.

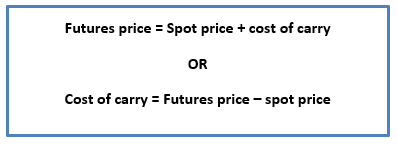

The prices of futures contract depend on the sum of spot price and the cost of carry. But on the same side the actual price of futures contract also affected by the demand and underlying stock. Cost of carry is the cost incurred on carrying an underlying security or index till the futures contract expiry. In other words, cost of carry may refer as the net cost of holding an asset or carrying underlying securities.

Frequently Asked Questions (FAQs)

How does Cost of Carry is Calculated?

Cost of carry is expressed in percentage value and calculated as annual rate. Investors and traders use the cost of carry as an indicator of the market sentiments, low cost of carry indicates fall in the value of underlying securities and high cost of carry indicates rise in the value of underlying security. The cost of carry can be calculated as:

Source: Copyright © 2021 Kalkine Media Pty Ltd

Cost of carry can be negative; it will happen when futures contract trade at discount to the underlying. This may happen because of two major reasons: when the stockholder is expected to get dividend, or when the traders using a reverse arbitrage strategy.

Analyst uses cost of carry to understand the market condition, if a cost of carry will rise, which means traders are ready to bear higher cost for holding a stock willingly and vice versa. Cost of carry is expressed in percentage annually.

How Cost of Carry relate with bullishness and bearishness?

Cost of carry is used with the open interest for the stock and index. Open interest may define the total number of positions available (open) in a contract. For an increase in open interest, rises in cost of carry pointing the growth of long positions and called bullishness in market, on the same side along with fall in open interest, fall in the cost of carry pointing short positions and bearishness in market.

When both cost of carry and open interest are decreased together that means traders and investors are closing long position. Analysts are also have eyes on the changes of Cost of carry in the derivatives contract’s expiry and if the number of positions rolled over with high cost of carry and indicate bullishness. Cost of carry also refers the difference of price of a stock/index between their spot price and futures. Cost of carry is important to understand the traders mind set, high value of cost of carry indicates that traders are ready to pay more money for carrying and holding the futures.

What factors of Cost of Carry affect the net return on an investment

Cost of carry influences the actual return on an investment. Investors keep all the factors of cost of carry in mind that affects net return of their investment. These factors are considered while calculating net return and plays a vital role in the due diligence. These are:

Margin accounts: Margin is a mandatory borrowing for an investor which needs an interest payment. This interest payment will deduct from total returns.

Short Selling: An investor is forgone on a dividend for the next best possible opportunity and that is called opportunity cost.

Other Borrowing: Sometime investors borrow money to do an investment, so investor should keep in mind the interest on loan which she/he has to pay, and that leads the reduction in overall total return.

Cost of Trading Commissions: Investor keep sight on the other cost like trading commission, it includes the cost of entering and exiting a position which decrease the total return.

Storage cost: Storage cost refers to the cost incurred in holding physical assets. An investor or trader should keep this factor in mind. The primary cost includes storage, physical commodities, insurance, and obsolescence that detract from total returns.

What do we mean by futures Cost of Carry Model?

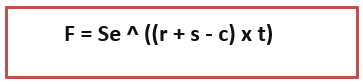

Cost of carry model is used for futures pricing and also called as arbitrage model. The model has two assumptions that arbitrage opportunities and efficient market cannot exist. Futures pricing depends on different characteristics of underlying assets. Cost of carry is used to calculate the futures price. Every investor is influenced by their own carrying costs and have willing to purchase futures markets at different level of prices. It is calculated by using convenience yield, which is the actual benefit of holding a commodity. It can be calculated by using given formula.

Source: Copyright © 2021 Kalkine Media Pty Ltd

In this, F stands for the future price, S stands for the spot price, e stands for the base of natural logs, which is approximated as 2.718, r stands for the risk-free interest rate, s stands for the storage cost, it is expressed in percentage of the spot price, c stands for the convenience yield, and t stands for timing of deliver a contract, expressed as a fraction of one year.

Please wait processing your request...

Please wait processing your request...