What is Cost of Goods Sold?

Cost of Goods Sold (COGS) is an important consideration in an established business or prospective business. It essentially helps firms to set the price of a product or any service.

COGS includes the direct expenses incurred by a firm in producing a product or service. It includes all direct labour and material cost incurred during the production of goods or services.

Cost of Goods Sold is an expense that is reported on the income statement of a firm. It does not include variable expenses such as marketing, distribution, administration costs. It is basically raw material and direct labour expenses incurred in manufacturing a product.

As revenue increases, COGS will increase proportionately as costs incurred in production also increases. Specifically in goods or products, the directs costs incurred by firms often include variable costs like labour, storage, factory overhead.

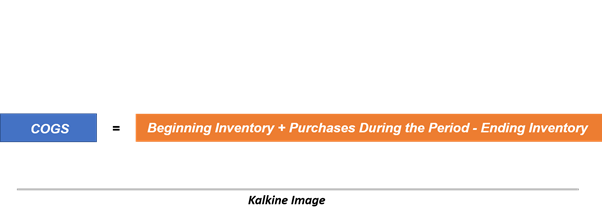

Inventory and cost of goods sold are linked in the income statement, and COGS reflects the amount of sold or processed inventory. As a firm drives sales, the inventory will be reduced from the balance sheet and transferred to income statement as an expense.

Beginning Inventory is the inventory left over from the prior period. Firms continue purchasing inventories to support production, and purchased inventory is added to beginning inventory. And ending inventory is subtracted to arrive at COGS.

The profit-making ability of the business is largely dependent on cost of goods sold by the business. COGS is essentially the cost of doing business and helps analysts and fund managers to judge the profitability of the business.

COGS and Gross Profit

Gross profit is an important metric to measure the profitability of an enterprise. To calculate gross profit, cost of goods sold is subtracted from the revenue of an enterprise during a given period. A firm can increase its revenue, but gross profit will relatively increase when cost of goods sold is decreased.

It becomes important for firms to lower cost of goods sold to achieve better profitability. As firms grow larger, the cost of goods sold should come down as a result of enhancements, economies of scale, technology, investments, pricing power.

Gross profits reflect the profits of production that is either driven by price advantages or cost advantages and indicates a firm’s efficiency in converting its revenue to profits. Companies with moat and capacity to suffer are able to increase their gross profit over time.

Cost of Sales Vs Cost of Goods Sold

Some firms are likely to provide cost of sales, which involves costs directly incurred in manufacturing and distribution of products. These costs may include raw material, direct labour, packaging, depreciation of warehousing and distribution facilities, and factory overheads like wages, salaries.

Cost of sales often confuses information users, and firms often use COGS and cost of sales interchangeably. Both items track the costs incurred by a firm in production until sales revenue is realised.

While analysing cost base of firms, it becomes imperative to study the direct costs of businesses to arrive at a reasonable gross profit forecast. Since firms will either provide cost of sales or cost of goods sold, gross profit is calculated by deducting cost of sales or cost of goods sold from the revenue.

Retail firms do not manufacture goods and source it from suppliers or manufacturers and incur costs that could be directly related to the product. Therefore, retail firms often report cost of sales, while manufacturing firms are likely to cost of goods sold.

Why is COGS important?

Cost of Goods Sold allows evaluating the firm’s operational efficiencies, pricing power, competitive advantages. When a business is able to successfully lower its cost of goods sold despite increased volume and quality of goods, it indicates that the firms have gained operational efficiencies.

Operational efficiencies can be gained through various factors, including newly developed processes, lower costs due to new equipment, a merger of businesses to achieve better cost advantages, automation of production floors.

It can also indicate the pricing power of a firm. When COGS is rising and revenue is falling, it would reflect that the firm is not able to pass the cost increments in the production of goods to customers by way of increase in the price of product.

When firms are growing revenue and volumes are not increasing proportionately to the increase in revenue, it may mean that business has raised the prices of products and the gross margin would increase since volume sales have not increased at a similar pace.

How COGS is impacted?

Discounts: When a firm is purchasing inventory on a larger scale, the supplier may provide with discounts, which will lower the cost of goods sold. As firms grow, a better relationship with suppliers and other stakeholders allows to negotiate more favourable terms for firms.

New Suppliers: Firms are likely to choose a supplier that is offering goods at a lower price. There could be many reasons regarding the change in prices of products such as new entries in the supplier’s market.

Meanwhile, it can be a case when suppliers collectively raise prices of products, forcing firms to buy inventories at higher price, causing cost of goods sold to increase.

Efficiency: A new machinery might allow firms to reduce their cost of goods sold. As new technologies are developed and adopted by firms, the cost of goods sold will likely come down as a result of advancement in processes. Firms can also develop new processes through research and development for more efficiency gains.

Business combination: The ultimate aim of acquiring a business or merging with a business is to generate profitability for the shareholders. Mergers and acquisitions are undertaken by firms to achieve better pricing power and cost advantages to impact the cost of goods sold.

Please wait processing your request...

Please wait processing your request...