What is meant by the term credit creation?

The creation of credit or deposits is one of the most critical functions of the bank. The bank is an intermediary between those who need money and those who have more than they need. Banks accept deposits and advance loans or credit. In simple terms, credit creation is the expansions of deposits.

Highlights

- Credit creation is the process of expansion of credit in the economy.

- The bank's reserve requirements determine the credit multiplier and, in turn, the potential to expand credit.

- Credit multiplier is the reciprocal of the reserve ratio that banks must maintain.

Frequently Asked Questions (FAQs)

How do banks create credit?

It is well known that banks don't keep 100% of their deposits as reserves. Whenever a depositor puts money in the bank, they only go back with a promise that they will be given the money when they demand it. Banks are sure that not all depositors will turn up for their money on the same day- this is a critical assumption in the credit creation process. Thus, the banks keep a very small part as reserves and lend as credit the rest by charging interest.

Source: © Turhanyalcin | Megapixl.com

Whenever a bank gives out a loan, it ultimately gets credited into the borrower's bank account. Thus, every loan lent creates an equivalent deposit in the bank. Thus, we see how credit creation is ultimately leading to the addition of bank deposits.

Banks are a business operating with the motive of profit. Thus, the process of granting loans on interest must be profitable by ensuring that they earn more than what they have to give out as interest on the deposits.

What are the types of bank deposits?

Bank deposits which are the backbone of the credit creation process, can be classified as follows-

- Primary deposits- When a customer approaches a bank to deposit money, the bank converts the currency in their hands into a deposit in their account, and it is called a primary deposit. These very deposits help in the credit creation process later.

- Secondary deposits- When a customer seeks a loan, the banks grant it by depositing the amount into their account. This is secondary deposit. It is also referred to as a derivative deposit. The creation of secondary deposit implies the creation of credit by the bank.

What is the cash reserve ratio?

Banks are aware that not all depositors will want their money at the same time. Hence, they keep only a portion of their total deposits for meeting the cash demands of depositors. Cash Reserve Ratio or CRR is the percentage of total deposits that banks must maintain for this purpose.

How can we arrive at the deposit multiplier formula?

Demand deposits are the deposits that customers make in the bank and can demand at any time- the banks are liable to pay this. It is the same as the primary deposit described above. Once a loan amount gets credited into the customer’s account, it becomes a demand deposit.

1/CRR is the reciprocal of the cash reserve ratio, and it is called the credit or deposit expansion multiplier. Therefore, the maximum credit that can be created with a deposit is dependent on this factor.

Understanding credit creation with an example

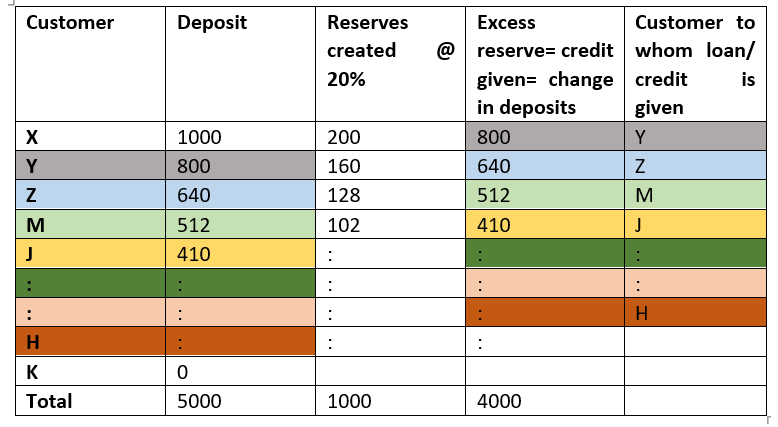

We can understand with the help of the following illustration how a single bank creates credit.

Suppose X deposits AU$1000 into ABC Bank. The bank keeps a CRR of 20%. The deposit by X is a primary deposit. The bank keeps 20% of 1000 i.e. AU$200, with itself and lends the remaining AU$800 to Y.

Now AU$800 becomes a primary deposit in Y’s account. The bank retains 20% of this AU$800 and lends the remaining AU$ 640 to Z.

Similarly, AU$640 becomes the primary deposit in Z’s account. Keeping 20%, the remaining AU$512 is given as a loan to say M.

Keeping AS$512 as M's demand deposit or primary deposit, a cash reserve of AU$102 is set aside, and the remaining AU$410 is given as a loan to J.

The process goes on till the initial primary deposit of AU$1000, and a CRR of 20% leads to credit creation of AU$4000.

Adding all the initial deposits/demand deposits will give us a total of AU$5000 as deposits.

The credit multiplier in this equation given by the reciprocal of the CRR is equal to 5.

And we can see that the credit creation is equal to five times the initial excess reserves available with the bank-

Initial excess reserve i.e., from X’s deposit = AU$ 800

Multiplier= 1/20% = 5

Credit created= 800*5=AU$4000

Initial deposit + Total of Secondary deposit or credit created/given = 1000+4000= AU$5000

Illustration for credit creation by ABC Bank

Source: Copyright © 2021 Kalkine Media

From the example, we also see how credit creation is the process of banks creating deposits for themselves.

What are the challenges in credit creation?

The process of credit creation is not as easy and smooth as shown in the above illustration. Some challenges and roadblocks may be experienced in the credit creation process. A few challenges are discussed below-

The banks can create only to the extent of cash possessed by them. This is not a factor in their control. It is dependent on the deposits made by customers. Therefore, the general public's banking habit becomes a key factor determining the credit creation process in the economy. If people do not have a saving tendency or they tend to keep drawing out of their savings, then the credit creation will not be at its highest potential.

Higher reserve ratios can obstruct the lending ability of banks. The higher the reserve requirements, the lesser will the bank's capacity be to lend and thus create credit.

Often the lending policies of banks differ. As a result, the credit creation process may not take the potential pace because the chain of credit expansion will be broken.

When the business cycle is in the recessionary phase, lending, in general, is low because business activities may be limited. As a result, credit creation in the economy weakens.

Similarly, when central banks are using contractionary policies, they intend to discourage borrowing and spending, and thus they limit credit creation by measures like increasing interest rates on loans.

Please wait processing your request...

Please wait processing your request...