What is Debt Security?

Debt security can be simply defined as the debts that can either be bought or sold between two parties prior to their maturity date. The structure of a debt security appears like a debt to the issuer (the government, a company, or an organisation) to an investor who appears to be the lender.

Some of the most common examples of debt securities are company bonds, government bonds, municipal bonds, certificate of deposit (CD), or preferred stock. Debt securities can also come in the form of collateralized securities, such as CMOs (collateralized mortgage obligations), collateralized debt obligations (CDOs), mortgage-backed securities issued by the zero-coupon securities and GNMA (Government National Mortgage Association)

Summary

- A debt security can be simply defined as the debts that can either be bought or sold between two parties prior to their maturity date.

- Debt securities can be issued through government bonds and corporate bonds.

- Some of the common features of debt security are- issue date and issue price, coupon rate, maturity date, yield to maturity

Image source: © Bear66 | Megapixl.com

Frequently Asked Questions (FAQ)

How do debt securities function?

Debt securities are flexible financial assets, i.e. its ownership can be legally transferred from one person to another very easily. One such example of assets are bonds. In the case of a corporate bond, the debt security is issued to the investor by the corporation. It denotes that the investor lends money to the corporation against a fixed rate of interest along with the return of the principal amount invested initially upon the maturity date.

In the case of government bonds, debt securities are a way by which investors lend money to the government against a fixed interest rate known as coupon payments. The money is returned to the investors along with the principal amount on the maturity of the bond.

Debt securities are also referred to as fixed-income securities as it yields a fixed flow of income. However, debt securities do also come with certain risk factors.

What are the common features of a debt security?

- Issue date and issue price

One of the salient features of a debt security is that it always comes with an issue date and an issue price.

- Coupon rate

The coupon rate is the rate of interest paid by the issuer to the investor of the debt security. The rate might be fixed throughout a lifetime or might vary as per inflation or economic downfall.

Image source: Copyright © 2021 Kalkine Media

- Maturity date

Maturity date denotes the term of the debt security. On the day of the maturity date, the money lender gets his money repaid along with interest from the debt issuer. There are three categories of debt securities depending upon the maturity period. Less than one year of maturity are called short-term debt security, maturity from one-three years is known as a mid-term debt security, and more than three years of maturity period is known as long-term maturity.

- Yield to maturity

Yield to maturity refers to the net amount of return that the investor expects to earn from the debt. This factor is important as it is used to compare between several debt securities of the same maturity date to determine the one that is more profitable.

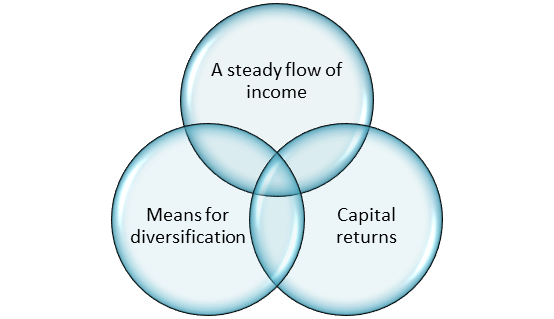

What are the benefits of investing in a debt security?

- Return on capital

There are numerous benefits of investing in a debt security, and one of them is the return on capital. The debt securities are basically structured to offer a reward to the investors in the form of interest for lending money to the corporations or the government.

- A steady flow of income

Debt securities offer a steady flow of income to the investors as the interest payment provides income to him or her throughout the year. These are generally fixed payments that are promised by the debt issuer to the investors.

Image source: Copyright © 2021 Kalkine Media

- Means for diversification

Another way of debt securities that can really be helpful is that they can act to diversify the portfolio of the investor depending upon the strategy of the debt securities. Unlike high-risk equity, debt securities can be used by investors to manage the risk of their portfolio.

What are the risks involving in debt securities?

There is always a risk factor existing in the case of any kind of investing activities. However, debt securities are considered to have a lesser number of risk factors as compared to equity investments.

For instance, let us assume that a company is having a strong balance sheet and operating in a matured marketplace, will have a lesser chance to default on their debts as compared to that of a startup company that has just begun to operate. A matured company will be given more credit points in such situations by the three major agencies like Standard & Poor, Moody's Corporation, and Fitch Ratings.

Regarding the risk involved with debt securities, matured companies are more likely to offer a lesser interest rate on debt securities than startups.

Example of a debt security

Let us assume that Alex has purchased a new property using a mortgage from his bank. The mortgage is viewed as a liability by Alex from his perspective, and he has to repay it at regular interval along with the interest rates. On the other hand, the mortgage is viewed as debt security from the bank's perspective as it fetches them a steady flow of cash at regular intervals.

Please wait processing your request...

Please wait processing your request...