Debt-to-Income ratio can be defined as the ratio that tells the repayment capability of a borrower. Debt-to-Income ratio is mainly used in the mortgage industry that helps a lender to determine the borrower’s capacity of repayment based of his/her income.

Summary

- Debt-to-income ratio is mainly used in the mortgage industry that helps a lender to determine the borrower’s capacity of repayment based of his/her income.

- Debt-to-income ratio includes several monthly expenses that won’t consider in the calculation of the ratio though these are part of your income.

Source: Copyright © 2021 Kalkine Media

Understanding Debt-To-Income Ratio (DTI)

Debt-to income ratio is the ratio or percentage that is used to determine the borrowing risk. Debt-to income ratio helps both the lender and the borrower by determining the borrowing risk and by telling how much debts is carried by the borrower in the comparison of their earnings. A lender uses debt-to-income ratio to know the repayment capacity of a borrower, if a borrower’s most of income go to the repayment of existing debts then it’s difficult for a lender to provide you more that increases borrowings.

If debt-to-income ratio is low that represents a good balance between debt and income of an individual. On the other side, if debt-to-income ratio is high that represent an individual has more debts to pay and in this case the repayment capacity of a borrower is low. Before issuing loan financial institutes that provide credit majorly look for low debt-to-income ratio

From creditor’s point of view, a high debt-to-income ratio is unfavorable as it shows a huge proportion of a borrower’s income going in the payment of debts.

Frequently Asked Questions (FAQs)

How to calculate Debt-To-Income Ratio?

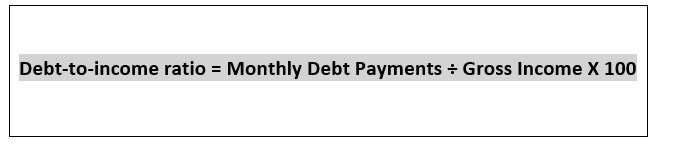

Debt-to-income ratio is estimating by considering the monthly debt payments and gross Income of an individual. Monthly debt payments refer to the total debt payments paid by a borrower monthly such as insurance including car and health, credit cards, car loans, rent/mortgage, student loans, medical bills, and others. Gross income includes the gross monthly salary/income, it refers to the income before taxes earned by an individual every month. Debt-to-income ratio can be calculated by using the formula

What is included in Debt-To-Income Ratio?

Debt-to-income ratio includes your monthly expenses that won’t get counted in the calculation of the ratio though these are important part of your income. Not every expense of an individual is counted as the monthly debt payments. Debt-to-income ratio includes expenses include:

- House payment: If an individual has a monthly payment towards home mortgage, it is considered in the front- and back-end debt-to-income ratio calculation.

- Vehicle loans: If an individual financed his vehicle and still paying loan installments, it will be included in debt-to-income ratio calculation.

- Personal loans: Personal loan is included in the calculation of debt-to-income ratio. An individual take personal loan for cover his/her personal expenses such as wedding, credit card payments.

- Student loans: Student loan is included in the monthly payment debts while calculating debt-to-income ratio. If an individual still paying the installments whether student loans are federal or private.

- Payment on credit card accounts: If an individual uses its credit cards on regular basis, its balance will change every month. It is included in the calculation in back-end debt-to-income ratio.

- Alimony and child support: If an individual is obligated to pay alimony and child support monthly, it will be counted as part of monthly debt payments and considered at the time of the debt-to-income ratio calculation.

How to reduce the Debt-to-Income Ratio?

A low debt-to-income ratio is favourable for both lender and the borrower. If a borrower has low debt-to-income ratio it shows that the borrower has the capacity to make the repayment. The lender will provide the loan without thinking much as the risk is low. A borrower can reduce its debt-to-income ratio by:

- Reducing monthly debt payments

An individual can decrease its debt-to-income ratio by reducing the monthly debt payments. An individual can cut down his unnecessary debt payments. For instance, if an individual has student loan, he/she can cut down the repayment amount by repaying the principal amount of loan. By paying the principal amount, interest charged on the loan will reduce.

- Increasing gross income

Increasing gross income is one of the way by which an individual can reduce their debt-to-income ratio. If an individual increases their gross income it will automatically reduce their debt-to-income ratio.

What is the difference between Front-End and Back-End Debt-to-Income Ratios?

Debt-to-Income ratio can be calculated by two ways and both the ways provide different perspective of an individual’s financial position. When an individual applies for loan, lender will calculate the debt-to-Income ratio from both the ways and takes the decision whether to approve the request of loan or not. The first way to calculate the debt-to-income ratio is front-end debt-to-Income ratio. It is calculated by considering the gross monthly income and the overall housing expenses. These housing expenses, include real estate taxes, homeowners insurance premiums, principal and interest payments on home mortgage, and any due of homeowners association.

The second way to calculate the debt-to-Income ratio is the back-end ratio; back-end debt-to-income ratio is calculated by considering the house expenses and other debt expenses including personal loans, student loans, auto loans and credit card balance.

The main difference between the back-end-debt-to-income and the front-end-debt-to-income ratio is that calculation of front-end ratio includes the housing expenses only as monthly debt payments and calculation of back-end ratio include other debt payments along with housing expenses.

Please wait processing your request...

Please wait processing your request...