What is meant by the term dividend frequency?

Dividend frequency refers to the number of times a dividend is paid on investments. Top companies can pay dividends monthly or quarterly or annually, or half-yearly. Factors like profits, interest rate, cash flow positions, future projects etc., are deciding factors for the dividend frequency of an organisation. There may also be instances when a company makes unexpected gains. In such cases, the companies are motivated to declare dividend and such a dividend is referred to a special dividend. Special dividends are a one-time phenomenon and are unaffected by dividend frequency.

Summary

- Dividend frequency refers to the number of times a dividend is paid on an investment.

- Companies can pay dividends monthly or quarterly or annually, or half-yearly.

- A company's dividend policy lays down how much dividend a company will pay to its shareholders and the number of times dividends will be paid during an accounting period.

Frequently Asked Questions (FAQs)

What is a dividend policy of a company?

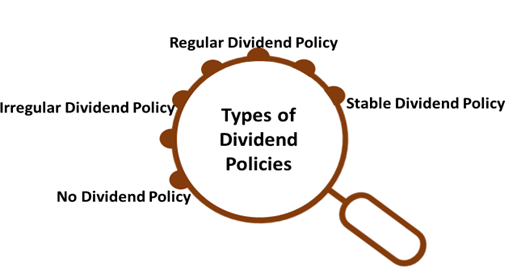

A company's dividend policy lays down how much dividend a company will pay to its shareholders and the number of times dividends will be paid during an accounting period. Whenever a company makes profit, there is a need to decide how the profits will be utilised. Companies can decide whether to hold it back in the company itself in the form of retained earnings or distribute it to the shareholders in the form of dividends. The number of times a company will pay a dividend will be subject to its dividend policy and other operational requirements. The different types of dividend policies are as indicated below-

Copyright © 2021 Kalkine Media

What are the various factors that a company might consider before deciding on its dividend frequency?

There are several financial parameters considered in this decision. Some may be internal factors and some external. A few factors are listed as follows-

- standalone or net operating profit after tax

- the operating cash flow of the company during a period

- liquidity position

- the total debt of the company

- working capital needs

- capital expenditures due

- fund requirement for expansion, mergers and acquisitions

- cash flow for emergencies

- capital adequacy considerations

- solvency considerations

- historical trends in dividend payments

- dividends received from subsidiaries

- windfall gains

- legal requirements of the geographical area where the company operates

- accounting laws

- dividend payout ratio prevalent in the industry

Under what circumstances can a company disrupt a dividend payment frequency?

A company may be known for regular dividend payments. However, if uncertain events like inadequate profits or significant losses occur, it may choose not to pay dividends. There may also be cases where there is a sudden increase in the working capital requirements or increased tax payments, which adversely impact the cash flows. Such situations cause an inability to pay dividends. There may also be certain capital expenditures due for bringing about better operational efficiency of the company. As a result, the company may choose to retain profits instead of paying dividends. Such a move may also be considered when any acquisitions or investments in joint ventures are due. Dividends may not be expected by investors even when there is an allocation of cash for buyback of securities.

© Alamafi | Megapixl.com

Is there a link between dividend frequency and profit retention?

When companies retain their profit after tax payments, it is called retained earnings. The proportion of net income that the organisation will hold back for its needs is given by the retention ratio of the organisation. Having a high retention ratio can mean a fat profit accumulation. It can imply that low dividends are paid; infrequent dividends are paid or no dividends are paid. The idea of ploughing back money into the organisation may be for various purposes like growth through a joint venture investment or capital expenditures for capital assets. Profit retention has the potential to either bring down the dividend frequency or reduce the amount of dividend. The impact of the retention ratio is subject to how a company decides on the matter

Dividend frequency in Australia

For companies listed on the Australian Securities Exchange (ASX) usually, dividends are paid two times a year. These dividend payments are interim dividends and the final dividend (declared usually at the end of the accounting period).

Dividend frequency in the US

In the US, there is no rule book specifying a frequency. But most of the companies pay dividends on a quarterly basis. However, some companies pay monthly, annually or semi-annually as well. Some companies have no schedule and pay irregular dividends.

What is meant by irregular dividend policy?

In irregular dividend policy, there is no fixation about the dividend rate or frequency of payment. Instead, the Board of Directors decide based on the profit recorded in the concerned period. Risk-averse investors usually do not prefer such companies.

Please wait processing your request...

Please wait processing your request...