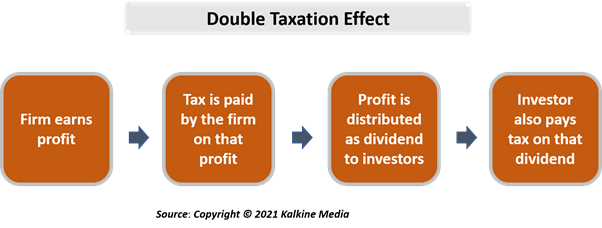

Dividend Imputation is a tax plan that helps in avoiding double taxation on dividends from companies to investors who get these cash payouts. The system shows that the company that has issued dividends has already paid tax on its profits.

Dividends are payouts made by publicly traded corporations to investors as a reward for their investment.

The problem of taxing twice or double taxation is tackled through tax credits. The investor who gets the dividend receives a tax credit from the firm by which tax authorities are informed that the company has paid for the needed income tax on dividends.

Summary

- Dividend imputation is a process of doing away with the double taxation on cash payments by firms to their shareholders.

- Companies pay taxes on their earnings, which are distributed as dividends, and the income is taxed again when an investor files for their personal taxes.

- Dividend imputation system helps in avoiding double taxation situation by giving tax credit to investors as a compensation for the tax already paid by corporations on their behalf.

- Shareholders may need to pay taxes twice if their marginal tax rate is higher than the corporate tax rate.

- New Zealand, Australia, and Canada, etc., are using dividend imputation system.

What is the objective of dividend imputation?

The rationale for dividend imputation is that the corporation already pays taxes on the earnings it distributes as dividends as a part of corporate tax. When an investor files their personal taxes, the income after tax is taxed once again. Hence, the same dividend income gets taxed twice. As a result, taxable income gets taxed once again.

Source: © Rummess | Megapixl.com

To overcome this situation, the imputation system provides investors with a tax credit to reimburse them for the tax already paid on their behalf by corporations.

An investor's dividend sheet shows the amount of dividend imputation as well as the value of the tax credit. The amount previously paid by the firm on dividends is used to counterbalance their total year income when they file their annual tax form to the government.

Frequently Asked Questions (FAQ)-

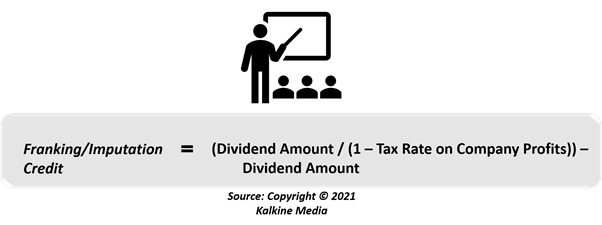

How is imputation credit calculated?

If an investor collects a $70 dividend from a firm that pays a 30% tax rate on its earnings, his/her franking/imputation credit is $30. This means that every shareholder will get $30 franking credits and $70 dividend amount, making a total measurable income of $100.

Though, each shareholder’s marginal tax rate must be taken into account to know if they will get the credits as tax refund or pay an extra tax to Taxation Office.

Do Imputing Credits help?

The notion of imputing or franking credits was first introduced in 1987. It gives investors in lower tax rates an extra reason to invest in dividend-paying firms. These credits help in promoting long-term equity ownership, leading to a rise in dividend payouts to investors.

Other nations may explore, including franking credits in order to decrease or abolish double taxation. As a result, supporters of a similar system in the United States and other countries are keeping a careful eye on the consequences of franking credits.

How does Dividend Imputation work?

Dividends are considered a form of income in most nations. This means they're generally combined with other sources of income when calculating total taxable income Whenever a business makes a profit, it is mandatory to pay tax on that profit.

With the imputation tax present, tax authorities will tax the dividend income only once instead of taxing the same income twice if no imputation system is there.

However, an investor might need to pay taxes twice in one case. There can be a scenario where an investor’s personal tax rate is greater than the corporate tax rate paid on dividends. In such a scenario, investors are required to pay the difference between marginal tax rate and corporate tax rate.

For example, assume that corporate tax rate and marginal tax rate in a country are the same at 30%. Investors will not be required to pay taxes on dividends in this case as the company haas already paid a 30% tax on the profits earned.

However, if the marginal tax rate is 40%, the investor will need to pay the difference i.e. 10% (40%-30%).

Which countries follow Dividend Imputation system?

Many countries that formerly supported such a tax scheme have changed their minds. Some of them have totally eliminated such a system, while others prefer partial credit.

Partially imputation with tax credits was once available in the United Kingdom and Ireland, which effectively decreased dividend taxes from 12.5% to 25%. Full dividend imputation was formerly offered in Germany, Finland, Norway, and France.

Australia, Canada, Chile, Korea, Mexico, and New Zealand have enacted dividend imputation systems.

Should countries keep using this system?

Supporters of imputation claim that double taxation problem encourages companies to choose taking debt over issuing stock shares when companies need money. Companies can raise cash for working capital or capital expenses by offering debt instruments to people or institutional investors or issue shares of stock in a public offering.

Removing imputation and cash needs may also encourage firms to retain their cash instead of releasing it to shareholders, leading to swollen balance sheets. They claim that this has the impact of slowing down economic growth.

Please wait processing your request...

Please wait processing your request...