What is meant by Exchange Rate?

Exchange rate refers to the value at which one currency can be measured against another currency. They are significant for open economies as they allow countries to trade, and they are important indicators of an economy’s well-being.

Exchange rates help determine the relative strength of currencies, and subsequently, the relative strength of the respective countries. In simpler terms, an exchange rate is a price in a domestic currency which one must pay to acquire a foreign currency. The higher the exchange rate, the higher is the variation in the strength of two currencies. A lower exchange rate value indicates that both currencies are relatively at par with each other.

For instance, an exchange rate value of EUR/USD = 1.19 means that 1 Euro is worth 1.19 USD. Effectively, this implies that 1.19 USD must be paid to obtain 1 Euro, or 1 Euro must be paid to receive 1.19 USD.

What are the different types of exchange rates?

There are two broad categories under which exchange rates are maintained – fixed exchange rate and flexible exchange rate. Countries have the provision of keeping an exchange rate that lies in between these two extremes.

- Flexible or Floating Exchange Rate: This is the type of exchange rate regime where the market forces have relatively higher control over the exchange rate compared to the central bank and monetary authorities. The demand and supply of foreign exchange determine the exchange rate system under such a regime.

These exchange rates are ‘flexible’ and vary with market forces. As a result, they fluctuate with time. However, under tight circumstances when the exchange rates fall too low, central banks have the provision of intervening and stabilising the rates.

A floating exchange rate reflects, more effectively, how the economy is performing. Since there is no constant regulation of authorities, flexible exchange rates adapt faster to economic changes in the home country than fixed exchange rates.

Some of the currencies that follow a flexible exchange rate are Canadian Dollar, US Dollar, Pound Sterling, Japanese Yen and Australian Dollar.

Most international markets observe a floating or semi-floating type of exchange rate. The regime adopted by the Canadian Dollar can be considered the closest a currency can get to a fully floating exchange rate.

- Fixed Exchange Rate: This type of regime includes continuous regulation by the authorities to keep the exchange rates fixed to a particular level. This regime is followed by those nations which possess enough foreign exchange reserves to influence their supply in the home country.

With adequate reserves of the foreign currency, it is possible to affect the exchange rates. If the domestic currency depreciates, the central bank can sell the foreign currency in exchange for the domestic currency.

Some of the currencies that follow a fixed exchange rate are the Saudi Arabian Riyal, which is pegged to the US dollar, the Danish Krone which is pegged to the Euro, the Hong Kong Dollar which is pegged to the US Dollar and many more such currencies.

How are exchange rates determined?

The demand and supply of foreign currency determine the exchange rate in a floating exchange rate environment. Currency appreciation refers to the increase in the value of a currency with respect to a foreign currency. On the other hand, currency depreciation refers to the decrease in the value of a currency with respect to a foreign currency.

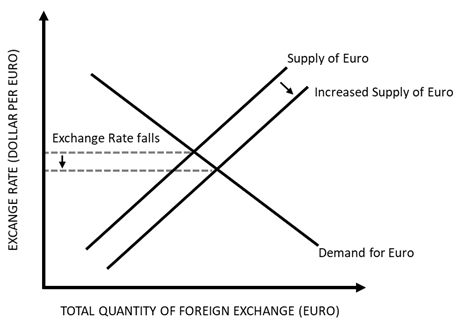

Consider the following example that shows how the exchange rate of Dollar in terms of Euro is determined. The supply of Euro refers to the quantity of Euro available as foreign exchange, while the demand for Euro reflects its demand in the domestic country.

Image Source: © Kalkine Group 2020

Considering the above diagram, the supply of Euro in the economy is increasing, while the demand for the Euro remains the same. As more and more units of Euro are accumulated as foreign exchange, Euro depreciates while Dollar appreciates.

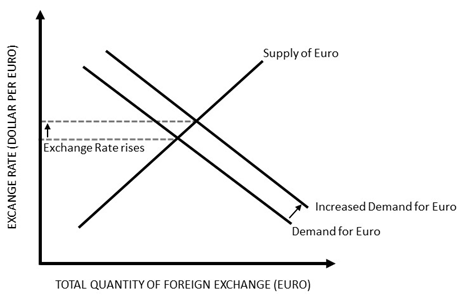

Now consider the following example when the domestic demand for Euro rises. Here the increased demand for Euro leads to a depreciation of Dollar while the Euro appreciates. Thus, the exchange rate of Dollar vs Euro rises.

Image Source: © Kalkine Group 2020

Apart from these natural shifts, countries can also manipulate exchange rates. It is possible to change the value of the domestic currency with respect to foreign currency by changing the supply of foreign exchange reserves of the latter. This method is used by central banks of various countries to devalue or revalue their domestic currency.

If the current exchange rate is maintained at 2:1, the home country can just announce that the value of the domestic currency will be devalued to 10:1. This is known as devaluation. This further decreases the value of the domestic currency. Further, if the central bank announces that the exchange rates will be maintained at 7:1 then this is called revaluation.

Please wait processing your request...

Please wait processing your request...