What is Fintech?

Our digital world is expanding, continuously evolving and enabling businesses to become customer-centric. Just until a few years back, nobody would have believed if someone said they could transfer money from their phone only within seconds. The world is participating in a revolutionary experience, and we may not even know it.

With the financial institutions providing their services online, the emergence of fintech has changed the financial dealings by 360 degrees. In simple words, Fintech refers to describing a technology which is integrated into providing financial services.

Whether you are paying a credit card bill or buying a coffee at a local coffee shop or applying for a loan, fintech is with us all the time. And believe or not, it is just the beginning.

Technology has entered every aspect of the world. Words like EdTech, MedTech, FoodTech are now a part of our regular vocabulary.

From cashless payments apps to financial institutions providing services online to even virtual currency, the financial technology sector is growing exponentially.

With integrating the latest technology in financial services, fintech is making life easier for the consumers and also for the providers.

The term fintech includes a varied range of products, technologies and also innovative business models. These innovations are disrupting the traditional financial systems and changing the industry. The conventional financial services and new technology companies are now crossing each other's lanes to meet the demand from the consumers and stay relevant in the developed market.

Hundreds of fintech companies emerging every day and changing the way consumers pay and borrow money. Investors are also showing keen interest in fintech companies.

GOOD READ: Which are the top Fintech companies in Australia?

How is the global fintech market performing?

The global fintech market consists of technologies driving the change in the financial ecosystem. The services offered in the sector provide applications, processes and products for money transfer and payments, savings and investments, borrowing and also insurance.

According to the Mordor Intelligence global fintech market report, the fastest-growing markets in the fintech industry are the Asia Pacific, and the largest market is in North America.

A big chunk of traditional global banks, insurance companies and investment management companies are planning to integrate their services with the financial technology companies in the next three to five years.

2019 KPMG's report on the FinTech investment landscape shows that the investment reached a new record in 2018 with a whopping US$112 billion pumping into the fintech industry. In 2017 it was US$51 billion.

The fintech market report by The Business Research Company states that the fintech industry market value is expected to reach US$309.98 billion through 2022.

DO READ: Things You Need to Know About Fintech Financing Model: Majors in Action

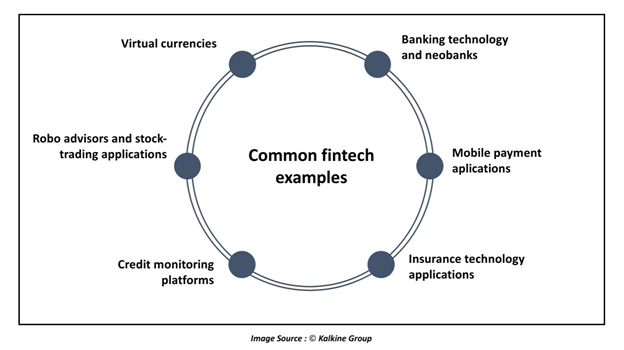

What are the common fintech examples that we use in everyday life?

Banking: Current technology has completely changed the way conventional Financial companies use to function. Before fintech, traditional banks offered essential services such as funds transfer, loan payments, bank account overview etc. by physically visiting a bank. The fintech startups, however, have not only made the offering of these traditional services easier and faster, but the competition has led the conventional system to increase the number of services they offer.

Apart from the necessary services banks these days are also offering AI chatbots, anti-money laundering systems and credit score information. These services are enhancing the user's experience.

Another exciting area is Neobanks. These digital app-based banks are growing much faster than we thought. Neobanks operate online, and they do not have branches like traditional banks. They offer services in finance management by using big data and artificial intelligence.

Mobile payment apps: Some of the biggest companies such as Apple, Amazon and Alibaba, have entered the mobile payment market with enormous investments. The reason is that the consumers are adopting fintech very fast. Applications such as Apple pay, Google Pay, Paypal, Amazon Pay are providing customer-friendly payment services to the consumers. They offer innovative strategies and cross-promotions with other companies, such as cashback, discounts on particular purchases etc.

Insurance: Fintech has disrupted the traditional insurance market just as it has disrupted the traditional banking market. The fintech insurance startups are getting innovative and staying ahead of the traditional insurance companies. Insurtech companies are providing third party insurance, phone insurance, car insurance to home insurance to data protection.

Credit monitoring platforms: Many countries, such as the United Kingdom and Australia, have complex credit score systems. Various companies offer services in order to maintain adequate credit score as for a layman building or improving credit score can get tedious and confusing. Fintech companies in this area have simplified this process. Financial technology business Clearscore provides individuals with an exact credit score, and it is also for free. There are many such startups successfully operating in this field.

Robo-advisors: Robo-advising applications use technologies and algorithms to provide information on asset recommendation. These applications also help investors build and manage their portfolio and have managed to increase efficiency in the trading sector and even with lower cost. Fintech technology enables investors to manage their wealth and investment on their own. Individuals looking for investment managers to manage their assets are now often turning to fintech applications. Apart from robo-advisor services, the fintech in the trading industry has changed the way traditional trading is conducted. Investors now can buy and sell shares from their mobile phones.

Virtual currencies: Cryptocurrency such as bitcoin, litecoin, and blockchain are one of the best examples of fintech. Cryptocurrency exchanges such as Coinbase and Gemini allow the users to buy and sell the cryptocurrencies on online platforms. Blockchain technology offers services such as smart contracts which utilises computer programs to automatically execute agreements between buyers and sellers or Ethereum, a distributed ledger technology (DLT) which maintains records on a network computer but has no central ledger. These technologies have practically transformed the investment world.

DID YOU READ: Opportunities and Challenges for Neobanks in the Present Scenario

What is the future of fintech?

With fintech infiltrating every part of our financial world, it is difficult to ignore the benefits its financial technology is providing. The sector is not just helping the consumers but also putting pressure on the traditional financial system to evolve and deliver the best services to the consumers in better and faster ways.

Fintech, however, like any other technology is falling prey to cybercrime. Now that fintech has proven its capabilities, the future of the industry relies heavily on providing security to its users. Most of the companies are engaged in creating awareness among consumers in order to avoid getting trapped in cybercrimes, such as financial fraud or identity theft. OTP (one-time-password), fingerprint or face recognition is trying to solve the problem. With cybercriminals staying a step ahead, financial technology companies will have to strengthen their cybersecurity to survive in the market.

ALSO READ: Fintech Drives The Banking Sector: Barclays Employs Third Tech Tool

Please wait processing your request...

Please wait processing your request...