How Can you Define Forex Trading?

The act of transfer of currency between buyers and sellers at an agreed price is termed as forex trading. The means by which companies, central banks and individuals exchange one currency for the other is defined as foreign exchange or forex.

Unlike commodities or shares, forex trading is not undertaken on exchanges but directly between buyers and sellers of foreign currencies in foreign exchange market.

A large amount of currency is converted every day in the forex market, which makes the price of these currencies extremely volatile. This price volatility makes the forex market more attractive to traders, strengthening the chances of earning high profits via trading. However, it also brings a risk of amplified losses with it.

Must Read: A Beginner’s Guide to Forex Trading

Why is Forex Trading Done?

Forex trading is majorly done to earn profits from variations in the value of a currency. It is a well-known fact that values of currencies keep on changing due to different political and economic factors, including inflation, the balance of payments and interest rate variations. The movement in the price of currencies makes it attractive for forex traders to take positions in the forex market.

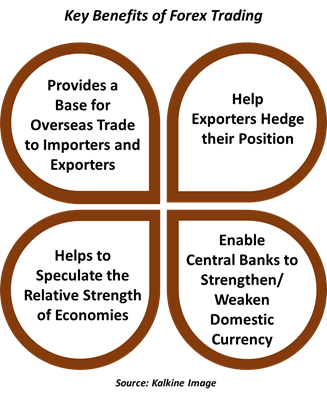

Some of the benefits associated with forex trading are outlined below:

- It provides a base for overseas trade, enabling importers and exporters to convert currencies and conduct global business efficiently.

- Exporters often use the forex market to hedge their positions and safeguard their interests by locking the exchange rate at the time of receiving orders from other countries.

- Central banks use the forex market to weaken or strengthen the domestic currency and ensure the smooth operation of the economy.

- It helps to speculate the relative strength of major and minor economies across the world.

Interesting Read: Discover the Influence of Economic Factors on Forex Trading

Who are the Key Forex Trading Participants in the Forex Market?

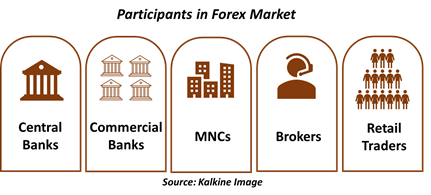

Forex trading is conducted by a range of participants dispersed across the globe, with a different set of motives. Below is the list of some key participants in the forex market:

- Central Banks: Central banks indulge in forex trading, primarily to regulate the movement of national currencies to maintain trade balance and prevent economic Typically, central banks use indirect means to control currency prices, such as raising or lowering interest rates or conducting open market operations.

- Commercial Banks: Forex trading is one of the major business activities of commercial banks, which purchase and sell currencies as part of their standard financial services offered to bank customers or retail clients.

- International Companies: MNCs or international companies trade in the forex market to exchange cash flows connected with their overseas operations.

- Brokers: Brokers act as a bridge between the buyers and suppliers of foreign exchange in return for a commission or a fee. Brokers do not commit capital and thus do not face the risk of holding a stock of currency balances amid exchange rate

- Retail Traders: Individuals who trade their own funds in the forex market to make a profit are categorized under retail traders. Over the last few years, retail traders have become one of the fastest-growing participants in the forex market.

What are the Different Characteristics of the Forex Market?

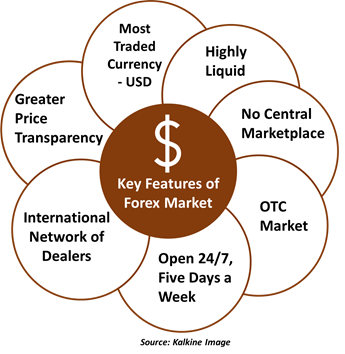

What’s more fascinating about the forex market is that it is the largest financial market in the world, with a daily turnover of over USD 5 trillion. The forex market has established its global presence, backed by its unique characteristics encompassing liquidity, transparency, and strong market trends.

With that said, let us quickly scroll through some of the exciting features of the foreign exchange market:

- It is the most liquid market amongst the other financial markets.

- There is no central marketplace to conduct currency exchange in the forex market.

- It is an over the counter market, de-centralized market.

- The foreign exchange market is open 24/7 but five days a week, and all major currencies are traded at key financial centres.

- It offers greater price transparency, which has further improved with the evolution of online forex trading.

- The market comprised of an international network of dealers, including investment banks and commercial banks.

- By far, the US dollar is the most traded currency on the forex market.

What are the Three Different Types of Forex Market?

The forex market can be broadly categorized into three kinds: spot market, forward market and future market.

- Spot Market: The spot market offers immediate payment to buyers and sellers of currencies as per the existing exchange rate. In this market, the trade is settled on the spot with a physical exchange of currency pair. Major participants in the spot market include central banks, commercial banks, brokers, dealers, speculators, and arbitrageurs.

- Forward Market: In this market, two parties decide to conduct a trade at some specific future date, at a stated quantity and price. There is no need for a security deposit in such market as no money changes hands at the time the deal is signed. Major participants in the forward market include government nodal agencies, companies, and individuals.

- Future Market: This market involves buying and selling of a specific currency at a future date at a fixed price via standardized contracts. These contracts include a settlement period, a standard size and are non-negotiable. This market is highly liquid relative to the forward one as unlimited individuals or participants can enter into the same trade.

What are the Risks Associated with Forex Trading?

Undoubtedly, trading in forex market comes with a risk. In this context, let us highlight key risks one needs to take into account while actively trading in the forex market:

- Risk resulting from changes in the value of the currency.

- Possibility that an unsettled currency position may not be repaid as decided, owing to an involuntary or voluntary action by a counterparty.

- Risk of not receiving funds from a failed bank.

- Settlement risk occurring due to variations in time zones of different countries.

- Leverage risks in volatile market conditions due to the aggressive use of financial leverage.

One needs to have an appropriate risk management plan in place to minimize the risks involved in forex trading.

Don’t forget, Warren Buffett’s famous quote, “Risk comes from not knowing what you’re doing.”

Please wait processing your request...

Please wait processing your request...