What is Fraud?

Fraud is a deceptive action or procedure of actions which are done intentionally to provide the culprit with a gain or result in withhold lawful rights of a person or community or organisation. There are many types of frauds such as credit card fraud, online banking fraud, bankruptcy fraud, tax fraud, security fraud and wire fraud.. The illegal practices can be undertaken by an individual, group, or whole business.

How are frauds committed?

Fraud is committed by either hiding the facts or manipulating the crucial information or making false statements. These actions are undertaken with the aim of gaining befits which may not be achieved without fraudulent activities.

The criminals have access to some information which the victim does not have, resulting in duping the victim. Chiefly, firms or individuals committing fraud have the upper hand over victims due to information asymmetry. The investment in technology for verifying and reviewing information related to the people involved in the process will result in the prevention of most of the frauds.

When are the legal actions taken against fraud?

The victim sues the criminal to recover the duped funds or sue the perpetrator to re-establish the rights, even if the monetary loss did not take place. If the following actions are committed by the perpetrator, then legal actions are taken against the criminal:

- The criminal has provided a false statement in the form of fact.

- The criminal has full knowledge that the statement provided to authorities was not true.

- The criminal intended to dupe the victim.

- The victim provides the evidence that the victim was relying on the information and facts provided by the criminal.

- Lastly, the victim has encountered a loss in form of monetary loss or loss of basic rights.

What is Financial fraud?

When a person or organisation harms the financial health or deprives a person of their money through legal practices, deceptive behaviour, or misleading the person, it is called financial fraud. Financial frauds take place through various activities such as investment frauds, or identity theft.

The money lost due to fraud cannot be recovered under many compensation programs. The funds lost may be recovered by civil justice.

The victim should report the crime to law enforcement bodies or the appropriate agencies at the earliest irrespective of the expectations of recovering the money lost. The documents required for reporting the fraud are bank statements, tax statements, credit reports, and regularly update the information to the authorities.

When are the Types of frauds?

Copyright © 2021 Kalkine Media Pty Ltd

Identity Theft

When personal information like bank account information, social security number, credit/ debit card information, and name are stolen by someone, then identity theft takes place. Through identity theft, the criminal assumes the victim’s identity and gain access to the accounts and conducts multiple transactions to drain the funds.

Following are the signs that identity theft has occurred:

- Amount is withdrawn from the account and the transaction is not undertaken by the owner.

- The messages or mail from the bank stops as the criminal might have changes the phone number or email id.

- Unfamiliar transactions are reported on the bank or credit statements.

- When a data breach takes place in the banking institution or the organisations a person is affiliated with.

Actions that can protect the victim from further loss during identity theft include going through the Federal Trade Commission’s (FTC) website that provides the instruction which should be undertaken by the victim of identity theft and recover the amount and identity. Firstly, the victim should contact the organisation through which the fraud might have occurred followed by freezing the account and changing the security PINs and login password. The theft should be immediately reported to the local police or on the FTC’s website.

Mortgage Fraud

The fraud is majorly carried out by mortgage professionals or real states. The fraudster might open a loan account by using someone’s personal information. In few cases, the loans are pushed to the customers with false information or creating high pressure to buy a loan.

Following are the signs that mortgage fraud has occurred:

- Payments are requested before providing the services.

- Loan modification is promised in the future.

- When payment is transferred to third-party account instead of the service providers.

- The process of loan buying, or property deals is slower.

- The service providers do not extend complete information or deny answering some of the questions.

- Sudden enforcement to sign a document.

Debit/credit card fraud

After the loss of debit/credit card, the fraudster gains an access to the personal information and utilise to drain the funds, then fraud occurs. The amount duped depends upon the card limit. Following actions can raise the red flags in the context of fraud:

- The transactions are not recognised by the card owner.

- Small transactions have taken place in the past.

- The transactions might be taken at a distant place or payment is made to an unrecognised organisation.

- A significant fall in the reported in the bank statement.

Charities fraud

Fake charities ask for the donation for a cause, but instead, the money is used by the organisation of person for their personal advantage. To protect oneself from charity fraud, it is necessary that people check before making the donation.

Federal Trade Commission has listed down the signs which indicate the charity fraud might take place in the future.

- A person from the organisation will give a visit to collect the amount.

- The organisation forces to make payment only in cash or through wire transfers.

- The organisation might utilise the name which sounds like top authentic charity firm.

- The charity organisation information is not available on the government sites like Charity Navigator.

- The organisation might create pressure to make payment in a short time.

- Charity organisation might ask for personal information.

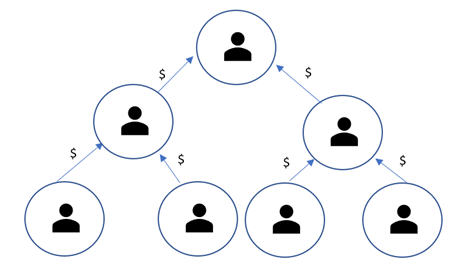

Ponzi scheme (Investment fraud)

The organisation promises the victim a higher rate of return for low risk. In this scheme, the organization uses the investment of a new investor to pay a return to the previous investor. It is also called a pyramid scheme as new investors’ funds are paid to past investors. The fraud intensifies when the new investors are not located by the organization.

Copyright © 2021 Kalkine Media Pty Ltd

Please wait processing your request...

Please wait processing your request...