What is a Futures Contract?

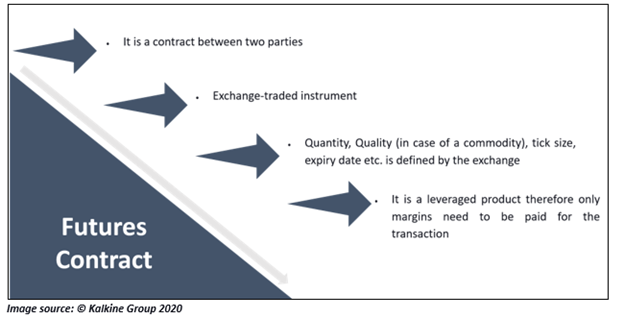

Futures contract refers to a binding agreement between two parties to buy and sell a fixed quantity of an underlying asset on a later date at a pre-determined price. The underlying asset upon which the futures contracts are made can be a commodity, shares of a company, or any other listed security.

Futures contracts are exchange-traded contracts, and all the contract specifications are defined by the exchange.

Unlike a forward contract, there is a clearing corporation which is associated with the respective exchange that guarantees the settlement of these trades. Therefore, there is almost no risk of default or counterparty risk associated with a futures contract which is one of the primary concerns in a forward contract.

FOR FURTHER UNDERSTANDING OF FUTURES ALSO READ: What is a Futures Contract?

How to Calculate the Contract value?

Future contracts are traded in lots which is essentially the quantity of underlying upon which the futures contract is made. Contract size or value is the total worth of the contract that is being traded.

For, e.g. a futures contract of XYZ share having a lot size of 100 shares is currently quoting at $50. Then the contract value would be equal to $5000 ($50 per share for 100 shares).

What is Long/Short position?

A person having an unsettled or outstanding buy position in a futures contract is said to have a long position. Similarly, if a person has outstanding sell position which has not been squared off is said to have a short position.

What is Settlement Day?

All futures contracts have a limited span of existence beyond which they cease to exist. The last trading day of the contract is the settlement day. All the obligations of buyers and sellers are needed to be settled on this day.

There are two mechanisms in which settlement takes place, namely:

- Cash settlement

At the time of expiration, the seller of the contract does not deliver the underlying asset but instead settles his net obligation in cash.

For, e.g. If B goes long on a contract of 100 shares of XZY at $100 and at the expiration, the price settles at $110, then instead of delivering 100 shares at $100 (pre-determined price), the sellers settle his net loss in cash and pays the difference to the buyer. i.e $1000

- Physical settlement

In a physical settlement, the obligation of both the parties settles through the physical delivery of the underlying by the seller. The buyer receives the asset, unlike price difference, in the case of cash settlement.

In every case, it is the exchange which defines the settlement mechanisms, and the parties cannot deviate from it despite a mutual agreement.

How are futures prices determined?

The prices of futures contracts move in positive correlation with the spot market prices of the underlying assets. Spot market price refers to the current price of the asset in the physical market.

Let us assume a person wants to buy the shares of a company and he/she enters into a futures contract. Now if the share price of the company is rising, then it is highly likely that the futures price would also rise and the buyer can sell his futures contract at a higher price. However, many times, it is possible that the change in the price of the underlying asset does not have any impact on the futures contract prices.

Although there is a precise mathematical model, i.e. “Cost of Carry” which determines the theoretical price of a futures contract. In real-time, the current market price may not be equal to the theoretical price as the forces of demand and supply also fluctuate the price.

ALSO READ: An Insight Into ASX 200 And Futures

What is ‘basis’ and the risk attached to it?

Although spot prices are highly correlated with the prices of the futures contract, these two prices are never the same. Basis refers to the difference between the spot price of an asset and the price of a futures contract of that asset.

If the price of a futures contract is greater than the spot price, the basis for the asset is negative. Similarly, if the spot price is greater than the futures price, the basis for the asset is positive. It turns to zero at the expiry of the futures contract, i.e. there should not be any difference between futures price and spot price at the time of expiry of the contract. Basis keeps weakening and strengthening according to the market situation. Thus, there are certain risks attached to basis.

What futures contracts do is that they convert the price risk, i.e., the risk attached to falling and rising prices of the underlying asset, into basis risk. Basis risk is better than price risk as it provides a window between which profits and losses are locked. Thus, with the correct hedging strategy, it is possible to set a limit beyond which losses will not be incurred to either the seller or to the buyer.

Who trades in futures contract and what are the benefits?

- Speculator/Trader

Futures contracts are well suited to place directional bets on interest rates, stock market indices, currency exchange rates etc. As futures is a leveraged product; therefore, the potential return on the capital deployed is relatively high as compared to transacting the same underling in the spot market.

- Hedgers

Hedging was the primary reason for the introduction of the derivatives market. Corporations, Government, banks etc. all hedge their exposure to their underlying business through the derivatives market. Hedging simply means to make a counter position to mitigate the risk of the initial position.

- Arbitrageurs

Arbitrageurs are the once who try to make risk free profits by exploiting mispricing in the market. An Arbitrage opportunity occurs when a single asset is being priced differently in two different markets, and Arbitrageurs looks to buy in the market with less price and sell in the market with high price simultaneously. This helps to make the difference between the two as a risk-free profit.

Please wait processing your request...

Please wait processing your request...