What is Hindenburg Omen?

The Hindenburg Omen is a technical tool that is utilised to predict stock market crashes. The crash is pre-determined by comparing the percentage of new 52 weeks lows and new 52 weeks high with the predetermined threshold percentage.

It is named after the Hindenburg airship crash which led to the death of 36 passengers in 1937. The technical indicator was promoted and conceived by Miekka in 2010. After few years, it was reported that the Hindenburg Omen has shown an accuracy in the prediction only 25% of the stock market declines.

Summary

- The Hindenburg Omen is a technical tool that is utilised to predict stock market crashes by comparing the percentage of new 52 weeks lows and new 52 weeks high with the predetermined threshold percentage.

- It is named after the Hindenburg airship crash which led to the death of 36 passengers in 1937.

- After few years, it was reported that the Hindenburg Omen has shown an accuracy in the prediction only 25% of the crashes.

Frequently Asked Questions (FAQs)

How Hindenburg Omen works?

When any abnormal activity is observed in the market, then the traders take safety precautions and respond in the market accordingly, this bias is inherited in most of the stock markets. This part of the investor’s psychology is one of the factors which leads to market crashes or declines in the market.

The Hindenburg Omen identifies statistical deviation in the normal conditions, under the assumption that stocks are making new 52 week lows or highs. It would be considered abnormal if both take place at the same time. The occurrence of these events is considered dangerous for the stock market as per the Hindenburg Omen. The signals can be detected when a new high or low are occurring in an uptrend stock market. It suggests that the market is becoming indecisive or nervous, and it can lead to the creation of a bear market.

How is Hindenburg Omen calculated?

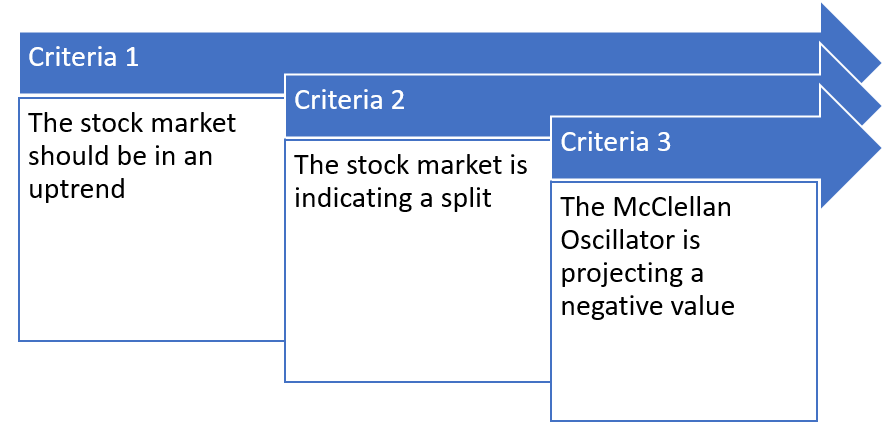

There is no official formula for calculating the Hindenburg Omen but the most employed procedure for predicting the market crash involves looking for few aspects in the stock market which are:

- Aspect 1: The stock market should be in an uptrend. For example, the S&P 500 is moving above the 50 day average.

- Aspect 2: The stock market is indicating a split. In other words, the 52 weeks low and high on the exchange should be higher than the 2.8% of all the declining and advancing issues.

- Aspect 3: the McClellan Oscillator is projecting a negative value.

Image source © 2021 Kalkine Media

When the Hindenburg Omen is triggered, then the participation in the market will be unhealthy for the traders. There can be trouble that cannot be seen on the surface; therefore, the long positions should not be taken, and the short position should be taken even if the market is showing an uptrend.

With the fulfilment of all the discussed aspects, the bearish position must be taken by the traders. When the signals appear in a cluster, then a worrisome situation is created in the stock market.

What is the significance of Hindenburg Omen?

Hindenburg Omen is employed by the traders to predict the decline in the stock market in advance. The omen has accurately predicted the stock market declines only 25% of the times from 1987.

The analysts are trying to add perfection to the tool by adding different criteria which should be met by the market before confirming the presence of the Hindenburg Omen.

It is named after the crash of the Hindenburg in 1937. 36 people were killed in the aeroplane crash and the negative media resulted in crushing the airship industry permanently.

How to detect a Hindenburg Omen?

A Hindenburg Omen can be detected by looking for four aspects:

- The daily number of 52-week lows and highs in the market index is greater than 2.2% which is the threshold amount.

- The highs of the 52 weeks must not be more than 2 times the lows of 52 weeks.

- The stock market is in an uptrend and the uptrend is identified as per the moving average of 10 weeks or the rate of change of 50 days.

- The McClellan oscillator is negative. The McClellan Oscillatory indicates the shift in the market sentiments.

After these criteria are met, then the Hindenburg Omen becomes active for a month, 30 days. During the period, any external signals are generally ignored. With the negative MCO, the Hindenburg Omen is confirmed, and the Hindenburg Omen is rejected if the MCO turns positive.

The traders generally exit their long positions or take a short position in the market when the MCO shows a negative value, particularly during the 30 days after the confirmation of the Hindenburg Omen.

If these precautions were taken by the traders in the past, then the traders could have escaped the financial crisis of 2008 and the market crash of 1987.

The estimated success rate of Hindenburg Omen is only 25%, and in few cases, it has jumped in many times. To gain confirmation regarding the take-profit or sell positions, the traders should use the Hindenburg Omen in conjunction with the technical analysis.

What criticism has the Hindenburg Omen received?

Despite the fool-proof logic extended by the Hindenburg Omen, it has gathered some criticism. The validity of Hindenburg Omen is still questioned, even if it provides 25% accuracy in the results.

False signal – Even if the market projects the Hindenburg Omen, it is possible that the market remains bullish. However, it has shown accurate results from the last 35 years. When the traders falsely predict a crash-like scenario using the omen, it can significantly damage the financial positions of many people. Therefore, it is important that the false alarm about the omen should not be created.

Skewed data – The market is misinformed in terms of the volume and breadth due to the skewness arising in the data because of the non-exchange funds and the non-cap stocks.

Outside effect – The misinformation generating because of the bearish nature of the stock in the international market and simultaneously good position in the domestic market.

Hindenburg Omen has been able to prove its worth as a technical indicator, however, the traders must be cautious while interpreting the signals related to the omen. Chiefly, the traders should not completely rely on the Hindenburg Omen is a technical indicator.

Please wait processing your request...

Please wait processing your request...