What are index funds?

An index fund is a kind of Exchange Traded Fund or mutual fund. It is a low-cost investment vehicle for investors compared to other investment vehicles. Index funds seek to replicate the performance of a benchmark, which is an index.

An index is a group of stocks and measures the changes in the price of its underlying stocks, bonds, commodity etc. It essentially measures the performance of the underlying assets. Indices are based on industry, sector, market capitalisation etc.

As a statistical measure, an index or some indices collectively are often referred to as the stock market. And the daily performance of the mainstream indices is tracked heavily to monitor the changes in prices of the largest companies.

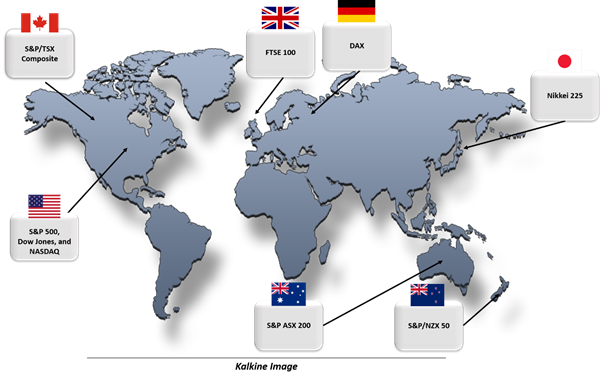

S&P/ASX 200, All Ordinaries, S&P 500, Dow Jones Industrial Average, EURO STOXX 50, DAX Index, FTSE 100, Nikkei 225, KOSPI are some popular stock indices globally.

Index funds replicate the performance of the indices by managing the same allocation and underlying securities. But they seek to match the performance before any expenses and fees.

An index fund gives investors exposure to a specific set of companies, which otherwise would have been expensive. As a passive investment, holdings in index funds are decided by the underlying index without any discretion of the investment manager.

Investment managers are not required to undertake research and stock picking for index fund since underlying securities are chosen based on the underlying index. An index is also rebalanced periodically, therefore underlying securities in the index funds are rebalanced concurrently.

Index funds Vs Active funds

Performance

In comparison, it has been observed that investors have preferred both investment strategies. Passive funds have mostly proved that beating the underlying benchmark in terms of returns has been impossible. After accounting for fee, expenses and cash, passive funds’ performance come near to the performance of the underlying benchmark.

Even though actively managed funds also struggle to outperform their benchmark, the likelihood of outperformance is more significant than that of passive funds, mainly due to active stock-picking based on the investment research and conviction of the manager.

Cost

Index funds have a relatively lower cost of operation as compared to active funds because fewer resources are required to run an index fund. Companies that provide index funds are not required to spend on research needs of the organisation and portfolio turnover is also low compared to active funds.

But index funds would need to pay licensing fees to the index provider, whose index has been used as the underlying benchmark for the index funds. Active fund management requires greater skill, and research capability for timely and efficient stock picking.

Fee and expenses

Since the cost of running an index fund is relatively lower than running an active fund, the fees and expenses incurred by the investors in index funds in lower compared to expenses incurred by active fund investors.

An active fund can also charge performance fees based on the stated parameters. Most of the times, active funds charge performance fees when the performance of the fund in a given period is well above the benchmark return.

What are the advantages of index funds?

Diversification: Most of the investors prefer index funds for diversification. Since some indices can have 500 stocks, 1000 stocks or 2000 stocks, the investor in such an index fund will have exposure to all the companies in the index.

An investor in active funds will get exposure to a set of companies that have been picked up by the investment manager. A fund with a larger number of securities would have a relatively lower market risk compared to a fund with concentrated equities.

Low cost: The variation in expenses charged by investment managers across index and active funds could be material to the performance of the fund. Since the index fund has a lower cost of operation, the investment managers often charge the lowest fees in the market for similar products.

Index funds also give tough competition to similar active funds because of their lower fee and expenses. Investors that are at the new to investing prefer index funds due to convenience and lower fees.

Specific exposure: As passive investment strategies have gained market appreciation and demand, the categories of index funds have also grown broader. Now they are available in all shapes, including sectors, asset class, themes and countries.

An investor seeking exposure to specific region, industry or region has the accessibility for a range of index funds. With lower costs already in place, the index funds industry continues to gain momentum driven by expanding offer base.

What are the types of index funds?

Dividend focused: Index funds with specific intention to invest in companies that pay dividends are called dividend index funds. Index providers have range indices that track dividend companies, and funds are benchmarked to such dividend-focused indices.

Sector funds: These funds are floated to capture the growth in a specific sector like consumer staples, technology, industrials, banks, energy, communication services. There are many sector-specific indices, which are also available based on the region as well.

Equity index funds: Equity index funds are a broader type of index funds, which only hold equity/shares or stocks. All index funds that invest in the equity shares fall under this category, including sector funds, dividend funds.

Investment-grade bond funds: Investment-grade bond funds mainly invest in bonds that are rated as investment-grade by the credit rating agencies.

High yield bond funds: High yield bond funds mainly invest in bonds that are rated as non-investment grade by the credit rating agencies.

International funds: These index funds are benchmarked to overseas indices and invest in global securities. It also includes equity and bond index funds that invest abroad in other countries.

Please wait processing your request...

Please wait processing your request...