What is a journal?

A journal is a comprehensive account that tracks all a company's financial activities. It is used for future account reconciliation and information transfer to other official accounting records, such as the general ledger.

Summary

- A journal is a complete record of a company's transactions.

- The data collected in a journal is used to reconcile accounts and transmit data to other accounting records.

- A journal records the date of the transaction, which accounts were affected, and the amounts in a double-entry accounting system.

Frequently Asked Questions (FAQs)

What does it mean to keep a journal?

Source: © Ziss | Megapixl.com

A journal is a digital document or physical record maintained as a spreadsheet, book, or data within accounting software for accounting purposes. For example, a bookkeeper records a business transaction as a journal entry whenever a business deal occurs. If the spending or earnings impact one or more business accounts, it will be noted in the journal entry.

Journaling is essential to maintaining accurate records since it enables quick evaluations and records transfer later in the accounting process. Along with the general ledger, journals are frequently examined as part of an audit or a trade.

Spending, sales, cash transactions, debt, and inventory are all everyday items noted in a journal. It is preferable to capture this information as it occurs rather than later so that the data is accurately captured, and no guesswork is required later.

In addition, keeping an accurate journal is essential for business success (by properly budgeting and detecting errors) and tax filing.

What are the kinds of journals?

The journal can be of two types:

General journal

It is a book in which a small firm keeps track of its financial activities daily.

Special journals

In large corporations, the journal is divided into several books referred to as special journals. These specific journals are used to keep records based on their type. Purchase daybook, cashbook, journal proper, sales daybook, bills payable book, bills receivable book, return inward book, and return outward book are examples of subsidiary books.

Occasional transactions, such as rectification entries, opening entries, and closing entries, are entered in the journal proper.

What is the procedure for entering transactions into a journal?

Journalising is the method of transaction records in a journal. All financial transactions are documented in the journal in the order in which they occur, together with a sufficient explanation, referred to as the "narration," supporting the entry.

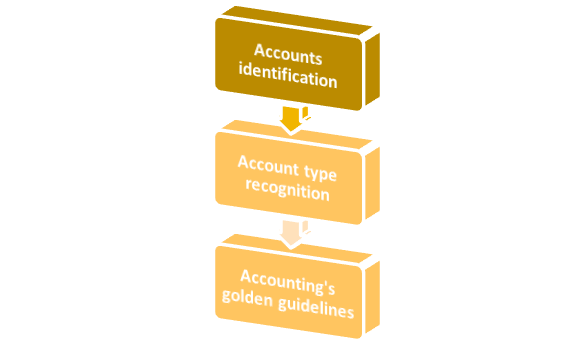

The following steps are followed in the Journalising process:

Accounts identification: The first and most crucial stage in each transaction is determining whose accounts are involved.

Account type recognition: Once the accounts have been recognised, the type of account is determined, such as a nominal, real, or personal account.

Accounting's golden guidelines: The credit and debit rules, which are the golden accounting principles, must be applied to the accounts affected by the transactions.

The journal's credit and debit sides should be equivalent. A compound journal entry is when more than one debt is assigned to a single credit, more than one credit is given to a single debit, or numerous debits and credits are assigned to a single entry. Nonetheless, the total amount of credit and debit in a transaction must add up.

Source: Copyright © 2021 Kalkine Media

What is the journal's format?

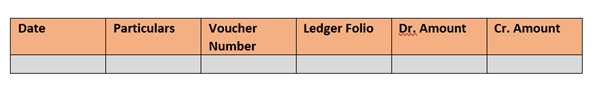

Source: Copyright © 2021 Kalkine Media

Date: In this section, we list the date of the transaction and the month in which it occurred. The year is just mentioned once at the top of the page, and it is not repeated with each date.

Particulars: This column lists the accounts that are impacted by the transaction, i.e., credited or debited. On the first line, we write the debited account, and on the far right of the same line and column, we write Dr., which stands for debit.

After some space, we write the account that is credited in the following line, beginning with the preposition 'to.' In the third line, which starts with the word "being," a short narration for the specific transaction is presented, which explains the entry in the brackets.

Voucher Number: The number indicated on the voucher of the relevant transaction is entered in this column.

Ledger Folio (L.F.): As we all know, transactions recorded in the journal are then transferred to the ledger and recorded in the appropriate accounts. The page number of the entry in the ledger is stated in this column.

Dr. Amount: The amount that will be debited for a specific entry is typed on the same line as the debited account.

Cr. Amount: The amount credited for a specific entry is provided on the same line as the credited account.

Except for the ledger folio column, which is supplied when the transaction is posted to the ledger, all the columns must be completed when recorded in the journal.

What are the benefits of keeping a journal?

- The journal contains detailed descriptions of transactions.

- It facilitates the division of recounting work among staff according to their productivity.

- It is simple to obtain relevant information from several subsidiary journals.

- As the number of subsidiary journals grows, they shrink in size and become easier to manage.

- It is a day-to-day ledger of transactions.

- It aids in reducing errors, increases accounting task efficiency and acts as a reference for the future.

What are the examples of a journal entry?

Companies keep track of their transactions in various journals, including cash receipts, sales, and accounts payable. All these distinct journals are voluntary, and the corporation can use them if it so desires. However, the general journal is the single journal that all businesses use.

The general journal records all general transactions that do not suit other journals, and it can be considered a "catch-all" journal.

Source: © Tale | Megapixl.com

The sales journal is being used to keep track of credit sales or inventory.

The cash receipts journal, also used for other cash purchases, is frequently used to record merchandise sales or cash inventory.

The sales returns journal records items that were sold but were later returned by customers.

The purchases journal is frequently used by businesses to keep track of all equipment and inventory purchases. Companies have access to an almost endless number of different journals, but most only use a few.

Please wait processing your request...

Please wait processing your request...