What are Krugerrands?

Krugerrands are gold bullion coins that are minted in South Africa. They are quite well recognised and are traded internationally. Krugerrands were first minted in 1967 in the Republic of South Africa. They are still used as a legal tender in the country.

Krugerrands are produced from one of the world’s largest gold mines in South Africa. They were developed with the intent of promoting trade in the South African gold internationally by making it easy for anybody to invest in gold. The provision of a legal tender makes Krugerrands easy to trade anywhere in the world.

What are Krugerrands made of?

Krugerrands are coins made from an alloy of copper and gold that weigh 1.0909 Troy ounces. The Krugerrand comprises of 1 Troy ounce of 24 karats of pure gold.

Mixing gold with copper allows the Krugerrand to stay durable and long lasting. No face value is inscribed on the coin; however, the weight in gold is marked on the coin to define its value.

The coin has the bust of Paul Kruger, four-term President of the South African Republic, inscribed on it. The name Krugerrand was coined by combining the words Kruger, for the President Paul Kruger, and Rand which is the South African currency.

How did the Krugerrand come into existence?

Paul Kruger was a dominant military figure and the President of South Africa in the late 1800s. The Apartheid government in the 1970s and 80s led to many countries banning physical imports of Krugerrands. However, people could still trade in the Krugerrands without owning them.

Thus, the Krugerrand became one of the most important forms of gold bullion trading in the world. With the government minting these coins, there is a sense of security attached to them. Over 50 million Krugerrands have been produced and sold as of 2018.

Eventually, other countries took inspiration from the Krugerrand and started minting their own bullion. For instance, the Canadian Maple Leaf and the American Gold Eagle continue to remain competitors to the Krugerrand.

How did the Krugerrand become so successful globally?

The demand for Krugerrand rose steadily in the 1970s, and declined in the 1980s. However, the demand became even stronger around 1999. Since their minting started, the production of Krugerrands surpassed the production of the American Eagle bullion coins by 30 million in the year 2018.

Currently, the minting of Krugerrands includes 1/2-ounce, 1/4-ounce and 1/10-ounce variants in the coins; however, originally only the 1-ounce coins were minted.

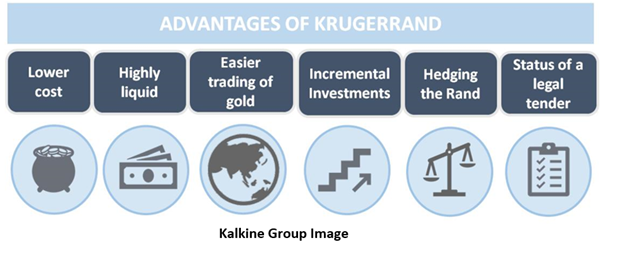

What are the advantages of Krugerrands?

The following aspects of Krugerrands make them a good investment:

- Lower cost: The lower cost of the Krugerrand compared to the American Gold Eagle or the Canadian Gold Leaf bullion is, perhaps, one the reasons why it is so popular. 1-ounce Krugerrands are generally the most cost-effective investments.

- Highly liquid: Krugerrands offer easier convertibility to cash, thus, they are highly liquid. As they are traded across banks and investors, there is always a market for Krugerrands.

- Easier trading of gold: The intent of bringing Krugerrands in the market was to make trading of gold easier. Krugerrands allow trading of gold worldwide, without having to physically import them. Through Krugerrands, even inexperienced investors can trade in gold, thus, making it a more accessible form of investment.

- Incremental Investments: The Krugerrand is available in different sets of weights, making it affordable for all types of investors.

- Hedging the Rand: The value of Krugerrand is tied to the value of gold. Thus, even when the Rand depreciates or is devalued, the value of Krugerrand continues to remain strong in international markets too. Thus, Krugerrand can be used to hedge against the fluctuations on the value of the South African Rand.

- Status of a legal tender: Krugerrand has been given the status of a legal tender by the South African government; thus, they are accepted worldwide. However, Krugerrands do not have a face value.

Which other precious metal is traded as a Krugerrand?

In 2018, the silver Krugerrand was launched and is the only other metal in which Krugerrands are offered. The South African Reserve Bank authorised Prestige Bullion to manufacture silver Krugerrands. The Rand Refinery and the South African Mint have partnered with Prestige Bullion to produce Krugerrands.

The introduction of silver Krugerrand gives silver investors the option to invest in coins now.

What are the problems associated with Krugerrands?

Due to their high popularity, Krugerrands are highly counterfeited. High counterfeiting of Krugerrands has been recorded in the US markets where people manufacture fake Krugerrands and sell them in pawn shops.

However, any experienced bullion investor would be able to determine a fake Krugerrand from the original one. The Krugerrand has a distinct orange colouring because of the presence of copper in it. Another important aspect is the non-magnetic nature of gold. If a coin shows magnetic properties, then it is not a Krugerrand as gold is not a magnetic metal.

These differences can only be spotted by experienced investors. However, there are various other tests that can be used to determine whether a Krugerrand is real or not. These include: X-Ray fluorescence analysers and ultrasound testing that can be used to check for the purity of the metals used in making a bullion.

Please wait processing your request...

Please wait processing your request...