What are legal risks?

A possible loss that a business or individual could incur due to legal issues is called a legal risk. The legal risk can be in the form of a claim an entity needs to settle or a new law or an amendment in existing law, or improper legal decisions.

According to the Basel II accord, the legal risk was considered as a type of operational risk and could cause harm to the company's reputation or financials.

Summary

- A possible loss that a company or individual could incur due to a legal issue is called a legal risk.

- Legal risks may threaten a business in monetary and non-monetary ways.

- Risk management is a means to avoid or minimise or solve issues associated with legal risks.

Frequently Asked Questions (FAQs)

What could be the possible causes of legal risks?

Due to legal risk, an entity may experience monetary risk or non-monetary risks like loss of goodwill, harm to brand image or reputation. Legal risks may be caused due to many reasons like the following-

- Assets and allied litigations

- Complexities in business contracts and agreements

- Non- compliance with existing legal meachanisms

- Matters related to intellectual property rights

- Patent or copyright violations

- Negligence

- Ignorance on legal matters

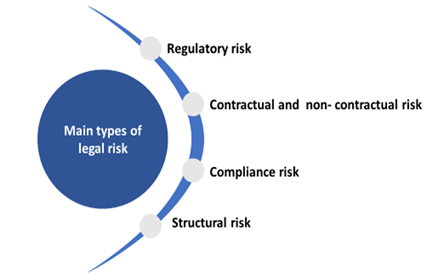

What are different types of legal risk?

Depending on the nature of the risk, legal risks can be classified in various types as follows:-

Copyright © 2021 Kalkine Media

Regulatory Risk

The risk that a change in law or legislation will impact the shares of a company, or the performance of a sector is known as regulatory risk. Companies must follow the rules put forth by the regulatory organisations that supervise their industry. As a result, every regulatory change might have a cascading effect throughout a sector. Regulatory risks are the dangers that occur as a result of the rules and laws that govern a company or the market in which it operates. Every country and government has laws and regulations in place to ensure that businesses run smoothly. Any non-compliance might have major ramifications for any company. In the instance of non-compliance with taxation requirements, for example, a business may face severe penalties and even shutdown. Thus all firms are required to follow the prescribed rules and laws.

Tariff and trade policies, tax policy change, minimum wage laws, required vacation and sick days, and banking regulations are all examples of regulatory risks. Such regulations can raise operating costs, create legal and administrative barriers, and even prevent a corporation from doing business.

Contractual risk

When contractual obligations are not met, contractual risk is incurred. Failure to satisfy contract conditions, offer services in accordance with the contract, incorporate risk mitigation mechanisms in the contract, and so on, all result in contract risk. Contracts are nearly a regular occurrence for businesses. As a result, a corporation is exposed to contractual risk daily. These dangers stem from the company's contractual responsibilities to third parties. If these obligations are not fulfilled, a company may face legal risks and obstacles. Furthermore, contractual risks include failure to deliver goods and services, insufficiency in service supply, quality difficulties, and so on.

Non-contractual risk

Even if a company is not involved in a contract with a third party, some hazards can arise. A rival may infringe on a firm's patents and copyrights or introduce a similar product to what the company is offering. The circumstance can also be the polar opposite. A lawsuit can be filed against a company by other companies. This can include trademarks, patents, and copyright infringement, among other things.

Also, as was the case of the Baby powder of Johnson & Johnson, companies may face legal action for harming consumers. The baby powder manufacturer was accused of asbestos in the product, which became a cause of cancer among its users. Even if the harm may be unintentional and just a one-off case out of millions of products sold, it may still cause a significant loss. The company may have to pay a huge compensation amount. Also, it may lead to a loss of reputation and brand image. While non-monetary losses are significant, the sued company can cover only monetary ones (like compensation payment or cost of litigation) under liability insurance policies.

Compliance risk

Risks associated with various compliances to which a company is subject are known as compliance risks. These compliances could be related to the company's internal policies and procedures. However, it could also be about the government's or other statutory authorities' exterior policies and statutes.

For example, a business must file returns, income and expenditure statements, balance sheets, and other documents. Before submitting, the entity's books of accounts may need to be audited. Authorities may impose penalties if the concerned companies do not comply. It could also lead to legal action against the corporation, which could result in significant damages.

© Kianlin | Megapixl.com

Risk of disputes

Multiple disputes cause a firm to be disrupted frequently. Customers, staff, or other stakeholders may be involved in a dispute. It should approach such disagreements with caution. The aggrieved party may file complaints and lawsuits as a result of the mishandling- this can put a company's reputation in jeopardy and cost it money in terms of wasted time and other costs associated with dealing with legal issues. Furthermore, the cost of defending such actions to the business might be substantial.

Structural risk

The majority of structural risks arise from ambiguity about conducting business or the future of an industry or technology. However, this type of danger is uncommon, particularly among small and mid-sized businesses, and can only be avoided by keeping up with industry advancements and trends.

Structural risks have the potential to change the landscape in unforeseen ways. For example, new technology gave birth to the video rental sector, which then vanished after only three decades due to changing technology. Unfortunately, there isn't much a business owner can do to defend oneself against structural legal risk unless they have a working crystal ball or a time machine, except to be informed about trends and developments in their sector. Timely upgradation is the only safeguard in such cases.

What can be done to deal with legal risks?

In the business world, failing to address legal concerns before they become genuine problems can be disastrous. Companies that fail to recognise and handle their legal risk, from contract breaches to compliance failures, can be held liable for damages, fines and penalties, as well as reputational harm.

The most effective method to avoid legal risks is to establish wording and clauses in advance that can mitigate losses or even remove some hazards entirely. Another practical approach to achieve this is to negotiate the best contract conditions while drafting contracts.

One important strategy is to seek stakeholder input as soon as possible, as individuals who will be involved in delivering on a contract will most likely have the experience to identify potential issue areas. Existing and archived agreements can also provide valuable insight into what has worked effectively in the past - and what backfired.

Each contract requires its response strategy for identifying and resolving any issues that may develop during the contract's life. Along with the contract administration plan, companies must include a risk response plan that addresses what could go wrong and what should be done.

Having a contract assessment might also assist in spotting emerging hazards by providing a meaningful benchmark against which to compare performance. Therefore, it's critical to specify what success looks like and identify a potential problem when establishing performance criteria and metrics for a contract.

Please wait processing your request...

Please wait processing your request...