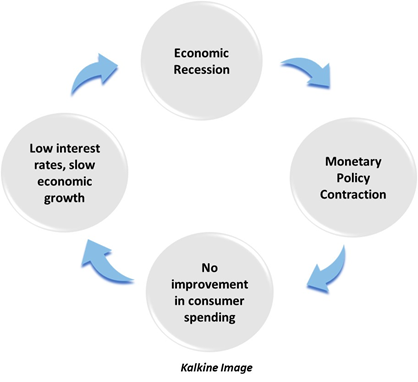

A liquidity trap is an economic scenario in which there is contraction in the economy despite very low interest rates. Under a liquidity trap, monetary policy fails to work as people hold onto their savings even in the presence of low interest rates.

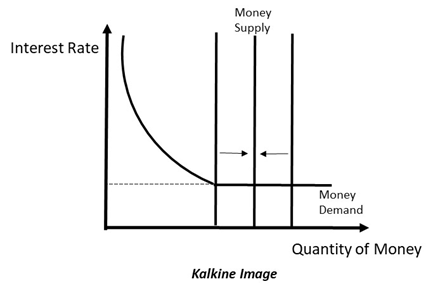

An expansionary monetary policy is applied to increase the money supply in the economy and to encourage spending in the economy. However, under a liquidity trap the transmission effect of monetary policy does not take place and it is rendered ineffective. The situation of liquidity trap is marked with low interest rates, slow economic growth, and low inflation.

What causes a liquidity trap?

Once the interest rate becomes too low, the demand for money becomes horizontal. This means that demand for money would not be affected to changes in interest rates beyond this point. This horizontal portion of the demand curve is called the liquidity trap. Individuals believe that since interest rates are too low, they will eventually rise. They believe that buying bonds would mean incurring a loss.

A liquidity trap usually occurs during an economic recession when people are afraid to spend money. Even when the government policies favour spending and are aimed at promoting consumption, consumers do not have enough confidence in the economy to utilise this increased liquidity. Therefore, the monetary policy fails to get utilised.

Thus, the intended use of monetary policy is not able to get fulfilled due to the loss of confidence of consumers. During slow economic growth, people are uncertain about the timeline of the recession. Thus, they prefer to hold not their cash instead of spending it.

How does a liquidity trap affect the economy?

A liquidity trap may lead to deflation in the economy which might persist for long. Low inflation is an ideal situation, however; if it persists for long, it may affect the interest rates. As interest rates increase, investment decreases and consumption might fall further. Thus, the economy might contract further.

A rise interest rates means people are unable to repay on the loans they have taken. Thus, higher defaults on loans lead to an increase in Non-Performing Assets with banks. This can further intensify the recession and reduce the economic growth. Thus, a trap can set in, from which it becomes progressively more difficult to get out.

What are the solutions to liquidity trap?

Following solutions can be adopted to get out of a liquidity trap:

- Increasing Interest Rates: Higher interest rates would encourage people to invest rather than hoard their money. Also, higher long-term rates would encourage banks to lend more as they would get higher returns in the future.

- Expansionary Fiscal Policy: Keynes argued that when monetary policy is rendered ineffective in a liquidity trap, fiscal policy is a better solution for it. The government must borrow from private sector and utilise it as government spending to give a boost to the economy. Fiscal stimulus can also be provided by reducing taxes. This would increase the confidence of consumers in the government and thus, they themselves would spend more.

- Reduction in Prices: Economy could receive a boost when prices fall. A reduction in stock prices would encourage investors to buy shares and then wait long enough for prices to increase back.

- International balancing: It is possible that one country is facing a liquidity trap and the others are not. Thus, countries may coordinate internationally to reduce the effects of a liquidity trap.

Why is the fiscal policy stimulus criticised?

Fiscal policy has been criticised as it merely shifts the monetary base from private sector to the government sector and does not increase any productivity. The argument comes because an increase in government spending may lead to a decrease in private sector investment. Thus, it would lead to a ‘crowding out’ of private investment.

However, Keynes argued that the government borrowing might crowd out the investment under normal circumstances. However, under a liquidity trap, the government borrowing would not crowd out investment but would, in turn, replace savings. Therefore, the private sector lending would help steer the economy.

It is important to note that expansionary fiscal policy might fail when the inflation expectations are low among the consumers. However, under expectations of moderate inflation, fiscal policy might be a solution to liquidity trap.

What are some real-life examples of liquidity traps?

The economy of Japan is in a liquidity trap. The interest rates are near zero, and government borrows money to boost the economy. However, there is not enough stimulus that could be given to the economy. Thus, low interest rates, constant deflation, slow economic growth are all indicators of a liquidity trap.

A liquidity trap may also set-in during recessions and economic depressions. The effects of the Great Depression were felt deeply in the Eurozone. Interest rates were maintained at 0%, however, this did not translate into economic stimulus. A similar situation was also observed during the 2008 housing market crisis.

Please wait processing your request...

Please wait processing your request...