What is LTC ratio?

The loan-to-cost ratio is a metric for determining the amount of money or the loan percentage that a lender is prepared to offer to fund a project depending on the cost to build the project. It is a measurement of how much of a property's purchase, rehab, and building expenses is covered by a loan.

The proportionate usage of debt in the funding of a real estate investment or development is described by LTC, which is a fundamental metric of leverage. LTC is majorly used for commercial loans, fix-and-flip loans and construction loans.

The ratio assists investors in planning their down payment and monthly payments, as well as determining possible returns.

Summary

- Loan-to-cost ratio (LTC) is used in financing for commercial real estate to find out how much of the project will be funded by either debt or equity.

- LTC values are affected by current market rates and allow investors to know about the equity that they will retain.

- LTC is the loan amount divided by the total cost of the project.

Frequently Asked Questions (FAQs)-

How is LTC calculated?

Loan amount includes the total amount of debt capital lenders put towards the project, while total project cost includes costs related to land, construction labour, construction materials, professional fees, and permits.

If a projects costs $1 million to complete and $600K is borrowed, LTC ratio would be 60%.

How does LTC Ratio work?

The LTC ratio is used to determine the amount of risk associated with providing construction finance. In the end, a larger LTC ratio indicates that lenders are taking an additional risk. Most lenders offer loans that only cover a portion of a project's cost.

Most lenders will fund up to 80% of a project's cost. Some lenders will fund a higher proportion, but this usually comes with a high interest rate.

Loan to cost (LTC) values are determined by market rates and tend to go on a higher side during bull markets.

The ultimate amount of borrowing is decided by a number of criteria, including the value of the security, the borrower's creditworthiness, and a strong CIBIL Score, among others.

What is the importance of LTC ratio?

The loan-to-cost ratio is significant since it aids in determining the size of a loan depending on the project's real expenses. Borrowers utilise their LTC rates to establish their maximum budget and out-of-pocket expenditures, such as the down payment, and monthly loan repayments.

Image Source: Copyright © 2021 Kalkine Media

LTC might also impact interest rates on loans. A greater LTC ratio indicates that the lender is willing to take on more risk in order to finance the project. Subsequently, interest rates may be greater, and more mortgage insurance might be required.

A lower LTC suggests that just a part of the project's cost is being protected. This allows the borrower to make a larger down payment, but it also means the borrower will have lower monthly principal or interest rate commitments.

Lenders generally establish a maximum loan amount and a maximum dollar amount depending on the LTC ratio. A lender may, for example, establish a maximum LTC of 75% or $200,000, whichever is lower. In this example, if a buyer reaches $200,000 while still falling short of the maximum LTC of 75%, they will be compelled to make up the difference by investing more of their own money.

How is LTC Ratio different from LTV ratio?

Both LTC and LTV are important parts to commercial real estate financing that assist lenders in finding out the acceptable risk levels for an asset.

While LTC expresses debt versus total project cost, loan-to-value (LTV) ratio measures the ratio of loan to value against the market/appraised value to the property.

The primary difference between the two formulae is the sort of project for which the loan will be used for - a construction project vs refurbishment of an existing building.

LTC is a superior metric for building projects since it takes into account both the construction costs and the needed finance to finish the project. It is more apt when evaluating a project that needs more construction.

While LTV is more apt while assessing a stabilised asset or core investment plan, LTV method is favoured for repair and flip projects or turn-key properties because the end price of the property is substantially greater than the original purchase price.

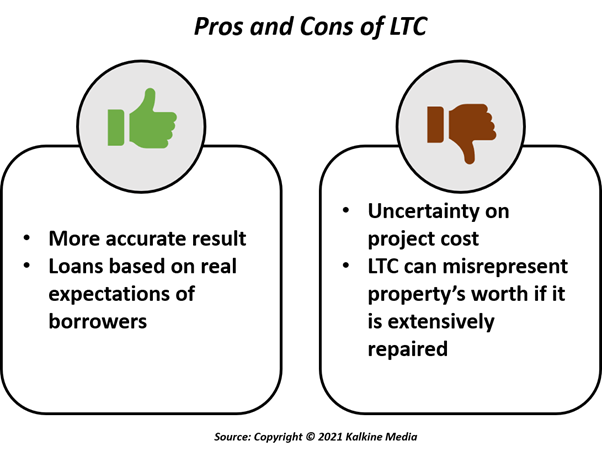

What are the pros and cons of LTC?

Loan to cost ratio is a significant metric of measuring the loan size while financing real estate projects. It has its own set of advantages and disadvantages.

Here are 2 pros of using LTC:

- More accurate result- The size of the loan is real total project cost, not simply an evaluation, is required when using LTC. As a result, the outcome is more precise.

- Loan based on real expectations- The loan amount is determined by the entire project cost rather than the assessed value, making it a more appropriate and realistic metric for lenders.

However, there are 2 challenges while using LTC ratio.

- Ambiguity- It can be challenging to estimate the whole cost of the project's construction and refurbishment expenditures from the onset of the project.

- Repairs- If a property is significantly restored or repaired, the LTC ratio misrepresents the property's worth. The loan to value ratio is a superior statistic since it permits borrowers to obtain additional finance by utilising the after-repair value.

Please wait processing your request...

Please wait processing your request...