What do you mean by Long-term capital gains?

Long-term capital gains refer to the profit earned from the sale of those assets or securities that were held for more than 12 months. Basically, it is a profit on “capital investment.” Usually, long-term capital gains are given more favourable tax treatment over short-term gains, which has been a debatable issue for a long time. Short-term refers to the profit stemming from the sale of those assets which were held for less than a year. The assets here can be mutual fund, real estate, stocks, etc. Taxation on long-term capital gains is different for different assets.

Long term capital gain is measured by calculating the difference between the purchase price and the sale price.

Summary

- Long term capital gains refer to the profit earned from the sale of those assets or securities that were held for more than twelve months.

- Long-term capital gains are taxed according to graduated thresholds for taxable income at 0%, 15%, or 20%.

- Long-term capital gains are given more favourable tax treatment over short-term gains.

Frequently Asked Questions (FAQs)

Can Capital Losses be adjusted against Long-term Capital Gains? Explain with the help of an example.

In United States, the Internal Revenue Service (IRS) has kept a lower tax rate for long-term capital gains than short-term capital gains. As of 2019, the tax rate for long-term capital gains ranged in between 0-20%, based on the tax slab that the taxpayer is in.

As far as capital losses are concerned, both short-term and long-term losses are treated equally. Furthermore, just as capital gains are counted as income, capital losses can be used as deductions to reduce taxable income.

It is to be noted that both types of losses, whether short-term or long term, can be set off against any long-term capital gains made by an investor in the immediate future years.

For example, imagine Alfred is filing his taxes, and he makes a long-term capital gain from the sale of his shares of stock for a private limited company. Alfred first bought these shares in 2005 during the initial offering period for $163,000 and is now selling them in 2018 for $210,000. We see here that Alfred is experiencing a long-term capital gain of $47,000, which will be taxed as capital gains tax, while filing the returns.

Later, suppose he is also selling his plot of land purchased in 2017 for $65,000, provided that he doesn’t have any equity in it. When Alfred sells this property just four months after its purchase, he got just $68,000. Thus, in this deal, he made a short-term capital gain of $3,000. This gain will be taxed as income, and it will add $3,000 to the already existing wage calculation.

If Alfred had rather sold his plot for $63,000, bearing a short-term loss, he could have used that amount of $2,000 to adjust against the tax liability for the $47,000 long-term capital gains he had experienced.

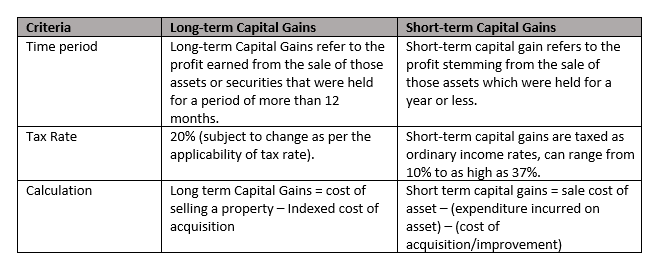

What is the difference between Long-term and Short-term Capital Gains?

Source: Copyright © 2021 Kalkine Media

What do you mean by adjusted basis, and what is its impact on Capital Gains tax?

Based on the difference between the adjusted basis and the amount at which an asset is sold, a taxpayer will either pay capital gains tax or experience a capital loss. The adjusted basis of an asset is usually the amount you paid during its purchase, plus the cost incurred in the sale of an asset and the improvements you made, less any depreciation. The higher the adjusted basis, the less an investor is likely to pay as capital gains tax. Noticeably, the tax on LTCG is always lower than if similar assets were sold (on profit) in less than a year. Since long-term capital gains are taxed at a more favourable rate than short-term capital gains, one can reduce the capital gains tax by holding these assets for more than a year.

Image Source: © Arturszczybylo | Megapixl.com

How are Long-term Capital Gains taxed? Is it true that Long-term Capital gains are given favourable tax treatment?

Long-term capital gains are taxed according to graduated thresholds for taxable income at 0%, 15%, or 20%. Taxation on long-term capital gains always been a hot topic in countries such as the US, primarily because LTCGs are given favourable tax treatment over the short-term capital gains, which are taxed at ordinary rates. Capital gains taxes are disproportionately paid by households belonging to high-income groups. This is because high-income households are usually the ones who possess assets that generate taxable income. While it not only supports the debate that those who are paying capital gains taxes are capable enough to pay more taxes, but it also hints at tax evasion or tax avoidance by these wealthy taxpayers.

Critics believe that the low-income taxpayers are at the receiving end in such a way because they may end up paying these taxes indirectly via changed prices as the actual payers pass through the cost of paying taxes. What has further complicated the use of capital gains tax to resolve income inequality is that capital gains are mostly not regular or consistent income.

Moreover, low tax rates give favourable treatment to long-term capital gains; but unlike wages or salaries, capital gains are not subject to taxation when the asset grows in value. Instead, they are taxed only when an investor sells an asset. Thus, this gives the taxpayers who own these assets to defer tax. Critics believe that this giant loophole in the tax code helps wealthy investors making long-term capital gains evade taxes. Furthermore, if an individual holds an asset for a lifetime, then an asset’s appreciation in value will never be covered under income tax.

What is the latest development in the US concerning the change in tax rates on Capital Gains?

Debate on tax rates is often biased in the United States, where the Republican Party favours lower rates, while the Democratic Party tends to support higher rates.

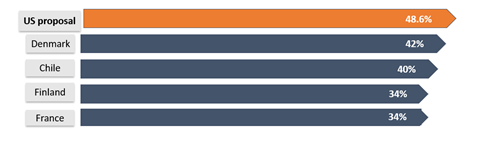

Tax policy occupied a central position in the US presidential campaign, 2016, as political parties proposed to bring changes in the capital gains tax rate. Recently, US President Joe Biden had put forward a proposal wherein he announced that the top federal tax rate on capital gain and qualified dividend would be raised to 39.6%. If this proposal is enacted, the country would have the highest top capital-gains tax rates among the Organisation for Economic Co-operation and Development (OECD) countries.

Which are the top 5 developed countries where tax rates on capital gains are highest?

If President Biden's proposal is enacted, then US will occupy a top position for taxation on capital gains:

Source: Copyright © 2021 Kalkine Media

Please wait processing your request...

Please wait processing your request...