What is a Margin Account?

Margin account in financial terms can be defined as a type of brokerage account used by investors wherein the brokers lend money to investors for purchasing financial items. The investors who borrow money are charged with a monthly interest paid and the broker's borrowed money.

A margin account is also commonly known as a loan account as it lends money to the investors to buy items from the financial market. A margin account enables an investor to purchase more financial items such as shares, securities, stocks, and bonds from the financial market.

Summary

- Margin account is a type of brokerage account used by investors wherein the brokers lend money to them for purchasing financial items.

- It allows investors to buy more financial items such as stocks, bonds, securities, etc.

- A margin account is only suitable for an experienced investor who is less vulnerable to market risk.

- There is no structured repayment plan available for margin accounts; however, the investor has to maintain the value of the margin account; this is known as maintenance margin.

Frequently Asked Question (FAQ)

How can the advantages and disadvantages of the Margin Account be explained?

As investors use a margin account to lend money from brokers to buy financial items from the market, certain advantages and disadvantages are involved.

Some of the advantages of using a margin account are:

- It allows investors to buy more financial items such as stocks, bonds, securities, etc.

- Upon buying securities with the help of a margin account, the value of securities does exceed the interest amount. The investor can earn more return on investmentthan when the investor buys securities with his own money.

Image source: © Aero17 | Megapixl.com

How to operate a Margin Account?

The margin account initially needs the approval of the broker to function. After the broker approves the margin account, a credit link is sent to the investor by the broker, which can be used to purchase stocks, securities, bond etc.

The financial securities that are purchased by the investor act as the collateral for the loan. There is no structured repayment plan available for margin accounts; however, the investor has to maintain the value of the margin account; this is known as maintenance margin.

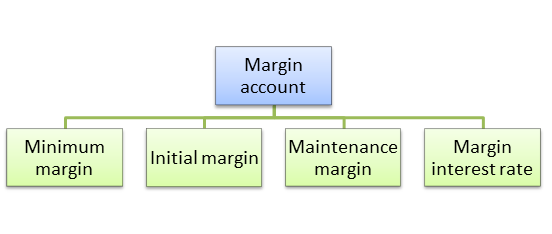

What are the essential components of a Margin Account?

There are few essential components of a margin account. The following are the elements of a margin account:

- Minimum margin -Minimum margin is identified by the minimum amount of money deposited by the investor before starting with the trade.

- Initial margin- Initial margin can be described as the initial limit permitted to the investor of lending money. For the first purchase, the investor is only allowed to lend 50% of the total value of the security. As the investment increases, the purchasing power of the investors doubles up.

Image source: Copyright © 2021 Kalkine Media

- Maintenance Margin-The maintenance margin can be explained as the minimum deposit that the investor must keep in the account. The broker firms set the minimum limit.

- Margin interest rate-As margin account offer a loan to the investors, they have to pay back the amount along with a particular margin interest rate. Each broker firm has got a particular margin interest rate, and it differs in every broker firm.

Some disadvantages of using a Margin Account are:

- The brokerage account will keep on adding its interest on the loan taken by the investor to buy the security until the entire amount is paid back. At times the interest amount exceeds the return gained from the security. If the value of the security decline, in that case, the investor must repay his loan along with interest.

- The investor might have to follow the instruction of the broker. For example, the investor will have to sell off its security if the broker might feel that his money is at risk or sue the investor if they are not fulfilling the margin callsor have a negative account balance.

- A margin account is only suitable for an experienced investor who is less vulnerable to market risk. Otherwise, the investor might end up losing more money than it is deposited in the margin account.

Image source: © Wutzkoh | Megapixl.com

How Cash Accounts and Margin Accounts are different?

The cash account and margin account has got a lot of difference between them. The following are the reasons how cash account and margin accounts are different from each other:

- Cash account-In the case of a cash account, all transaction must be done in cash only. To buy securities through a cash account, the investor must deposit cash for settling the trade. If you own a cash account, you will also be able to let the broker know about your willingness to lend the shares. If there is a demand for the shares, then the broker will quote the price with which he is willing to buy the shares.

- Margin account-In the case of a margin account, the investors are enabled to buy more shares, stocks, and bonds, and they can lend money from the brokers to buy them. This is best suited for experienced investors who can analyse the market risk accurately to save themselves from experiencing loss.

Why are Margin Accounts considered bad?

Margin accounts can be an excellent option for experienced investors to invest in more securities and maximise their income. However, when it comes to beginners, margin accounts may cause a massive loss of money. It is essential to analyse the market and predict it accurately before lending money from a broker to invest in a stock. Failing to do so may cause serious harm, and undoubtedly, the beginners are the ones who get affected the most. Therefore, it is always advised to the experienced investors to utilise margin account benefits and the beginners to stay away from it.

Please wait processing your request...

Please wait processing your request...