What is Money Laundering?

Money laundering is an illegal scheme in which criminals make and transfer large amounts of money through disguising identity and location via different criminal activities such as drug, arms and human trafficking, embezzlement, terror financing. The laundering scheme is conducted while making the process look legitimate.

The money, however, is processed via criminal conduct; hence it is called "dirty", but because of the process of making it look legitimate or clean, it is referred as "laundering".

READ OUR BLOG: What Is Meant By Money Laundering?

Money laundering is a dangerous financial transactions crime which is commonly performed to launder the black money or dirty money. Laundering lets the criminal transform their illegal funds into legitimate assets , which could even be a real estate property, ultimately making it look legal in the purview of the law.

The criminal activities related to money laundering are conducted across the globe and are also commonly carried on by the white-collar criminals. Most of the money laundering is done in illegal narcotics trafficking.

Usually, it is the criminals conducting money laundering activities for their own business purpose; these days, it is also seen that money laundering is offered as a service in the organized crime world. Various professionals such as lawyers, bankers and even accountants are participating in enabling money laundering activities.

Criminals launder their dirty or black money so that they can use clean cash for everyday transactions without making it look suspicious.

The laundering also helps them from preventing the funds being traced back to their illegal business activities and locations, ultimately saving the funds from getting confiscated by authorities.

GOOD READ: Money Laundering and Child Abuse Suspicions Over PayPal; External Audit Ordered by AUSTRAC

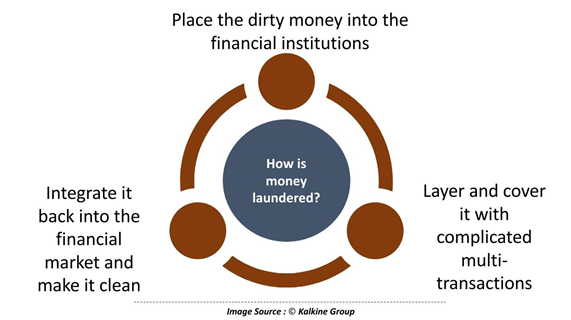

What Are the Commonly Used Steps To Launder Money?

Money laundering is a systematic process. The three common steps which are followed by the criminals are placing, layering and integrating the dirty money.

- Placing: First, let us understand why this step is required. Placing helps the criminals put their dirty money into the financial system. There are various ways to do this. The first step is always critical because there are higher chances of getting the funds detected while transferring into the financial system in large sums.

If it looks suspicious to the bank, there are chances of police getting informed. Therefore, many countries have defined amounts to deposit funds into the financial systems. If the payment is larger than the limit, the financial systems have to inform the authorities by mandate.

These days the criminals also use alternative ways to place their money by using cryptocurrencies such as bitcoin.

DO READ: Bitcoin for Beginners: 5 things you need to know

- Layering: This step involves transferring the funds from financial systems through complicated ways to track. Sometimes the criminal closes the course of the money once it's moved to other systems. Several transactions are undertaken in this process to conceal the initial foundation of the funds.

Similarly, it's done for transactions in Shell Corporations. In some countries, the financial systems have stringent privacy laws such as Switzerland , Panama, the Cayman Islands, etc. It is difficult for the authorities to investigate once the funds are transferred into such financial systems.

- Integration: Now that these funds are difficult to trace back to its origin, the integration takes place. Integrating the money back in the market is the last step to clean the cash from being dirty.

Casino and gambling points, real estate transactions, purchasing the securities and also life insurance policies are commonly used to integrate laundered money into the financial world.

What Are the Anti-Money Laundering Regulations Worldwide?

Different countries have different set of rules to combat money laundering. Although, Financial Action Task Force (FATF) works towards dealing with money laundering globally. While more than 200 countries and jurisdictions are participating in implementing FATF recommendations and policies.

The agency has set international standards to ensure the states are able to prevent organized crime, corruption and terrorism. The agency also provides information on the criminals to the local authorities. Most importantly, the agency works towards bringing a political will to implement laws in these areas.

The agency develops policies, recommendations with the help of its members and also provides adequate information and support to deal with the terror funding. The FATF body calls itself a money laundering and terrorist financing watchdog.

Various countries came together to create this inter-governmental agency in order to combat money laundering. The headquarter of this agency is in Paris, France. The agency currently has 39 members on board along with 37 jurisdictions.

FATF’s two regional organizations, the Gulf Cooperation Council and the European Commission are working towards the same goal. Apart from the member countries, 31 international and local organizations are part of FATF as its Associate Members or Observers of the FATF.

How Does Money Laundering Affect Businesses?

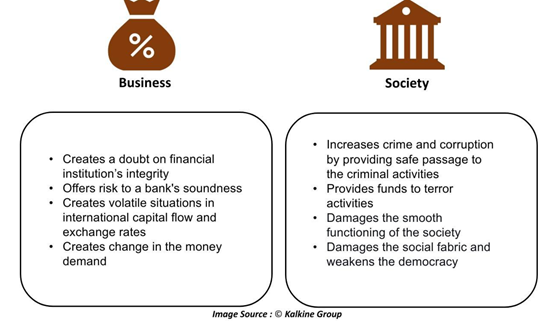

- Impact on markets: Once the illegal dirty money is integrated into the marketplace, it is difficult to track back the unlawful criminal activity. While placing the funds into the financial system, the criminals also at times bribe the employees or sometimes the institutions turn a blind eye towards these transactions. It creates a doubt on the overall integrity of financial players. The evidence of such activities is impacting on the character/standing of the financial institutions.

Another important aspect is the funds generated via money laundering are used in creating volatile situations in international capital flow as well as exchange rates.

Most of the time, the money which is laundered is used for cross-border asset transfer. These funds once integrated into the market, creates change in the money demand. Such funds offer risk to a bank's soundness.

- Impact on society, democracy and law and order: Money laundering not just impact the market and economy but because it is leads to corruption, crime and terrorism, it damages the smooth functioning of the society. Unchecked or ineffective handling of money laundering can have severe impacts on the social and political aspects of the community.

Once the dirty money is infiltrated into systems, it can get control of the broad sectors such as real estate investment. Once these elements take control of the society, it damages the social fabric, at large weakening the society from its core.

Laundering provides safe passages for the criminals to exist and conduct furthermore criminal activities; therefore, governments take money laundering gravely.

ALSO READ: Why is Governance important for banks: NAB under Money Laundering Trap

Please wait processing your request...

Please wait processing your request...