What is negative cash flow?

The cash flow situation where the company has utilised more cash than it takes in is where the company experiences negative cash flow. It generally happens during the initial phase of a business where the company struggles for funding and has much more expenses to cover.

Summary

- In a situation where the cash outflow exceeds the cash inflow within a business, the company is said to be experiencing negative cash flow.

- A negative cash flow could put an end to the growth of a company.

- Negative cash flow is a phase that companies mainly experience in their initial years.

Frequently Asked Questions (FAQ)

What are the possible causes of negative cash flow?

The possible causes of negative cash flow are stated down:

- Generating low profit

The most apparent reason behind negative cash flow is the low profit generated in the company. Such a situation arises when the company fails to recover its operating expenses by selling its products or service to its customers. The possible reasons that give rise to a low-profit income in a business are:

- Improper or inappropriate sales and marketingstrategies

- Inefficient workforce

- High operating expense

- Zero control over cash outflow

Image source: © 72soul | Megapixl.com

- Excessive investments

Another major cause that gives rise to negative cash flow in businesses is excessive investments. The investments are made expecting to earn extra profit. However, these investments ultimately drain away from the fund and give a negative cash flow to the company.

- Poor financial planning

Poor financial planning would also result in giving rise to negative cash flow in a company. Therefore, financial planning includes planning investments and expenses and planning strategies to overcome all the cash outflow through sales and investments.

- Unpredicted expenses

Often unpredicted expenses start appearing in a business that was not initially included in the plan. High unpredicted expenses might exceed the cash outflow in a company and give rise to a negative cash flow.

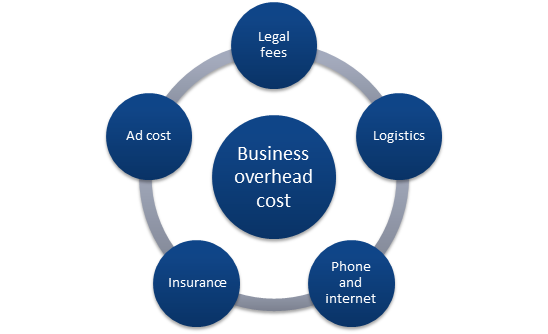

- Expensive cost of overheads

Overheads are the additional expenses that are involved with the production and operations of a company. Sometimes these expenses become higher than expected and become a cause for arising negative cash flow in a business.

Image source: Copyright © 2021 Kalkine Media

- Product pricing - either too high or too low

The cost of the products must be kept moderate, keeping the market prices in mind. If your products are very highly priced then, customers might not opt to buy your product.

What does a negative cash flow indicate in your small business?

A negative cash flow obviously indicates a loss of money in a small business. In certain cases, it also indicates the wrong timing of investment and income in small businesses. When negative cash flow prevails in a business, the primary focus of the business should be to recover losses and achieve a positive cash flow as soon as possible rather than reinvesting.

As negative cash flow also portrays the poor decision-making skill of the company management in terms of investments, it also makes investors sceptical about investing in that company as negative cash flow also puts a question on the growth of the overall business.

How to analyse negative cash flow?

The analysis and calculation of negative cash flow are simple. Although the mathematical formula gives a practical value of cash flow, it is important to analyse business activities to develop a clear understanding of negative cash flow.

We need to calculate the cash flow first before determining the negative cash flow. The mathematical formula to calculate cash flow:

Cash flow = Cash inflow - Cash outflow

If the value of cash flow is obtained as a negative value, it can be concluded that it is experiencing negative cash flow.

How does negative cash flow impact your business?

The goal of every business organisation is to maintain a positive cash flow consistently throughout their business. However, negative cash flow is a part of business and is inevitable at some point in the business. If negative cash flow is continued for a prolonged period, the following impacts will be faced by the company:

- Stagnant growth

Negative cash flow might put an end to all the possibilities of growth in a company. A company would not be able to function or operate without enough revenue. The possibilities of earning revenue in the future also seem to diminish if a company cannot operate or manufacture its products.

Image source: © Blueximages | Megapixl.com

- Difficulty in drawing investors

Every company experiencing negative cash flow would be in dire need of money from investors. However, the negative sign before the cash flow statement of a company makes investors sceptical about investing as they are uncertain about the returns on investment.

Moreover, without a steady cash inflow, the companies will also fail to pay dividends to the dividend holders.

- A deficit in the promotional fund

A negative cash flow could give rise to a deficit in the promotional fund of a business. As a result, these companies cut their marketing and promotional budget to continue with operations.

How can a company cope up with negative cash flow?

As we have already stated, maintaining a positive cash flow is the goal that every business strives to achieve. The following ways can quickly help a company to cope up with negative cash flow:

- Keep a careful tab on all your income and expenses

Carefully analyse every income and expense that is taking place within the business. Keep a tab on every employee, analyse your business needs and review your financial statements regularly. If possible, equip new software that can make your task easier.

- Update your cash flow statement regularly.

Update your cash flow statements frequently where all the income and expenses of the company are accounted for.

- Cut down expenses if possible.

Review your company's financial statements regularly and find out points where the operating expenses can be brought down. This will enable the company to increase cash inflow and diminish the cash outflow to some extent.

- Create an emergency fund

Ensure you have an emergency fund ready during such challenging times when you will not get monetary support from investors.

Please wait processing your request...

Please wait processing your request...