What are Non-Fungible Tokens?

Non-fungible tokens or NFTs are used to represent the ownership of a digital item that is unique. NFTs have gained popularity in the digital art space, collectible space and even in real estate. NFTs can have only one official owner at a time, even though they can be easily reproduced.

The reproduced version of an NFT do not change the original ownership of it. However, what sets NFTs apart from other forms of assets is that they are non-fungible or not interchangeable for other items. This happens because they have certain unique properties associated with them that do not allow any other asset to replace them.

Thus, the economic term ‘non-fungible’ is used to describe these investments. Other items that can be categorized as non-fungible include one’s furniture, one’s computer and other everyday items. NFTs are secured by the Ethereum blockchain.

How do NFTs work?

Unlike physical artwork, digital artwork is often recreated and duplicated. Thus, NFTs provide a safe haven for digital works of art. This is done by tokenizing these digital pieces to create a digital certificate of ownership that can be bought and sold.

This is achieved through the blockchain technology, the same technology used in cryptocurrencies to keep a track of ownership of the asset. This ensures that the accounts do not get forged, and the assets do not get recreated by anyone across the globe.

This token of ownership may also allow the original artist to financially benefit from any future sale of the asset.

What are the characteristics of an NFT?

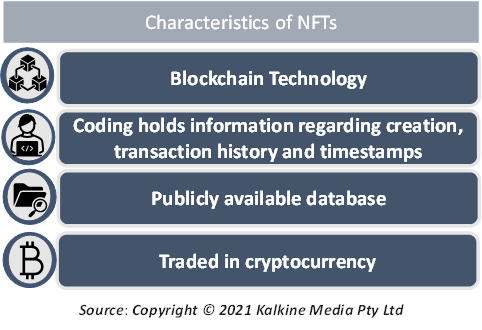

The following characteristics help maintain the authenticity and uniqueness of an NFT:

- Blockchain: Blockchain is a digital account used to hold information pertaining to the ownership of the asset in question. However, unlike manual ledgers, blockchain technology allows the record of ownership to be maintained digitally with the help of embedded coding.

Once data in this digital ledger is entered, it cannot be changed or modified as everything is done through technology and coding.

- Individual Coding: The aspect that sets apart one NFT from another is the information pertaining to its creation, transaction history and various related timestamps that is embedded in its coding. A single physical asset may be associated with multiple NFTs, that still does not make an NFT transferable.

Therefore, an NFT, if reproduced, is not homogenous with respect to the original NFT. It would be deemed an imitation or a replica, at best.

- Publicly available database: The transaction history of NFTs is publicly available to ensure full transparency in the ownership of the asset. This is much like the governmental database that is available regarding various economic indicators.

- Traded in cryptocurrency: NFTs can only be traded in cryptocurrency like Ether. This is done as cryptocurrency is also secure and operates on blockchain technology.

Why would one invest in an NFT?

Despite the fact NFTs can be reproduced, they are still bought and sold for millions of dollars. This means that if a buyer pays an extravagant amount of money to buy an NFT, even then the NFT can be viewed by others and is freely available on the internet.

The incentive for the buyer, however, is the aspect of ownership attached to the NFT, much like in the case of a signed football jersey or a painting by Monet. NFTs may have different price ranges depending on their creator. The aspect binding them together is the opportunity to gain ownership of an asset that cannot be shared.

The ownership does not affect the copyright associated with the artwork. To better understand this, consider an artwork by Picasso that is sold for millions or billions of dollars. Despite a famous museum or a rich industrialist holding ownership of the physical asset, the artwork continues to be a Picasso painting. The same holds true for an NFT. The original creator remains the same despite change in ownership and holds the copyright to the artwork.

How are NFTs different from cryptocurrency?

The fundamental characteristic of non-fungibility is what sets NFTs apart from cryptocurrencies. Despite both these investments operating on the same blockchain technology, there is a difference in the operational use of both.

Cryptocurrencies are held for the purpose of making a profit and for carrying out trade digitally. They are held for the inherent value they hold and are always equal in value. For instance, consider a Bitcoin held by Person A and another Bitcoin held by Person B. Both Bitcoins are homogenous in nature and are equal in value.

Unlike cryptocurrencies, NFTs have differing values and are not homogenous. Each NFT published is different in properties to the others.

What are some examples of NFTs?

- Virtual Real estate: This is one investment space that is quickly gaining popularity. Like URL domains were sold at the beginning of the internet boom. Decentraland sold USD 1 million worth of virtual land in the form of NFTs. Many companies are seeing exponential growth due to the sale of their virtual land. Additional updates are being done to make drivable cars, residential and commercial property accessible over NFTs.

- Art and Entertainment: NFTs have primarily benefitted the art and fashion industry as it provides a digital medium for artists to sell their work without the risk of it getting plagiarized. This has been especially important in times of Covid when museums and art galleries have been shut.

Some of the fashion industries have opened to payments in fiat form as well as in the form of cryptocurrencies. This could be the next big thing as people get to draw their digital avatar and dress it up too.

- Big brands: All the famous and renowned brands are jumping on the NFT bandwagon despite having little to do with the digital artwork space. Brands like Burger King are making use of the NFT frenzy as a marketing tactic.

Additionally, NBA Top Shot is an NFT released by the National Basketball Association that includes digital cards with live moments captured from games.

What are some of the challenges related to NFTs?

NFTs are relatively new to the market and many people are still trying to understand what holding an NFT means. These may increase in value over time like many assets and their value is speculative. This means that the value of NFTs depends largely on how valuable people perceive them to be.

Despite the high level of security attached to NFTs it is still possible to get counterfeit NFTs. It is also possible that the first entry in the blockchain is incorrect which can tamper with subsequent entries.

Please wait processing your request...

Please wait processing your request...