NZX's primary mission is to function and govern New Zealand's securities and derivatives markets, as well as to provide trading and data services for these markets. This is done to contribute to the wealth creation for its shareholders, as well as the individuals, businesses, and economies in which it functions.

Source: © Suthisa88888888 | Megapixl.com

What is NZX Equity Derivatives (NZCX)?

NZX initiated an Equity Derivatives Market in June 2014 that presented investors with the instruments required to cope up with and get exposure to the New Zealand capital market.

Summary

- The Equity Derivatives market was launched by the NZX in June 2014.

- The key purpose of the market was to offer tools to investors that could help them in managing and gaining exposure to the New Zealand Capital Market.

- The NZX Equity Derivatives market provides index futures contracts and exchange-traded options on Spark and Fletcher Building ordinary shares.

- Derivatives trading is done to control risk associated with the trading of commodity and financial instruments.

- Options trading can help investors in making profits from market volatility and play an important part in lowering transaction costs.

Frequently Asked Questions (FAQ)-

What is a derivatives contract?

A derivative is a contract whose value relies on (or derives from) the value of say an agricultural product, interest rate, foreign currency, or financial instrument - for example, tonnes of Whole Milk Powder (WMP) or shares in a publicly traded firm.

How to access equity derivatives market?

Firms can either become certified derivatives market participants or trade via a NZX-certified derivative market participant to get direct access to the market. A majority of individual traders use an approved market participant to get access to the market.

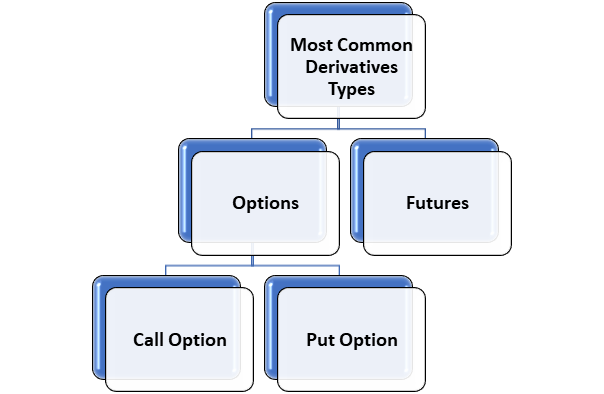

What are different types of derivatives?

There are 2 most common types of derivatives - options and futures.

A futures contract is a legally binding commitment between a buyer and a seller to trade an asset at a predefined price at a certain specific date in future.

An options contract is a tradable contract that offers the buyer or seller the right but not the incentive to buy or sell an underlying asset at a future date. This implies that the options buyer is purchasing the right to buy or sell shares in the future at a price agreed today.

The type of option, underlying share, strike price, expiry date and premium are the 5 key elements of an options contract.

Call and put are the 2 types of options contracts. A call option gives the buyer the right (but not the duty) to purchase underlying shares at a future date at a price agreed upon today, whereas the seller must sell the underlying shares to the buyer if the buyer exercises that right.

A put option gives the option buyer the right (but not the duty) to sell the underlying shares at a future date for a price agreed upon today, whereas the seller must buy the underlying shares from the option buyer if that right is exercised.

Which contracts are offered by the NZX Equity Derivatives Market?

The NZX Equity Derivatives Market presents index futures contracts based on the S&P/NZX 20 Capital Index and Exchange Traded Options (ETOs) contracts on chosen stocks, Spark New Zealand Limited (NZX:SPK; ASX:SPK) and Fletcher Building Limited (NZX:FBU; ASX:FBU) ordinary shares in this case, within the S&P/NZX 20 Capital Index.

How is the S&P/NZX 20 Index calculated and why to list futures on this index rather than on S&P/NZX 50 Index?

The S&P/NZX 20 Index is computed by using a free float market capitalisation approach with a 15% weighting cap for any 1 component.

The liquidity of each individual element of the index was a significant aspect in determining which index would be used for futures contracts. In comparison to the S&P/NZX 50 Index, which has comparatively illiquid components, the S&P/NZX 20 Index has all of its constituents with very high levels of liquidity.

How much will a trade cost to an individual?

Index futures need an initial margin of about 6% of the assumed value of the position, with daily payment or collection of variation margin. When buying options, the trader must pay a one-time premium to cover the cost of the contract.

Options trading costs are $0.36 and $0.48 for futures contracts, respectively, while options clearing fees are $0.54 and $0.72 for futures contracts.

What are the benefits of options and futures trading?

Investors may be able to profit from market volatility and absorb price fluctuations in the underlying asset without trading the asset. Options over equity assets can expose investors to share price swings for a part of the buying cost of the shares themselves.

A financial adviser or professional adviser can be consulted before deciding to invest in equity derivatives.

What are the risks involved in trading equity derivatives?

Just like any investment tool, there are differing levels of risk related to derivatives. Futures and options, being the most common derivatives traded, carry certain market and liquidity risk.

Investors make judgments and take positions based on assumptions, technical indicators, and other factors that drive them to specific findings about how a particular investment will do. A significant element of investment research is evaluating the likelihood of a profitable investment and analysing the risk/reward ratio of prospective losses vs potential benefits.

Further, there is also a liquidity risk for the investors who close a derivative trade before maturity.

When exchange traded options are purchased, risk is often defined by the price of the option but, when selling or writing options, the prospective shortfalls/losses can be significant. Selling/writing calls can be risky if the underlying shares are not owned by that person, as his losses can be limitless if the stock price increases substantially, which forces him to sell at the agreed strike price.

The same is true for writing put options if the share price falls substantially. index futures might be risky if the stance is unhedged and the index steps in the reverse course of the price at which the futures trade was opened.

Please wait processing your request...

Please wait processing your request...