What is occupancy rate?

A ratio expressing rented space as a proportion to the total available space is occupancy rate. Analysts use occupancy rates to understand the performance of businesses providing housing facilities or for hospital beds occupied. It shows how much of the available space is in use or generating revenue.

Highlights

- It is a ratio showing occupied space as a proportion to the total available space.

- It is often used as a KPI by real estate companies, hotels, hospitals, and passenger transport operators.

- The occupancy rate is generally used as a base by analysts to predict the income stream. Management uses it to set revenue models.

Frequently Asked Questions (FAQ)-

How is occupancy rate computed?

Source: © Richelle538 | Megapixl.com

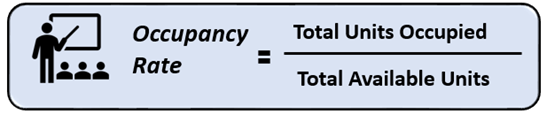

The occupancy rate is computed using the following simple formula:

Source: Copyright © 2021 Kalkine Media

The resultant is very useful in determining current revenues for real estate and property businesses. It is also a metric commonly visible in the hospitality sector’s annual reports.

The following steps help determine the occupancy rate-

- Firstly, the count of total units available to be occupied is to be determined.

- Next, the count of occupied units is finalised.

- It is then divided by the count of the total available units.

Example-

To understand what occupancy rate means, let’s take a simple example.

Suppose there are 50 houses in a residential complex; tenants occupy 20 out of them. So, the occupancy rate would be (20/50) x100, i.e. 40%.

Similarly, if in the next month the number of tenants moving in goes up. Then, the occupancy rate will increase. Say 10 more houses got occupied due to favourable surroundings, the occupancy rate of the residential complex will go up to 60%.

The vacancy rate is the exact opposite of it. The vacancy rate is the percentage of all available units, which means the number of houses remaining in the residential complex.

What does the occupancy rate tell?

A high occupancy rate is typically a sign that real estate properties are not being used to their full potential. The metric is a clear indication of how the company is performing and what are its expected cash-flows. A real estate investor can quickly get a hold of his earnings then.

The occupancy rate is generally used as a base by analysts to predict the income stream. Therefore, it is an essential metric for forecasting and valuation. If an investor is interested in buying an entire shopping mall or a real estate company wants to attract institutional investors, they need to keep occupancy intact.

Source: © Typhoonproject | Megapixl.com

When the occupancy rate is meagre, the business needs to pitch in with advertising and promotion. New techniques must be found out to increase the rate. It indicated underutilised capacity. Investors do not want this to happen in the business they hold a stake in. It is a bearish signal for investors. It shows that the business is not able to break even. Sometimes it is an early indicator of a loss-making estate if even advertising does not boost the occupancy. In addition, taxes and other regulatory charges might overburden the business. Investors in businesses with low occupancy rates must remain wary of the cash crunch situation. Prolonged low occupancy can cause business closure.

Apart from commercial real estate, occupancy has significant applications in hospitals, hotels, senior housing units and call centres. In call centres, usually, a team leader assesses how much time an associate spends in the call-in line with the allocated hours.

What does the occupancy rate show in various sectors?

- For the hotel industry- Occupancy rate is considered as one of the top metrics by owners while formulating a revenue management strategy. It is used alongside the average daily rate and revenue charged per available room. Those working in the hotel industry aim for a high occupancy rate, indicating that space is being utilised efficiently. However, it should not be the only goal; revenue maximisation and customer satisfaction are essential. A 100% occupancy rate is the best output achievable, but hotel owners may have lower room charges to achieve it. Thus, hoteliers could make more money even on an 80% occupancy rate by maintaining a higher charge. It also helps determine peak periods for the business.

- For hospitals- The occupancy rate is the number of beds in a hospital or a nursing home that patients occupy. It helps analyse patterns like the growth of patient admissions, growth of the hospital, vacancy rates, etc. In COVID-19, this was also an assessment metric to see the availability of treatment facilities in infected areas. Hospitals need to manage their occupancy rates to avoid any kind of overcrowding. Hospitals may use it to better determine growth and demand. Occupancy levels for different departments can also be maintained and analysed. It helps the management assess the popularity of treatment provided by various operational divisions. Usually, occupancy rates go up if an infectious disease spreads in the geography or if a doctor is famous for his skills. It is thus, again, used as a KPI (key performance indicators) in hospitals.

- For passenger transport services – If busses or trains take tourists from one destination to another, the occupancy rate is used. It is the number of seats the passengers have occupied over the total available seats. It is used as a KPI by busses, trains and aircraft owners and operators. Here also, it helps determine and set a revenue strategy. It is a crucial metric for this industry as all revenues depend on bookings and occupancy. Transport operators can assess busy routes and heavy passenger inflow periods using this metric. They can offer discounts and price packages accordingly.

Please wait processing your request...

Please wait processing your request...