What is the definition of operating activities?

Operating activities are the key activities that a firm engages in to generate revenue. As a result, these activities significantly impact the cash flow moving in and out of the firm's business and the net income.

The following are the most significant company's activities-

Source: Copyright © 2021 Kalkine Media

Moreover, these activities are a crucial element of a firm's day-to-day operations and influence its annual, quarterly, and monthly profits and revenue. They also offer most of the cash flow and are used to calculate profitability.

Furthermore, the cash expenditures and inflows from operating activities are reported separately in two financial statements.

- They first show on the income statement, where they are utilised to calculate net income.

- The other is that they are reported on the cash flow statement. This statement demonstrates how cash flows from three principal sources, such as financing, investment, and operating, fluctuate over time.

Whatever a corporation does to market its services or goods is called an operating activity in the business community. Operating activities, in simple terms, are costs or actions that do not entail investing or financing. Thus, anyone who understands operating activities will better understand how they relate to the firm's cash flow.

Furthermore, operating activities are fundamental business activities that directly affect the corporation's profitability and are typically the organisation's primary unit. Maintenance and administrative activities are also included in this category.

Additionally, operating activities let the firm account for changes in current liabilities and current assets from its income. The goal of a business is to generate more revenue than it spends or borrows. Furthermore, lower expenses do not always equate to higher revenue. The firm will need to have cash outflow to produce operating revenues.

Summary

- Operating activities are the key activities that a firm engages in to generate revenue.

- Operating activities are a vital element of a firm's day-to-day operations and influence its annual, quarterly, and monthly profits and revenue.

- Operating activities directly affect the corporation's profitability and are typically the organisation's primary unit.

Frequently Asked Questions (FAQs)

What are the different types of operating activities?

Source: © Lancelotlachartre | Megapixl.com

Marketing, selling, and manufacturing a firm's goods or services are examples of operating activities. These are the activities that a business does to sell commodities, make more profit, or stay in business. Listed below are a few different sorts of operating activities:

Advertising and marketing activities: These are the activities taken by the firm in terms of advertising and marketing. This could entail employing a graphic designer to make promotional materials or launching a new advertising campaign to advertise their services or products.

Revenue-generating activities: These could include product sales or providing the service, which generate revenue for the firm. The more revenue generated, the more profitable the business will be.

Customer service activities: These could include ordering goods and interacting with consumers to make a sale.

Administration activities: These comprise various responsibilities carried out by the firm's administration department, like information technology, accounting, and material purchasing.

Maintenance activities: These could include any company-wide upkeep responsibilities, like facility maintenance.

What constitutes operating activities?

The financial statements, especially the cash flow statement and the income statement, detail the firm's operating activities.

The operating activities part of these statements is regarded as the most significant since it offers cash flow information about the business's daily operations and permits stakeholders to evaluate the firm's long sustainability. It also determines a firm's capacity to cover existing costs like debt repayment and personnel costs.

The following are the operating activities that lead to income generation:

Source: Copyright © 2021 Kalkine Media

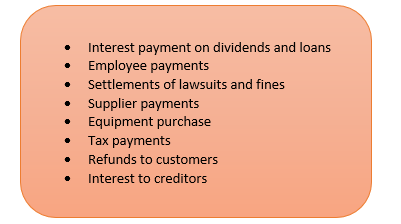

Operating activities that result in cash outflows include the following:

Source: Copyright © 2021 Kalkine Media

What are operating revenues?

The revenue earned by a firm because of its activities is referred to as operating revenue. Unlike operating income, which refers to profit after deducting operating expenses, operating revenue refers to the entire income generated by the firm from marketing, good or service sales and other sources.

You may evaluate your firm's financial position over time by comparing operating revenue from one year to the next. After identifying revenue sources, you may also start evaluating which operating activities have shown to be incredibly beneficial to the business.

Source: © Cammeraydave | Megapixl.com

What do you mean by operating expenses?

An operating expense indicates the cost for a specific operating activity like product selling, manufacturing goods or purchasing supplies, or you can say it's the amount of cash that the firm must spend to function. All firms must incur operating expenses to make a profit and stay in business.

Attempting to cut or minimise expenses could be devastating to the firm. Buying less materials and supplies, for instance, will result in fewer goods available for consumers to purchase, resulting in a lower profit margin for the firm. Therefore, if you want to cut operating expenses, you can notify the Internal Revenue Service during tax season and claim a deduction.

Here are some instances of common operating expenses:

Source: Copyright © 2021 Kalkine Media

What are non-operating activities?

The financial statements, especially the cash flow and income statements, detail the firm's operating activities.

Furthermore, for tax purposes, these activities will be included in the calculation of net income but will be removed from any evaluation of a firm's regular financial performance.

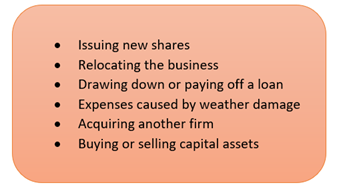

Non-operational activities can also include:

Source: Copyright © 2021 Kalkine Media

Please wait processing your request...

Please wait processing your request...