What is Par Value?

Also commonly known as the nominal value, Par Value is a stock or bond’s face value as has been stated in the Company’s filed document.

Highlights

- The value of stock or bond, as stated in a Company’s filed document, is known as the par value or nominal value.

- These par values are usually seen in denominations of $100 and $1000.

- The importance of par value is that it determines the maturity level of a bond or instrument as the coupon payments’ dollar value.

FAQs:

What is the difference between Par Value for bonds and stocks?

In simpler words, Par Value is essentially the face value of any bond. It holds importance for fixed income instruments as well as bonds because this is what decides its maturity value and the dollar value for the payment of coupons.

Market price of the said bond could be below or above par, depending on factors like interest rate levels and credit status of the bond.

Usually, bond par value is about $100 or $1000 considering that these are the regular denominations used to issue them.

Share power value refers to the price of a stock, which is stated as per the corporate charter. Usually, shares don't have a par value or have a very low par value, say about 1 cent per share. When it comes to equity, there is very little relation to the market price of the shares with the par value.

Why is Par Value critical for bonds?

Par Value is one of the most essential and critical elements of a bond. This is because it's the money agreed by the bond issuer towards the bond holders on the date of the maturity of the said bond. Bond, as we know is an agreement made in writing about the repayment of the loaned amount to the issuer.

It is to be noted that Par Value is not always used for the issuance of bonds. They may be issued at a discount or even at a premium, all depending on the interest rate level in the economy.

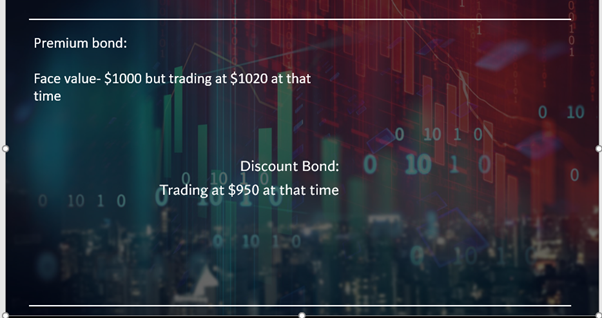

If a bond is trading above its par value, it is known to be trading at a premium. In case the said bond is trading below par value, it is known to be trading at discount.

How to explain bond Par value with an example?

In the time periods when interest rates tend to trend lower, a major part of bonds are trading either at premium or above par. In the case of high interest rates, there will be discount trading for the majority of the bond.

This means that in case there’s a bond trading at face value of $1000, which was trending at $1020 that minute, it will be considered trading at premium, whereas if a bond is trading at $950, it would be known as a discount bond.

Image source: © 2021 Kalkine Media New Zealand Ltd

Now in case, a taxable bond is bought by an investor for an above-par price, there can be amortisation of the rest of the life of the bond, by offsetting the received amount of interest from the same.

This would mean a reduction of the taxable income of the investor from the said bond. This kind of premium amortisation isn’t available in case of those tax-free bonds that are bought at an above-par price.

In comparison with interest rates, the coupon rate of a bond is the deciding factor about the par value of the bond, whether below par or above par.

What is coupon rate of a bond?

Known as interest payments to be made to the bond holders either biannually or annually, coupon rate is essentially compensation for the amount of money loaned by the issuer.

For instance, if the Par Value of a bond is $1,000 and there's a coupon rate of 6%, the annual coupon payments shall amount to $60 (6%x$1000). And in case, par value stands at $100 with a 6% coupon rate, the annual coupon payment shall amount to $6 (6%x$100).

It is further to be noted that if a coupon bond of value 6% is issued, with 6% interest rates, the par value for the trading of the bond shall be the same in the case of the coupon as well as interest rates.

On the other hand, if the interest witnesses a rise to pay 7%, the bond value will see a drop which will result in trading on lesser than par value. The reason for this will be a lower interest rate being paid by the bond, towards the bond holders, as compared to the 7% rate of interest which is going to be paid by similar bonds.

On the flip side, if interest rates are lower, say 5%, that will be witnessed in the bond value, as well as the above par trade as the 7% coupon stands to be more attractive than the 5% one.

What is Par Value for stocks?

Some jurisdictions mandate setting a Par Value, which will be the lower limit of a share sale. In order to comply with regulations of the state, many companies tend to set a Par Value with a predefined minimal amount.

In the initial public offering, these shares can't be sold below the minimal value ensuring that the investors remain content about nobody having an extra edge in the prices.

On the other hand, there are even some jurisdictions where the issuance of stocks requires no Par Value, in the case of which there isn't even an upper limit for the share prices for these stocks.

What does Par Value mean for preferred stock?

Here Par Value is the amount related to the dividend calculated for a preferred stock. This means if the stock’s Par Value is $1000 and the dividend amount it around 6%, then the issuer unit would pay $60 every year till the time there is outstanding preferred stock.

Please wait processing your request...

Please wait processing your request...