What are payday loans?

Payday loans are short term loans that usually involve high interest rates. They are usually due on the forthcoming payday of the borrower. These loans are high cost loans that are riskier than other covered loans. The borrower may not be asked to provide collateral in exchange for a payday loan.

People usually take payday loans when they are short on money to get through the month till their payday. Even though these loans involve small amounts, they are very expensive, and, in some cases, the most costly loans offered.

Non-bank institutions offer these loans. Companies may offer payday loans to those people who have difficulty making ends meet. If consumers start becoming dependent on these loans to get through the month, then the company would benefit hugely.

How does a payday loan work?

Payday loans are offered online or through a physical payday lender. The laws governing payday loans might be different for different countries. The limits on how much can be borrowed or lent and how much interest can be charged are different between states as well.

Taking a payday loan comes with a cost called a finance charge. The borrower must repay the borrowed amount along with the finance charge, which depends on the amount borrowed. A period of 14 days might be offered after the borrower earns his pay check to repay the loan.

The borrower must request the amount of loan, once the request is accepted, the loan is granted. The payday loan can be rolled over to the next month in case the borrower is unable to pay. However, since the interest charged on payday loans if excessively high, the cost keeps on accumulating. The rollovers may be limited in certain areas.

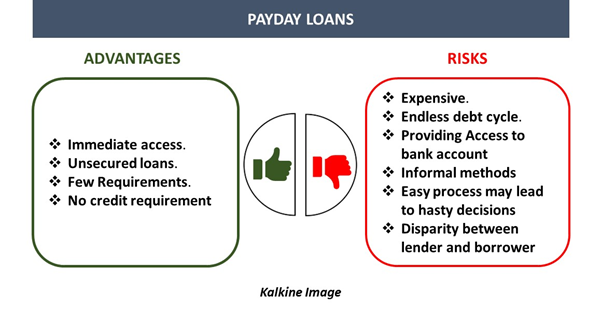

What are the advantages of payday loans?

- Immediate access: Payday loans are easier to access than other loans. Once accepted, the lender may offer the money within 24 hours. There is also not a lot of gap between the time when the request is put in and the time when it is accepted. Thus, they are a good option when there is an immediate need for money.

- Unsecured loans: Lenders may not be asked to provide collateral against a payday loan. This again makes them more accessible and more smoothly operated than other loans. However, sometimes lenders might have access to the bank accounts of the borrower. So even if the lender may not be able to seize any collateral in case of a default, they might pursue legal actions against the borrower.

- Few Requirements: Contrary to other personal loans, payday loans do not require as many documents and can be granted more quickly. The absence of these regularities makes these loans appear informal.

- No credit check required: Traditional loans would require thorough checking of the credit history of the borrower. However, no such requirement is there in case of payday loans. Thus, payday loans may be easier to attain for people with a lower credit score than attainting other traditional loans.

What are the problems associated with payday loans?

Despite all the advantages offered by payday loans, it is important to note that these loans are much riskier than traditional loans and can be extremely hard to repay if they accumulate over time. Some major issues with payday loans are:

- Expensive: As mentioned, payday loans are costlier than other loans available. The rates charged on these loans may be as high as an average annual interest rate of 400%. This is much higher than the average interest rates charged on personal loans which may fall between the range of 6% to 10%.

- Endless debt cycle: It is highly likely that a borrower who is not able to make ends meet with his regular salary, would not be able to repay the loan within the small time frame that is offered for repayment. This is impacted further because of the high interest rates charged on these loans. Therefore, borrowers might find themselves in an endless debt cycle, from which they are unable to come out. They might have to take another loan to finance the previous one, and this might go on.

- Providing Access to bank account: Certain lenders might require bank account details of the borrowers to make the monthly payments easier. A Lender usually has postdated cheque to access money directly from the borrowers’ bank. However, this direct payment from the bank may turn out to be an additional expense for the borrower incase he is short of money in his account,

- Informal methods: As the relaxed procedure might make payday loans appear more lucrative, they make the process of procuring repayments informal as well. Many times, debt-collectors might adopt informal methods to procure loan repayments from borrowers, especially when the borrower is in a debt trap.

- Easy process may lead to hasty decisions: As the process of obtaining a loan is easy and quick, many people might make hasty decisions. However, they can not back out from the agreement once it has been signed. Thus, easier access of payday loans might be more of a disadvantage than an advantage.

- Disparity between lender and borrower: The lenders of payday loans are wealthy companies that enter into the loan agreement with the intention of collecting profits, rather than with the intent of helping the borrowers. This may lead to exploitation of the borrowers, as they do not have much financial backing. Thus, lenders might choose legal measures to get back their money, which would be difficult for a borrower to fight because of the cost and length associated with the procedure.

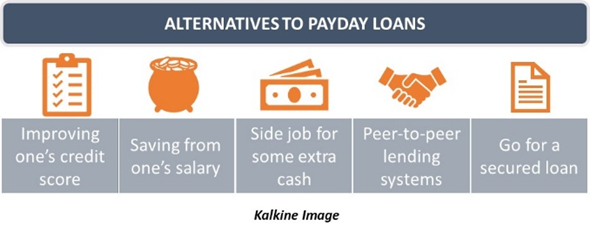

What are the alternatives to payday loans?

Payday loans are usually highly discouraged. They are not seen as frequently and might be more popular in the regional areas. There are various methods with which payday loans can be avoided. This includes improving upon the credit score and building a credit history to be eligible for traditional loans.

A great alternative would be to save from one’s salary and keep an emergency fund ready for the case of an emergency. If one job does not suffice the financial requirements, then having a side job for weekends can also be an effective solution.

Many people start peer-to-peer lending system that do not have very high interest rates. This can be done by pooling in a certain amount into an emergency fund, and each member taking a loan from the money collected by them. This is a local alternative that would ensure there is no exploitation of borrowers. It is always better to go for a secured loan, as usually secured loans have lower interest rates.

Please wait processing your request...

Please wait processing your request...