What is payroll?

Payroll is the total amount of money paid by an employer to the employees on a specific date in a month. Mostly, payrolls are managed by the human resource department or the accounts department of a company. However, if the size of the company is small than in that case either the owner or an associate handles the payrolls.

At present, business owners are resorting to a new practice, wherein, specialised firms are hired to take care of the processing of the paychecks. Tasks like tax withholding and employee benefits and insurance are also performed by these firms. There are firms which use advanced technological tools to simplify the payroll process. Leveraged technology has made the payroll process more convenient and less time-consuming for the employees by providing them e-payroll documents. Some of the payroll firms include-- Bitwage, Finch, Wagestream, Feel, Atomic and Pinwheel.

Summary

- Payroll is the total amount of money paid by an employer to the employees on a specific date in a month.

- The payroll process involves tracking working hours of the employees, calculation and distribution of payments through direct deposit or check.

- Mostly, payrolls are managed by the human resource department or the accounts department of a company.

Frequently Asked Questions (FAQs)

What are payroll deductions?

Image Source: © Rummess | Megapixl.com

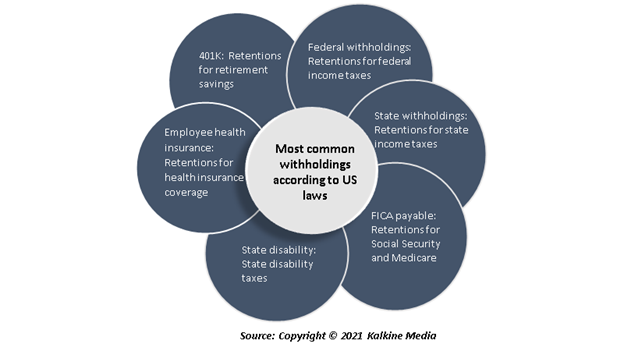

Payroll deductions are the amount withheld from an employee’s paycheck for a variety of purposes like - retirement policies, benefit payments, paying taxes, life insurance premium or wage garnishments. Through this deduction an employee can make contribution to an ongoing investment. It can also be called as paycheck deductions.

Payroll deductions can be classified into two categories – Mandatory deductions and Voluntary deductions.

Mandatory deductions are the deductions which an employee has opted to have subtracted from his gross pay. While voluntary deductions can include the deductions that are taken out of an employee's gross pay before taxation and those being taken out post taxation. In voluntary deductions, the pre-tax deductions are beneficial to an employee as they can bring down the amount of taxable income.

We can also define payroll as the list of employees working for a company and the amount of compensation which is yet to be paid to them. Businesses or companies incur major expenses in payroll process; however, this amount is always deductible. The expense thus deducted lowers the taxable income of the said company. Also, payroll can vary from one period to another depending upon certain variables such as overtime or sick leave.

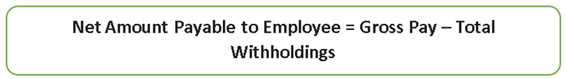

Formula to calculate amount payable to an employee

Which all are the most common withholdings?

What are the current trends in payroll process?

Payroll is the method of paying compensation to the employees of a business for a set period on a specified date. In current times, many big companies hire payroll services from outside to perform the payroll process. To run a business smoothly, it is required that the employers keep an eye on the working hours of each employee and pass on this information to the payroll service.

Many medium- and large-size companies contract outside payroll services to streamline the process. Employers keep track of the number of hours each employee worked and relay this information to the payroll service. On payday, after deducting taxes and withholdings from an employee's earnings, the payroll services make payments to the employees.

What are the advantages and disadvantages of using professional payroll services?

Usage of payroll services by a company can be both advantageous as well as disadvantages. The biggest advantage of a payroll service is that it makes the payroll process simple and saves time. Additionally, the payroll firms also ensure that the hiring companies complete the legal formalities with regard to tax filing requirements.

Moreover, the payroll services also keep a track on the working hours of the employees and number of leaves an employee has used.

On the negative side, for meticulous accounting and payrolls, businesses depend entirely on firms providing payroll services. Therefore, if there is any error on their part in the accounting process, then the companies will have to bear the results. In such cases, these companies are likely to face legal issues and tax penalties in case of violation of any business rules.

Also, payroll services are expensive and thus not everyone can afford them.

Image Source: © Adiruch | Megapixl.com

What are the steps involved in payroll accounting?

As soon as a company hires a new employee, it creates an employee identification number (EIN). This is followed by a decision as to when will the company make payment to its employees, and this time period should not exceed a month.

The other two important steps include employee’s benefits and insurance and employee's forms. The employees form carries all the personal information of an employee.

After the company gathers all the required personal details of its employee, there are various other steps involved in the calculation of payroll accounting. Some of the steps are:

- Obtain both direct and indirect compensation for labour: At the end of the month add all the direct costs, which includes salaries as well as overtime.

- In the second step, add all the indirect stuff like commission and bonus.

- Measure deductions and withholdings. Thereafter, as per the requirement calculate an employee's taxes and wage deductions.

- Calculate provisions. Provisions refer to the expenses incurred because of a contractual deal with an employee.

- Create a record of entries in a book.

- Make the payments: After all these steps, the companies make payments to their employees, government bodies (with respect to withholdings) and others.

Are payroll software programs better as compared to other payroll services?

There are companies who prefer payroll software programs over the payroll services. This is beneficial in a way that it is a onetime payment, which means that once the software is purchased, the company is not required to pay the fees monthly. However, one drawback with the software program is that it is time-taking and thus it is of little help for companies which are relatively smaller in size.

Please wait processing your request...

Please wait processing your request...